Fatcamera | E+ | Getty Photos

The Home tax and spending invoice would push tens of millions of Individuals off medical health insurance rolls, as Republicans lower packages like Medicaid and the Reasonably priced Care Act to fund priorities from President Donald Trump, together with nearly $4 trillion of tax cuts.

The Congressional Finances Workplace, a nonpartisan legislative scorekeeper, initiatives about 11 million individuals would lose well being protection because of provisions within the Home invoice, if enacted in its present kind. It estimates one other 4 million or so would lose insurance coverage because of expiring Obamacare subsidies, which the invoice does not prolong.

The ranks of the uninsured would swell on account of insurance policies that will add obstacles to entry, elevate insurance coverage prices and deny advantages outright for some individuals like sure authorized immigrants.

The laws, generally known as the “One Massive Stunning Invoice Act,” could change as Senate Republicans now think about it. Well being care cuts have confirmed to be a thorny problem. A handful of GOP senators — sufficient to torpedo the invoice — do not seem to again cuts to Medicaid, for instance.

Extra from Private Finance:

How debt influence of Home GOP tax invoice could have an effect on customers

3 key cash strikes to think about whereas the Fed retains rates of interest greater

How baby tax credit score might change as Senate debates Trump’s mega-bill

The invoice would add $2.4 trillion to the nationwide debt over a decade, CBO estimates. That is after slicing greater than $900 billion from well being care packages throughout that point, in line with the Penn Wharton Finances Mannequin.

The cuts are a pointy shift following incremental will increase within the availability of medical health insurance and protection over the previous 50 years, together with via Medicare, Medicaid and the Reasonably priced Care Act, in line with Alice Burns, affiliate director with KFF’s program on Medicaid and the uninsured.

“This is able to be the largest retraction in medical health insurance that we have ever skilled,” Burns stated. “That is makes it actually troublesome to know the way individuals, suppliers, states, would react.”

Listed below are the key methods the invoice would improve the variety of uninsured.

No inhabitants ‘secure’ from proposed Medicaid cuts

Speaker of the Home Mike Johnson, R-La., pictured at a press convention after the Home narrowly handed a invoice forwarding President Donald Trump’s agenda on Could 22 in Washington, DC.

Kevin Dietsch | Getty Photos

Federal funding cuts to Medicaid could have broad implications, consultants say.

“No inhabitants, frankly, is secure from a invoice that cuts greater than $800 billion over 10 years from Medicaid, as a result of states must modify,” stated Allison Orris, senior fellow and director of Medicaid coverage on the Heart on Finances and Coverage Priorities.

The availability within the Home proposal that will lead most individuals to lose Medicaid and subsequently turn out to be uninsured could be new work necessities that will apply to states that expanded Medicaid beneath the Reasonably priced Care Act, in line with Orris.

The work necessities would have an effect on eligibility for people ages 19 to 64 who shouldn’t have a qualifying exemption. Affected people would want to exhibit they labored or participated in qualifying actions for not less than 80 hours per 30 days.

States would additionally must confirm that candidates meet necessities for a number of consecutive months previous to protection, whereas additionally conducting redeterminations not less than twice per 12 months to make sure people who’re already coated nonetheless adjust to the necessities.

In a Sunday interview with NBC Information’ “Meet the Press,” Home Speaker Mike Johnson, R-La., stated “4.8 million individuals won’t lose their Medicaid protection except they select to take action,” whereas arguing the work necessities aren’t too “cumbersome.”

The Congressional Finances Workplace has estimated the work necessities would immediate 5.2 million adults to lose federal Medicaid protection. Whereas a few of these could get hold of protection elsewhere, CBO estimates the change would improve the variety of individuals with out insurance coverage by 4.8 million.

These estimates could also be understated as a result of they don’t embrace everybody who qualifies however fails to correctly report their work hours or submit the suitable paperwork in the event that they qualify for an exemption, stated KFF’s Burns.

General, 10.3 million would lose Medicaid, which might result in 7.8 million individuals dropping medical health insurance, Burns stated.

Proposal creates state Medicaid funding challenges

Shield Our Care supporters show “Palms Off Medicaid” message in entrance of the White Home forward of President Trump’s tackle to Congress on March 4 in Washington, D.C.

Paul Morigi | Getty Photos Leisure | Getty Photos

Whereas states have used well being care supplier taxes to generate funding for Medicaid, the Home proposal would put a cease to utilizing these levies sooner or later, Orris famous.

Consequently, with much less income and federal help, states will face the robust alternative of getting to chop protection or lower different elements of their state price range so as to preserve their Medicaid program, Orris stated.

For instance, residence and community-based providers might face cuts to protect funding for necessary advantages like inpatient and outpatient hospital care, she stated.

The Home proposal would additionally delay till 2035 two Biden-era eligibility guidelines that had been meant to make Medicaid enrollment and renewal simpler for individuals, particularly older adults and people with disabilities, Burns stated.

States would even have their federal matching price for Medicaid expenditures decreased if they provide protection to undocumented immigrants, she stated.

Reasonably priced Care Act cuts ‘wonky’ however ‘consequential’

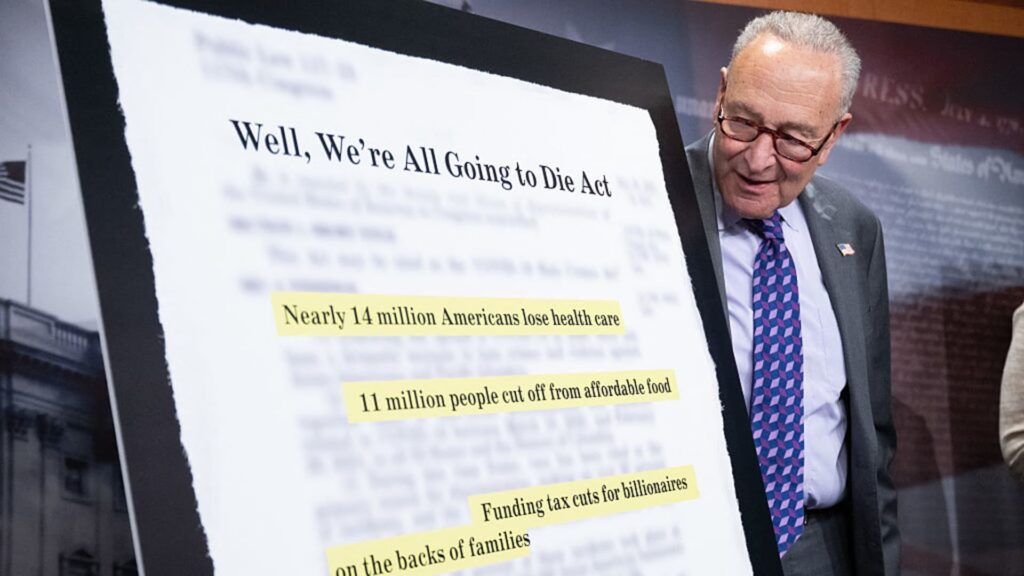

Senate Minority Chief Chuck Schumer, D-N.Y., speaks in regards to the well being care impacts of the Republican price range and coverage invoice, often known as the “One Massive Stunning Invoice Act,” throughout a June 4 information convention in Washington, D.C.

Saul Loeb | Afp | Getty Photos

Greater than 24 million individuals have medical health insurance via the Reasonably priced Care Act marketplaces.

They are a “essential” supply of protection for individuals who do not have entry to medical health insurance at their jobs, together with for the self-employed, low-paid employees and older people who do not but qualify for Medicare, in line with researchers on the Heart on Finances and Coverage Priorities, a left-leaning assume tank.

The Home laws would “dramatically” cut back ACA enrollment — and, subsequently, the variety of individuals with insurance coverage — because of the mixed impact of a number of adjustments reasonably than one massive proposal, wrote Drew Altman, president and chief govt of KFF, a nonpartisan well being coverage group.

“Lots of the adjustments are technical and wonky, even when they’re consequential,” Altman wrote.

Expiring ACA subsidies add to protection prices

ACA enrollment is at an all-time excessive. Enrollment has greater than doubled since 2020, which consultants largely attribute to enhanced insurance coverage subsidies provided by Democrats within the American Rescue Plan Act in 2021 after which prolonged via 2025 by the Inflation Discount Act.

These subsidies, known as “premium tax credit,” successfully cut back customers’ month-to-month premiums. (The credit might be claimed at tax time, or households can decide to get them upfront through decrease premiums.)

Congress additionally expanded the eligibility pool for subsidies to extra middle-income households, and decreased the utmost annual contribution households make towards premium funds, consultants stated.

The improved subsidies lowered households’ premiums by $705 (or 44%) in 2024 — to $888 a 12 months from $1,593, in line with KFF.

The Home Republican laws does not prolong the improved subsidies, which means they’d expire after this 12 months.

About 4.2 million individuals might be uninsured in 2034 if the expanded premium tax credit score expires, in line with the Congressional Finances Workplace.

“They may simply determine to not get [coverage] as a result of they merely cannot afford to insure themselves,” stated John Graves, a professor of well being coverage and drugs at Vanderbilt College College of Medication.

Protection will turn out to be costlier for others who stay in a market plan: The everyday household of 4 with revenue of $65,000 can pay $2,400 extra per 12 months with out the improved premium tax credit score, CBPP estimates.

Including crimson tape to eligibility, enrollment

Greater than 3 million persons are anticipated to lose Reasonably priced Care Act protection on account of different provisions within the Home laws, CBO initiatives.

Different “massive” adjustments embrace broad changes to eligibility, stated Kent Smetters, professor of enterprise economics and public coverage on the College of Pennsylvania’s Wharton College.

For instance, the invoice shortens the annual open enrollment interval by a few month, to Dec. 15, as a substitute of Jan. 15 in most states.

It ends automated re-enrollment into medical health insurance — utilized by greater than half of people that renewed protection in 2025 — by requiring all enrollees to take motion to proceed their protection annually, CBPP stated.

Senate Majority Chief Sen. John Thune (R-SD) (C) converse alongside Sen. John Barrasso (R-WY) (L) and Sen. Mike Crapo (R-ID) (R) exterior the White Home on June 4, 2025. The Senators met with President Donald Trump to debate Trump’s “One, Massive, Stunning Invoice” and the problems some members throughout the Republican Senate have with the laws and its value.

Anna Moneymaker | Getty Photos Information | Getty Photos

The invoice additionally bars households from receiving subsidies or cost-sharing reductions till after they confirm eligibility particulars like revenue, immigration standing, well being protection standing and place of residence, in line with KFF.

Graves says including administrative crimson tape to well being plans is akin to driving an apple cart down a bumpy street.

“The bumpier you make the street, the extra apples will fall off the cart,” he stated.

Uncapping subsidy repayments

One other biggie: The invoice would remove compensation caps for premium subsidies.

Households get federal subsidies by estimating their annual revenue for the 12 months, which dictates their whole premium tax credit score. They have to repay any extra subsidies throughout tax season, if their annual revenue was bigger than their preliminary estimate.

Present legislation caps compensation for a lot of households; however the Home invoice would require all premium tax credit score recipients to repay the total quantity of any extra, regardless of their revenue, in line with KFF.

Whereas such a requirement sounds cheap, it is unreasonable and maybe even “merciless” in observe, stated KFF’s Altman.

“Earnings for low-income individuals might be risky, and plenty of Market customers are in hourly wage jobs, run their very own companies, or sew collectively a number of jobs, which makes it difficult, if not unattainable, for them to completely predict their revenue for the approaching 12 months,” he wrote.

Curbing use by immigrants

The Home invoice additionally limits market insurance coverage eligibility for some teams of authorized immigrants, consultants stated.

Beginning Jan. 1, 2027, many lawfully current immigrants similar to refugees, asylees and other people with Non permanent Protected Standing could be ineligible for backed insurance coverage on ACA exchanges, in line with KFF.

Moreover, the invoice would bar Deferred Motion for Childhood Arrivals recipients in all states from shopping for insurance coverage over ACA exchanges.

DACA recipients — a subset of the immigrant inhabitants generally known as “Dreamers” — are presently thought-about “lawfully current” for functions of well being protection. That makes them eligible to enroll (and get subsidies and cost-sharing reductions) in 31 states plus the District of Columbia.