The inventory market has gotten off to a scorching begin in 2024. About halfway by way of the yr, the S&P 500 has gained roughly 15% whereas the tech-heavy Nasdaq Composite is up almost 18%.

One of many hottest sectors fueling the market to new heights is know-how — primarily pushed by euphoria surrounding all issues associated to synthetic intelligence (AI). As inventory costs proceed to surge, some corporations have resorted to inventory splits in an effort to open shares as much as a broader base on traders.

Semiconductor firm Broadcom (NASDAQ: AVGO) is the latest chip firm to announce a inventory break up, becoming a member of its friends Nvidia and Lam Analysis.

Let’s dive into some essential particulars concerning inventory splits, and assess whether or not Broadcom may very well be a profitable alternative for long-term traders.

1. What are inventory splits and the way do they work?

A inventory break up is a monetary engineering instrument throughout which an organization’s inventory value and share rely change by the issue within the break up ratio.

In early June, Broadcom introduced that it will likely be finishing a 10-for-1 inventory break up. Which means after the break up happens, Broadcom’s excellent shares will rise by 10x whereas its share value can be divided by 10.

Let’s check out an instance. Within the desk beneath, you possibly can see Broadcom’s present share rely, inventory value, and market cap on each a pre- and post-split foundation.

|

Merchandise |

Pre-Break up |

Submit-Break up |

|---|---|---|

|

Share rely |

465 million |

4.6 billion |

|

Inventory value |

$1,698 |

$169 |

|

Market cap |

$790 billion |

$790 billion |

Information supply: Broadcom SEC filings and Yahoo! Finance.

If the break up have been to happen at this time, Broadcom’s excellent shares would rise from about 465 million to 4.6 billion. On the identical time, the corporate’s inventory value could be lowered by an element of 10 — dropping from $1,698 to $169. Given this dynamic, traders can see {that a} inventory break up doesn’t change the market cap of an organization.

2. Why may Broadcom be splitting its inventory?

AI has been one of many largest tailwinds within the capital markets during the last 18 months. Chip shares particularly have benefited tremendously from the hype round AI.

Since January 2023, shares of Broadcom have soared 204%. As of the time of this writing, Broadcom inventory is hovering round $1,700 — near its 52-week excessive of $1,851.

For the reason that inventory is buying and selling close to document ranges and boasts a four-figure price ticket, many traders possible see Broadcom as costly. Nonetheless, this mind-set just isn’t fully right and may really forestall retail traders from lacking out on good alternatives.

What I imply by that is that traders shouldn’t base their determination to purchase a inventory purely on its value. A detailed evaluation of valuation multiples, and benchmarking the corporate towards a set of friends, are wanted to find out whether or not a inventory could also be overvalued or undervalued.

3. How do inventory splits get dealt with?

The great factor about inventory splits is that they’re dealt with fairly seamlessly. Should you at present personal shares of Broadcom, your funding dealer will deal with all of the mechanics within the background.

For instance, as an instance that you simply at present personal 10 shares of Broadcom at a median value of $1,500. Offered that you do not purchase or promote any extra shares previous to the break up, your account will mechanically mirror 100 shares owned at a median value of $150 as soon as the break up is full.

4. Has Broadcom ever break up its inventory?

Broadcom initially went public in 1998 and traded below the ticker image BRCM on the Nasdaq inventory trade. Throughout its time buying and selling below the ticker BRCM, Broadcom accomplished three inventory splits.

Nonetheless, in 2016, Avago Applied sciences acquired Broadcom for $37 billion. As a part of the transaction, Avago Applied sciences modified its title to Broadcom Inc. The BRCM ticker image was retired, and Broadcom now trades on the Nasdaq below the image AVGO.

Since buying and selling below its new ticker as a part of Avago Applied sciences starting in 2016, Broadcom has not break up its inventory.

5. Is Broadcom inventory a purchase proper now?

Valuing semiconductor shares is usually a little bit of a frightening train. The chip area is very cyclical, and proper now corporations throughout the board are witnessing outsize demand on the heels of the AI revolution.

Given the character of the chip business, metrics similar to earnings and money stream can rapidly go south. For that reason, utilizing the price-to-earnings (P/E) ratio or price-to-free money stream (P/FCF) a number of is not overly helpful, as a result of every may be inconsistent over long-term time ranges.

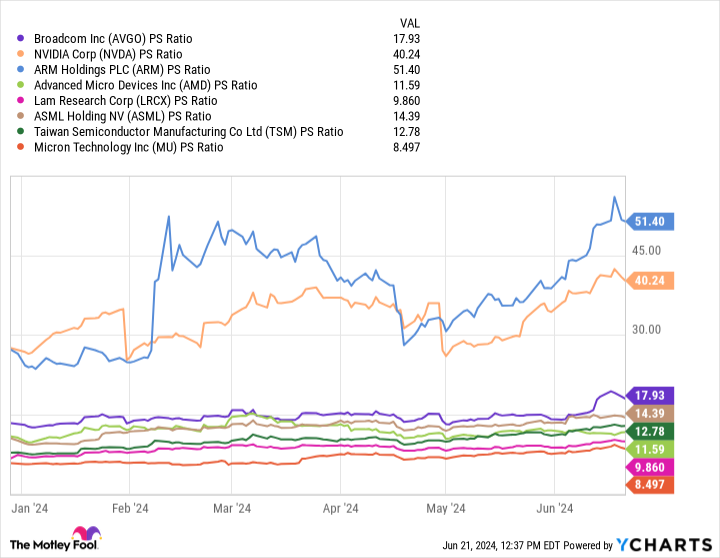

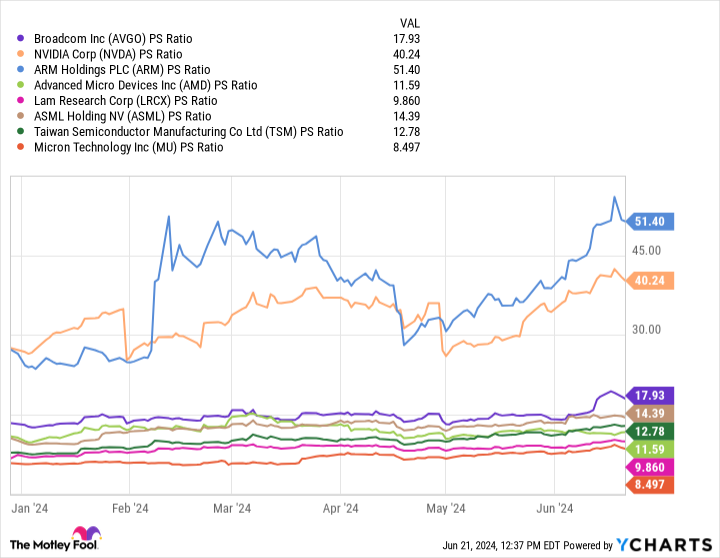

Utilizing the evaluation within the chart above, traders can see that Broadcom’s 17.9 price-to-sales (P/S) a number of sits squarely in the midst of this peer set. With that mentioned, Nvidia and Arm Holdings are apparent outliers amongst this cohort. Excluding these two, Broadcom could be valued at a premium in comparison with most of its friends within the chip realm.

Regardless of its dear valuation, I might advise towards ready till after the break up to scoop up shares. As defined above, the cheaper price tag on Broadcom shares post-split doesn’t imply it is really inexpensive.

Furthermore, inventory splits typically fetch a variety of consideration. Inventory-split shares can expertise fairly a little bit of volatility and momentum across the time of the break up, thereby pushing the share value increased after the break up happens. If this happens, it technically means you are shopping for Broadcom inventory at the next valuation as in comparison with earlier than the break up.

To me, investing in Broadcom must be rooted in long-term conviction round AI and the corporate’s potential to emerge as a pacesetter. In case you are trying to hedge different chip shares in your portfolio or acquire publicity to the long-term tailwinds in AI, Broadcom may very well be alternative proper now.

Do you have to make investments $1,000 in Broadcom proper now?

Before you purchase inventory in Broadcom, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Broadcom wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $775,568!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 24, 2024

Adam Spatacco has positions in Nvidia. The Motley Idiot has positions in and recommends ASML, Superior Micro Units, Lam Analysis, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.

Right here Are 5 Issues Good Buyers Ought to Know About Broadcom’s Upcoming 10-for-1 Inventory Break up was initially revealed by The Motley Idiot