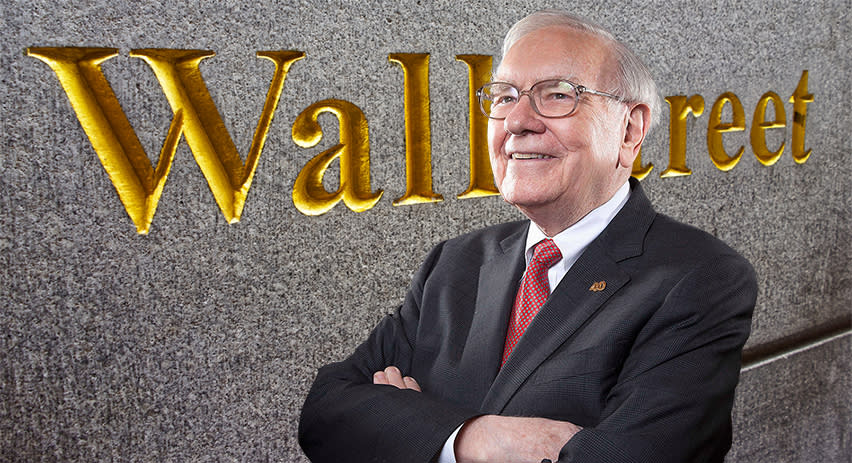

Wall Road legend Warren Buffett has at all times been a proponent of worth investing. The Oracle of Omaha’s many years of just about unparalleled success have been constructed on recognizing when a inventory is priced considerably under its inherent value after which betting large on it. Touting the deserves of endurance and the long-term impact of compounding returns, Buffett is a grasp of his occupation.

Nonetheless, even probably the most profitable traders’ portfolios embrace shares that undergo down intervals. It’s in all probability secure to say that in these difficult intervals, Buffett, who is understood for his sage recommendation to “be grasping when others are fearful,” may be planning to extend his holdings if he’s satisfied a sure inventory will finally recuperate.

With this in thoughts, we used TipRanks’ database to pinpoint a pair of equities sitting in Buffett’s portfolio which were underperforming this 12 months. These should not low stakes; true to type, he has multi-billion-dollar holdings in each, and has been a shareholder of every for over 5 years. Let’s see what Wall Road’s inventory specialists make of them proper now.

Kraft Heinz (KHC)

First on the underperforming Buffett checklist is a stalwart of the buyer items sector, Kraft Heinz, one of many largest meals and beverage firms in North America and proprietor of such standard manufacturers as Philadelphia cream cheese, Jell-O, and Velveeta.

Whereas foods and drinks are important, Kraft’s inventory has undoubtedly underperformed in latest months – KHC is down by 15% year-to-date. That hasn’t phased Buffett, or induced him to scale back his holdings within the inventory. The billionaire investing legend has been a shareowner in KHC since 2015, and his agency presently holds 325,634,818 shares value $10.89 billion. The dimensions of the holding makes Berkshire the most important proprietor in Kraft Heinz.

Kraft Heinz can boast of proudly owning 8 manufacturers able to producing $1 billion-plus yearly, and has a world repute as a trusted supplier of the meals and drinks that individuals like to eat. The corporate generated roughly $26 billion in complete income final 12 months, and noticed each income and earnings present year-over-year will increase within the newest monetary report, from 2Q23.

That stated, whereas Kraft’s Q2 high line got here to $6.72 billion, rising 2.55% y/y it missed the forecast by $81.9 million, with the corporate noting a pointy 7% drop in quantity. On the backside line, the corporate’s EPS of 79 cents in contrast favorably to the 70-cent determine from the year-ago quarter and got here in 3 cents per share higher than anticipated.

Buffett has at all times favored dividend shares, prioritizing high-yielding dividend payers to generate a powerful passive revenue from his holdings. KHC is about to pay out a standard share dividend of 40 cents per share on September 29. The dividend annualizes to $1.60 per share and offers a yield of 4.74%. Kraft’s dividend has been held at its present stage since 2019.

Turning to the Road’s analysts, we discover Deutsche Financial institution’s Stephen Powers taking a bullish place on Kraft Hienz. Powers notes headwinds within the business, however sees the corporate as essentially sturdy.

“Whereas we acknowledge and perceive latest detrimental sentiment round packaged meals shares owing to (i) skepticism round demand/ quantity restoration, (ii) potential retailer pushback on pricing, and (iii) the dangers of commerce down or intensifying aggressive dynamics, we stay constructive on KHC’s improved fundamentals (i.e., structurally stronger portfolio, clearer progress/ company technique, growth alternatives in Foodservice and Rising Markets, more healthy ranges of reinvestment spending vs. pre-pandemic, enhanced capabilities throughout the corporate, higher administration execution, and many others.) and supportive valuations. Therefore, we stay Purchase rated,” Powers said.

That Purchase score is backed by a $47 worth goal that factors towards 40% share appreciation within the coming 12 months. (To look at Powers’ monitor report, click on right here)

General, KHC inventory will get a Reasonable Purchase score from the Road’s analyst consensus, based mostly on 15 latest critiques that break down to five Buys and 10 Holds. The shares are buying and selling for $33.45 and their $40.47 common worth goal implies ~21% upside potential within the subsequent 12 months. (See KHC inventory forecast)

Financial institution of America Company (BAC)

The second inventory on our checklist, Financial institution of America, is a serious identify within the world banking business, and with $3.12 trillion in complete property, is without doubt one of the world’s largest financial institution companies.

That stated, BAC shares are down some 11% this 12 months, even because the S&P 500 has posted a web achieve of 16%. The share worth decline hasn’t saved Berkshire Hathaway from sustaining an intensive holding in BAC; the agency has ~1.033 billion shares within the financial institution, making up 8.5% of the Berkshire portfolio. The Buffet stake in BAC is valued at greater than $29 billion, and Berkshire Hathaway is Financial institution of America’s largest single shareholder, proudly owning practically 13% of the excellent shares.

Financial institution of America has a wide-ranging enterprise, in each shopper and business accounts, small- and mid-market enterprise banking, and large-scale institutional banking. The financial institution’s complete income grew by 11% y/y, in keeping with the 2Q23 monetary launch, to achieve $25.2 billion, coming in $258.8 million over the estimates. This supported a web revenue of $7.4 billion, up 19% y/y, with an EPS of 88 cents that beat the forecast by 4 cents per share. Financial institution of America completed Q2 with $373.5 million in complete money and liquid property, in comparison with simply $198 million on the finish of 2Q22.

This financial institution firm is understood for its sturdy capital return coverage and in Q2, the financial institution returned $2.3 billion to its stockholders via share repurchases and dividends. The inventory’s dividend was final declared on July 19, for a September 29 payout at 24 cents per frequent share, marking a 9% improve from the earlier quarter. The dividend annualizes to 96 cents per share and yields 3.3%.

Whereas Financial institution of America’s sturdy dividend historical past should be engaging to Buffett, based mostly on his personal long-stated preferences, Properly Fargo analyst Mike Mayo takes a unique tack. He’s impressed by BAC’s measurement, seeing the financial institution’s gigantism as an total optimistic, an asset that can not be denied.

“In our view, Financial institution of America is among the many finest positioned large-cap banks because it pertains to deposits (esp. shopper), price administration, credit score high quality, and repute as a frontrunner in stakeholder capitalism. As well as, BAC is a frontrunner in tech amongst banks, which ought to assist it additional develop its main deposit share towards its aim of one-fourth within the U.S. and support in its effort to point out superior working leverage. Certainly, its tech advantages ought to assist BAC present about the perfect 2023 unfold of income vs. expense progress, resulting in increased incremental Shopper Financial institution revenue margins. General, BAC is a Goliath at a time when Goliath is successful,” Mayo opined.

Mayo goes on to offer the inventory an Chubby (i.e. Purchase) score, and his $40 worth goal signifies confidence in a 39% achieve on the one-year horizon. (To look at Mayo’s monitor report, click on right here)

General, BAC boasts a Reasonable Purchase consensus score based mostly on 16 latest analyst critiques, together with 8 Buys, 6 Holds, and a pair of Sells. The $28.84 buying and selling worth and $35.13 common worth goal mix to recommend ~22% one-year upside potential. (See BAC inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather essential to do your individual evaluation earlier than making any funding.