The inventory market has gotten off to a stable begin in 2024 with the S&P 500 index already up by shut to eight% and setting new highs, and the great half is that the market might maintain rising due to a robust U.S. financial system and receding inflation.

Expertise shares, particularly, might have one other stable yr on the again of catalysts equivalent to synthetic intelligence (AI). It’s price noting that the Nasdaq-100 Expertise Sector index has jumped by greater than 62% prior to now yr, so it could be tough to search out bargains on this sector. However you probably have $1,000 to spare after paying your payments, saving sufficient for a wet day, and paying off high-interest debt, you could wish to use that investible money to purchase one share of every of those two tech corporations that appear to be stable buys proper now primarily based on their long-term prospects.

1. Twilio

Cloud communications specialist Twilio (NYSE: TWLO) could appear to be a stunning purchase suggestion contemplating that it has underperformed the inventory market prior to now yr, shedding 18% of its worth. There was extra dangerous information for Twilio traders when the corporate launched its fourth-quarter outcomes final month.

Although it beat expectations for the quarter and its income for the yr rose 9% to $4.15 billion, administration failed to supply full-year steerage for 2024. The corporate is finishing up an operational evaluation of its buyer knowledge platform enterprise, referred to as Phase, and says it plans to challenge the 2024 steerage this month as soon as that evaluation is full.

Nevertheless, a better take a look at Twilio’s steerage for the present quarter signifies that that is going to be a tough yr for the corporate. It expects simply 2% to three% income progress within the quarter to $1.03 billion. Twilio has additionally guided for adjusted earnings of $0.58 per share on the midpoint, which might be a 23% soar from the prior-year interval. For comparability, Twilio’s full-year earnings elevated to $2.45 per share in 2023 from simply $0.15 per share in 2022, pushed primarily by its cost-cutting strikes.

The comparatively slower progress forecast for 2024 explains why some traders have been promoting Twilio inventory. In consequence, it could possibly now be purchased for simply 2.7 occasions gross sales, which is nicely beneath its five-year common gross sales a number of of 6.5. Moreover, Twilio is buying and selling at 24 occasions ahead earnings proper now, which makes it cheaper than the Nasdaq-100‘s ahead earnings a number of of 30 (utilizing the index as a proxy for the tech sector).

Shopping for Twilio at these multiples might transform a sensible long-term transfer. That is as a result of the corporate’s slowdown is more likely to be short-term contemplating the communications-platform-as-a-service (CPaaS) trade that it operates in. Twilio’s utility programming interfaces (APIs) permit corporations to construct voice, messaging, and video purposes to stay linked with their clients. This enables organizations to do with out old-school bodily name facilities, which require lots of preliminary funding.

As of October 2023, Synergy Analysis Group describes Twilio because the main participant in CPaaS with a 37% market share. In the meantime, as of June 2023, market analysis agency IDC estimates that Twilio controls practically 1 / 4 of this market. IDC additional provides that “regardless of the setbacks of slowing gross sales cycles, restructuring, and downsizing, the trade remains to be one of many strongest IT sectors with attainable double-digit and worthwhile progress in attain of many corporations.”

This explains why the CPaaS market is predicted to generate virtually $30 billion in income in 2026 in comparison with $14 billion in 2022. As such, it will not be stunning to see Twilio’s progress choose up as soon as once more within the subsequent couple of years. And, if the corporate continues to manage 1 / 4 of the CPaaS market in 2026, its income might enhance to $7.5 billion primarily based on IDC’s forecast.

That may translate right into a three-year income compound annual progress fee of practically 22% primarily based on Twilio’s 2023 income. If Twilio maintains its present price-to-sales ratio of two.7, its market cap might enhance to $20 billion within the subsequent three years. That may be a pleasant soar from the present degree of virtually $11 billion.

2. Nvidia

Nvidia (NASDAQ: NVDA) could look like one other stunning choose for traders on the hunt for cut price shares. It trades at 33 occasions gross sales and 69 occasions trailing earnings following its 244% inventory surge prior to now yr. By these measures, it seems dear. Nevertheless, Nvidia’s ahead multiples inform a distinct story.

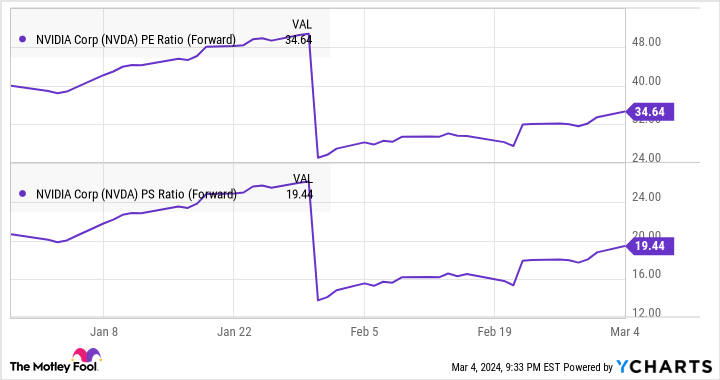

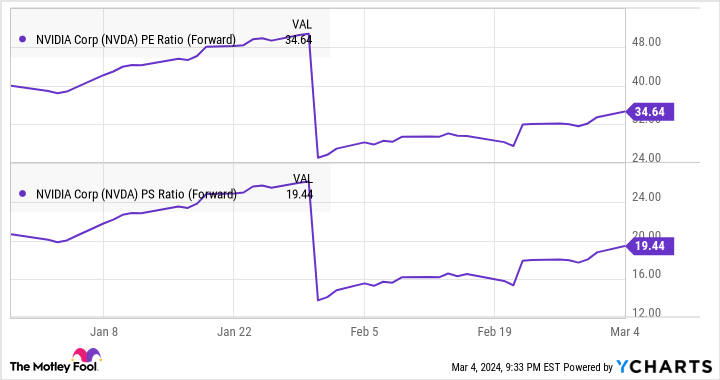

Because the chart above signifies, Nvidia’s ahead earnings and gross sales multiples have come down quickly of late. That is not stunning, as the corporate’s high and backside traces are predicted to rise sharply this yr. Analysts anticipate Nvidia’s earnings to leap to $24.43 per share in fiscal 2025 from $12.96 per share in fiscal 2024, which ended Jan. 28. Its high line is forecast to extend virtually 80% to $109.5 billion.

Extra importantly, Nvidia appears able to sustaining these spectacular progress charges past 2024. Analyst Vijay Rakesh of Japanese funding financial institution Mizuho estimates that Nvidia might generate $300 billion in income from AI chips by 2027. That may be a large enhance over the $47.5 billion income that it generated from its knowledge heart enterprise final yr by promoting AI chips, which was a good-looking 217% enhance from the prior yr.

There are just a few the reason why it would not be absurd to see Nvidia’s income develop at such a wide ranging tempo over the following three years. First, Nvidia’s peer AMD has forecast that the worldwide AI chip market will generate $400 billion in annual income by 2027. Second, Nvidia is in a pleasant place to take advantage of this chance because it reportedly instructions a whopping 90% of this market.

Additionally, Nvidia’s efforts to maneuver into further niches of the AI chip market might ultimately assist it get near the formidable income goal that Mizuho has set for it. All this means that Nvidia might transform a high progress inventory in 2024 and past, and its low ahead multiples imply that traders are getting a very good deal on it proper now.

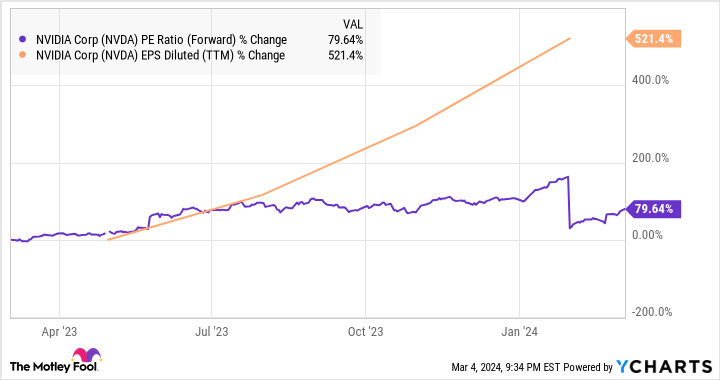

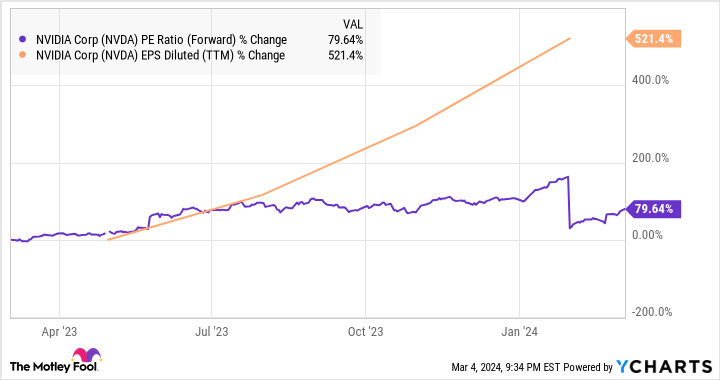

One other factor price noting right here is that Nvidia has justified its valuation prior to now yr by clocking gorgeous earnings progress that has outpaced the expansion in its price-to-earnings ratio.

As such, Nvidia inventory seems like a cut price contemplating the potential progress on supply, which is why savvy traders ought to think about shopping for it earlier than it strikes increased.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 11, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Nvidia, and Twilio. The Motley Idiot has a disclosure coverage.

Have $1,000? These 2 Shares May Be Discount Buys for 2024 and Past was initially printed by The Motley Idiot