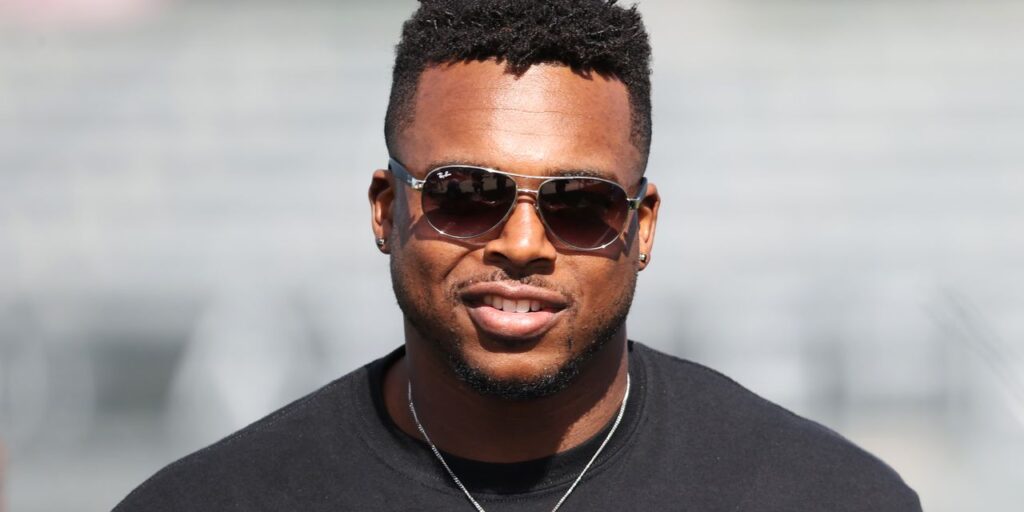

“A wholesome emergency fund sometimes incorporates three to 6 months’ wage or residing bills, however as at all times, you need to assess your state of affairs and save as a lot as you fairly can,” says NFL linebacker Brandon Copeland. (Copeland himself reportedly saves nearly all of his personal wage.)

Getty Photographs

NFL linebacker Brandon Copeland made $990,000 within the NFL final yr, in line with CBS Sports activities — however that’s not even near probably the most fascinating factor about him. He’s additionally constructed a monetary empire referred to as Copeland Media, the place he serves because the CEO and oversees the corporate’s monetary consulting agency referred to as Cascade Advisory Group. Whereas attending the College of Pennsylvania, he interned at UBS and has since returned to his alma mater to show a monetary literacy course. And two years in the past, he added contributing editor at Kiplinger to his resume.

One piece of his recommendation that feels significantly related now — as a recession might loom and a few financial savings accounts are paying greater than they’ve since 2009 (see the most effective financial savings account charges you might get now right here) — is that this: You want an emergency fund. Right here’s what he advises on that entrance — in addition to what different consultants say.

“A wholesome emergency fund sometimes incorporates three to 6 months’ wage or residing bills, however as at all times, you need to assess your state of affairs and save as a lot as you fairly can,” says Copeland. (Copeland himself reportedly saves nearly all of his personal wage.) He notes that an emergency fund can assist you within the occasion of a medical difficulty, job loss, holding our of debt, and extra.

What the professionals say about an emergency fund now

Licensed monetary planner Danna Jacobs of Legacy Care Wealth agrees that an emergency fund of three to six months of bills is a crucial basis for a wholesome monetary dwelling. “We sometimes earmark these financial savings in high-interest financial savings accounts in order that our purchasers can earn a bit of extra on these funds,” says Jacobs. See the most effective financial savings account charges you might get now right here. See the most effective financial savings account charges you might get now right here.

Jacobs says in case you’re a twin revenue family you may sometimes goal a smaller emergency fund since you’ve supplemental revenue to assist a possible job loss. However these with dependents, who’ve much less secure jobs or who’ve a single revenue might wish to save extra.

“Having a considerable pile of money to have the ability to draw on provides a lot flexibility, and there’s actual peace of thoughts in realizing you’ll be okay if catastrophe strikes,” says licensed monetary planner Keith Spencer of Spencer Monetary Planning, who notes that it’s higher to err on the aspect of an excessive amount of money relatively than not sufficient.

If the really useful quantity of reserves appears unachievable to the family, licensed monetary planner Paul Collinson of Legacy Planning Advisors recommends splitting the quantity into achievable parcels. “Maybe purpose to build up one month of reserves each 3 to six months till the really useful variety of months is achieved. The backdrop is that you will need to maintain family members accountable when setting aspirational targets resembling when constructing an emergency fund over a interval of months or years,” says Collinson.

And observe that this quantity could also be fluid. “In the event you’re paying for childcare proper now, that may positively be included however in a number of years, it may not must be,” says licensed monetary planner Cristina Guglielmetti of Future Excellent Planning.

The recommendation, suggestions or rankings expressed on this article are these of MarketWatch Picks, and haven’t been reviewed or endorsed by our business companions.