LONDON/NEW YORK/HONG KONG, March 31 (Reuters) – March’s market turmoil has compelled many macro and trend-following hedge funds to chop bait on dangerous portfolio bets and precipitated at the least one financial institution that lends to them to scrutinize its shoppers’ publicity, based on sources and preliminary information reviewed by Reuters.

The sudden collapse this month of two regional U.S. banks and Swiss lender Credit score Suisse rocked inventory, bond and foreign money markets, catching many hedge funds off-guard and leaving them with sudden losses.

Macro and trend-following hedge funds dropped 3.2% this month by March 29, whereas algorithmic commodity buying and selling advisor funds (CTAs) dove 6.8%. These funds are down 2.7% and 6% for the 12 months by March 29, respectively.

Hedge fund methods based mostly round macroeconomic concepts like these run by Rokos, DG Parters and EDL Capital fund posted unfavourable performances in March, sources and financial institution information mentioned.

HSBC Analysis confirmed EDL Capital misplaced 6.4% in March whereas DG Companions misplaced 8.1% this month by March 28. EDL mentioned it had recouped March losses and was optimistic for the 12 months however didn’t add additional particulars. DG Companions declined to remark.

Edouard de Langlade, founder and proprietor of EDL Capital, mentioned in a letter final week that he believed the transfer in charges was brought on by CTAs unwinding positions due to risk-control functions.

“There may be a whole lot of ache on the market and the opposite large query we should ask ourselves is how a lot of the quick cash has been unwound,” de Langlade wrote.

London-based Rokos Capital Administration was down 12% on the 12 months by March 24 resulting from market losses, mentioned a supply acquainted with the matter. Rokos declined to remark; it advised traders final week it determined to chop danger after the hit.

Development-following hedge funds, which commerce on systematically programmed concepts, additionally posted large losses. Progressive Capital Companions, Systematica, and Man Group (EMG.L) had funds which posted losses of 19.8%, 13.1% and seven.6% in March, respectively, mentioned HSBC. Systematica and Man Group declined to remark.

Progressive mentioned losses sustained by its Tulip Development fund stemmed from quick strikes in interest-rate markets. The fund gained 29% in 2022, it mentioned.

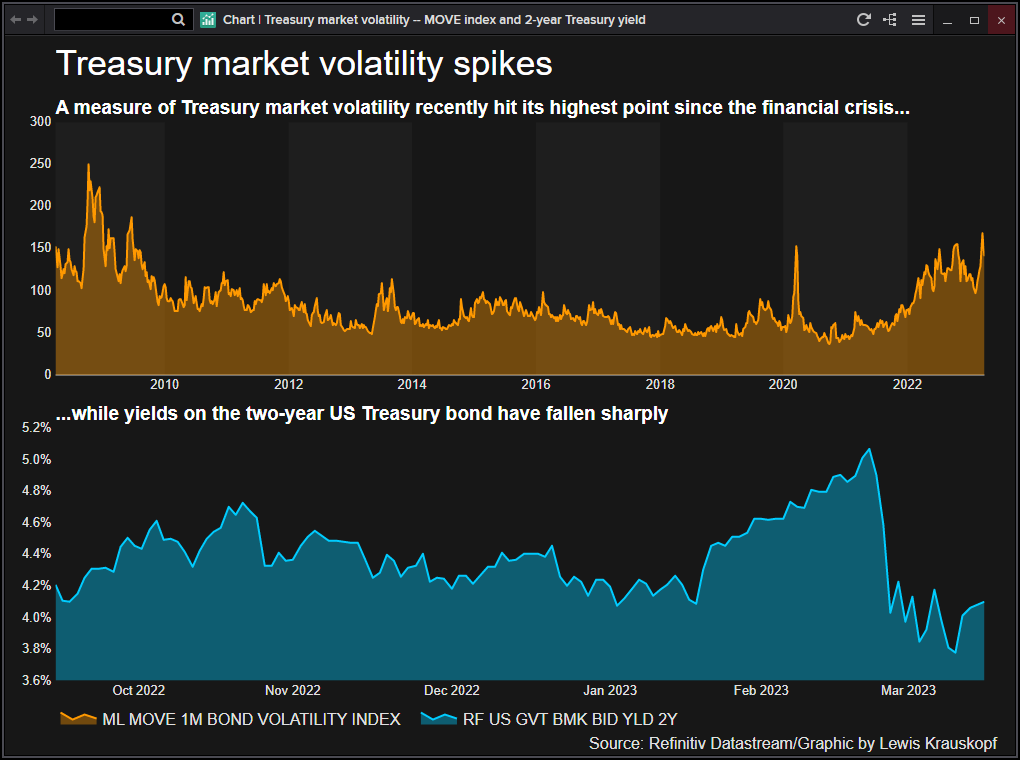

Jim Neumann, chief funding officer of options advisory agency Sussex Companions, mentioned many funds had been caught off guard in brief positions in sovereign debt markets. The blowup in banks precipitated traders to flee to the security of bonds, sending yields down at a price not recorded because the 2008 monetary disaster.

“The violent swings within the world charges markets took their toll on many discretionary and systematic (CTAs) managers,” mentioned Neumann, including portfolio managers on common lower danger publicity by 50% following the selloff.

CTAs lower their whole lengthy publicity of roughly $60 billion in equities in two weeks and are additionally chopping credit score publicity, UBS mentioned in a observe to shoppers. Funds exited quite a few trades, together with hedges that didn’t defend traders from market volatility, based on a chief dealer at a big financial institution.

The financial institution determined to not change shoppers’ borrowing limits, however it has elevated diligence oversight on the hedge fund publicity, together with new shoppers, the dealer mentioned.

Development-following funds are likely to bail shortly on trades that cease working, mentioned a pension fund director who invests in hedge funds. He doesn’t plan to scale back his funding in pattern funds as a result of he believes trend-following methods will work over the 12 months.

Macro funds which misplaced cash would possibly face investor redemptions, mentioned Don Steinbrugge, founder and chief government of Agecroft Companions.

“For individuals who spend money on CTAs, they have a tendency to know in case you have sharp reversals, they aren’t going to do nicely staying with them,” mentioned Steinbrugge.

Reporting by Nell Mackenzie in London, Carolina Mandl in New York, and Summer season Zhen in Hong Kong; Treasury graphic by Lewis Krauskopf; Enhancing by Josie Kao

: .