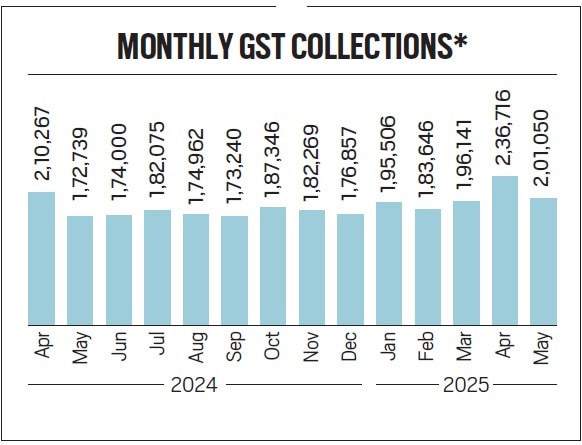

Gross Items and Companies Tax (GST) collections rose 16.4 per cent year-on-year to Rs 2.01 lakh crore in Could (for gross sales in April), knowledge launched by the federal government on Sunday confirmed. The GST collections in Could have been decrease than final month’s record-high degree of Rs 2.37 lakh crore whilst the expansion charge was increased at 16.4 per cent in Could as towards 12.6 per cent development seen in April.

Whereas April collections had gained from year-end gross sales, GST collections in Could slowed down from the home phase. GST collections from imports grew 25.2 per cent year-on-year to Rs 51,266 crore in Could. GST collections from imports have been Rs 46,913 crore in April. On the home entrance, GST collections grew 13.7 per cent to Rs 1.50 lakh crore in Could, however have been decrease than Rs 1.90 lakh crore in April. On a internet foundation, GST collections elevated 20.4 per cent to Rs 1.74 lakh crore, the information confirmed. Consultants stated a 16 per cent plus year-on-year development implies financial restoration is holding up.

Abhishek Jain, oblique tax head and accomplice, KPMG stated, “Whereas final month’s spike was anticipated with year-end reconciliations, the consistency this month together with a 16 plus per cent year-on-year development factors to robust underlying momentum and a restoration that’s clearly taking maintain.”

Some specialists identified a decrease GST assortment from the home gross sales in Could (for gross sales in April) as towards April (for year-end gross sales in March). “GST collections are about what we anticipated, displaying a 15 per cent drop from final month. Nonetheless, home GST collections fell by practically 21 per cent in comparison with final month, suggesting a shift in how a lot shoppers are spending. Whereas final month’s increased collections doubtless included year-end business-to-business gross sales pushed attributable to targets, this huge lower factors to some little bit of change in client spending presumably attributable to international uncertainties. Additionally, export refunds are down considerably, by 36.25 per cent, which means that the final month’s elevated exports have been totally on account of firms constructing their inventory at US degree attributable to imposition of tariff,” Saurabh Agarwal, tax accomplice, EY India stated.

Whole refunds stood at Rs 27,210 crore in Could, down 4 per cent YoY. Whereas home refunds grew 53.7 per cent YoY to Rs 18,314 crore in Could, refunds for imports have been down 45.9 per cent to Rs 8,896 crore.

In April, home refunds had risen 22.4 per cent YoY to Rs 13,386 crore, whereas refunds on imports had elevated 86.1 per cent YoY to Rs 13,955 crore.

State-wise knowledge for October confirmed that out of 38 states/Union territories, 20 states/UTs recorded increased development in gross GST collections than the nationwide common of 16.4 per cent development charge.

Story continues beneath this advert

In absolute phrases, Maharashtra was on the high with assortment of Rs 31,530 crore (17 per cent development), adopted by Karnataka with assortment of Rs 14,299 crore (20 per cent development), Tamil Nadu with Rs 12,230 crore (25 per cent development), Gujarat with assortment of Rs 11,737 crore (4 per cent development), and Delhi with Rs 10,366 crore assortment (38 per cent development).

States/UTs which recorded a contraction in GST collections in Could included: Andhra Pradesh at Rs 3,803 crore (-2 per cent), Uttarakhand at Rs 1,605 crore (-13 per cent), Dadra and Nagar Haveli and Daman & Diu at Rs 351 crore (-6 per cent), and Mizoram at Rs 29 crore (-26 per cent).

“The large variations within the development of GST collections throughout states require an intensive evaluation throughout the sectors which might be vital in every state. Whereas giant states like Maharashtra, West Bengal, Karnataka and Tamil Nadu have reported assortment will increase of 17 per cent to 25 per cent, comparable giant states like Gujarat, AP and Telangana have proven will increase of solely -2 per cent to six per cent t. Some states like MP, Haryana, Punjab and Rajasthan have proven a median enhance of 10 per cent. Therefore, the common development throughout the nation doesn’t look like uniformly mirrored throughout states presumably attributable to sectoral or seasonal components which require a deeper knowledge primarily based evaluation,” MS Mani, accomplice, oblique taxes, Deloitte India stated.

The gross Central GST (CGST) — the tax levied on intra-state provides of products and companies by the Centre — collections stood at Rs 35,434 crore, State GST (SGST) — the tax levied on intra-state provides of products and companies by the states — collections have been Rs 43,902 crore, whereas Built-in GST (IGST) — the tax levied on all inter-state provides of products and companies — collections stood at Rs 1.09 lakh crore and cess at Rs 12,879 crore through the month.

Story continues beneath this advert

The gross Central GST (CGST) — the tax levied on intra-state provides of products and companies by the Centre — collections stood at Rs 35,434 crore, State GST (SGST) — the tax levied on intra-state provides of products and companies by the states — collections have been Rs 43,902 crore, whereas Built-in GST (IGST) — the tax levied on all inter-state provides of products and companies — collections stood at Rs 1.09 lakh crore and cess at Rs 12,879 crore through the month.