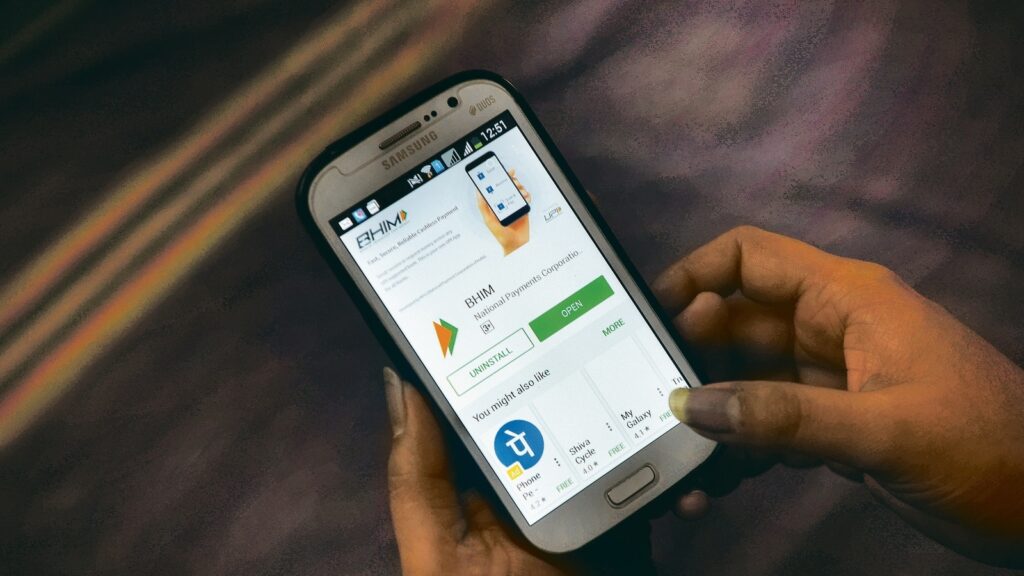

Incentives paid by the federal government to banks for selling RuPay debit playing cards and low-value BHIM-UPI transactions won’t appeal to GST, the Finance Ministry stated.

Final week the Cupboard cleared a ₹2,600-crore incentive scheme for banks to advertise RuPay debit playing cards and low-value BHIM-UPI transactions within the present fiscal.

Underneath the Incentive scheme for the promotion of RuPay Debit Playing cards and low-value BHIM-UPI transactions, the federal government pays banks an incentive as a share of the worth of RuPay Debit card transactions and low-value BHIM-UPI transactions as much as ₹2,000.

The Funds and Settlements Techniques Act, 2007 prohibits banks and system suppliers from charging any quantity from an individual making or receiving funds by means of RuPay Debit playing cards or BHIM.

In a round to chief commissioners of GST, the Ministry stated the motivation is within the nature of a subsidy straight linked to the value of the service and the identical doesn’t type a part of the taxable worth of the transaction in view of the provisions of the Central GST Act, 2017.

“As really useful by the Council, it’s hereby clarified that incentives paid by MeitY to buying banks underneath the Incentive scheme for promotion of RuPay Debit Playing cards and low-value BHIM-UPI transactions are within the nature of subsidy and thus not taxable,” it stated.

In December alone, UPI achieved a file of 782.9 crore digital cost transactions with a price of ₹12.82 lakh crore.

Individually, the Ministry has additionally clarified the applicability of GST on lodging companies provided by Air Drive Mess to its personnel.

It stated that the income division had acquired references requesting clarification on whether or not GST is payable on lodging companies provided by Air Drive Mess to its personnel.

ALSO READ: Defined: How Reserve Financial institution’s e-rupee is totally different from UPI?

Presently, all companies, barring a number of specified companies similar to companies of the postal division, transportation, provided by Central or State Governments, or native authority to any individual aside from enterprise entities are exempt from GST.

“It’s hereby clarified that lodging companies offered by Air Drive Mess and different related messes, similar to Military mess, Navy mess, Paramilitary and Police forces mess to their personnel or any individual aside from a enterprise entity are lined by Sl. No. 6 of notification No. 12/2017 Central Tax (Fee) dated 28.06.2017 offered the companies provided by such messes qualify to be thought of as companies provided by Central Authorities, State Authorities, Union Territory or native authority,” the Ministry stated.

“CBIC has clarified that lodging companies offered by Air Drive Mess, Military mess, Navy mess, Paramilitary, and Police forces mess to their personnel or any individual aside from a enterprise entity are tax impartial. This clarification would assist limit the price of lodging companies for our elite forces companies,” AMRG & Associates Senior Accomplice Rajat Mohan stated.