-

Goldman Sachs says Jerome Powell’s speech at Jackson Gap on Friday might ship some surprises.

-

It would not be the primary time he used the occasion as a possibility to reset traders’ expectations.

-

Markets are eyeing charge cuts of 100 foundation factors between now and the tip of the 12 months.

All eyes are on Jerome Powell’s speech on the Federal Reserve’s Jackson Gap Symposium on Friday, and Goldman Sachs says the central financial institution’s chairman might nonetheless shock traders regardless of their confidence within the Fed’s path for the remainder of the 12 months.

It would not be the primary time Powell used his Jackson Gap speech as a possibility to reset the market’s expectations.

In 2022, when inflation was hitting a 40-year excessive, Powell delivered a brief however direct eight-minute speech that strengthened the Fed’s path to elevating rates of interest to fight inflation though the inventory market was in the course of a painful bear market.

Bond yields surged, and the S&P 500 misplaced practically 8% within the week after Powell’s hawkish Jackson Gap speech.

However with inflation virtually below management and the labor market exhibiting indicators of degradation, Powell might strike a a lot totally different tone on Friday.

And in keeping with Goldman Sachs, there are a couple of methods the Fed boss might catch markets off guard.

“Potential dovish surprises might embody a extra involved tackle the labor market or any suggestion that the excessive degree of the fed funds charge is inappropriate in gentle of the progress made on inflation,” David Mericle, a Goldman economist, stated in a notice on Tuesday.

Such an occasion would doubtless be bullish for the inventory market, as it might reinforce the concept the Fed will begin to lower rates of interest at its Federal Open Market Committee assembly in September and that the bar for a lower of greater than 25 foundation factors or a string of consecutive cuts is decrease than most count on.

The CME FedWatch instrument suggests traders see 100 foundation factors of charge cuts by way of the remainder of this 12 months.

Then again, Powell might shock markets to the draw back if he adopts a extra hawkish tone than traders count on.

“A potential hawkish shock is likely to be highlighting as a substitute that broad monetary circumstances are nonetheless fairly straightforward, which might suggest that the excessive degree of the funds charge, whereas maybe pointless, isn’t an pressing downside,” Mericle stated.

Mericle finally expects Powell to be extra dovish in his Jackson Gap speech, given the weak July jobs report and up to date information that signifies inflation is falling nearer to the Fed’s long-term goal of two%.

The latest downward revision to employment development of 818,000 jobs additionally does not assist the Fed’s case for remaining hawkish.

“This may imply expressing a bit extra confidence within the inflation outlook and placing a bit extra emphasis on draw back dangers within the labor market,” the notice stated. “Powell may also reiterate that the FOMC is watching the labor market information rigorously and is properly positioned to help the economic system if essential.”

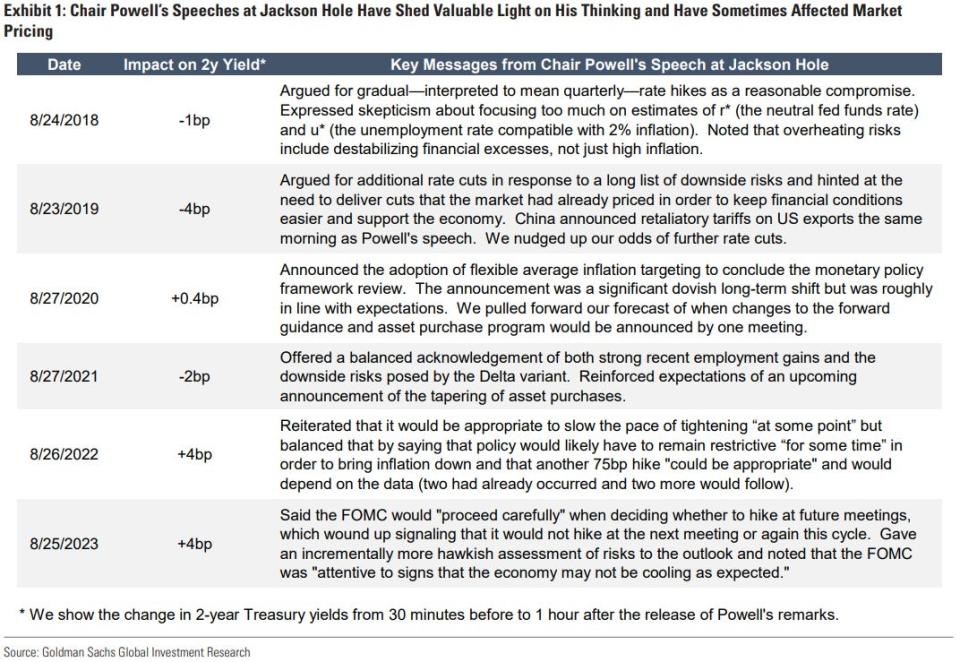

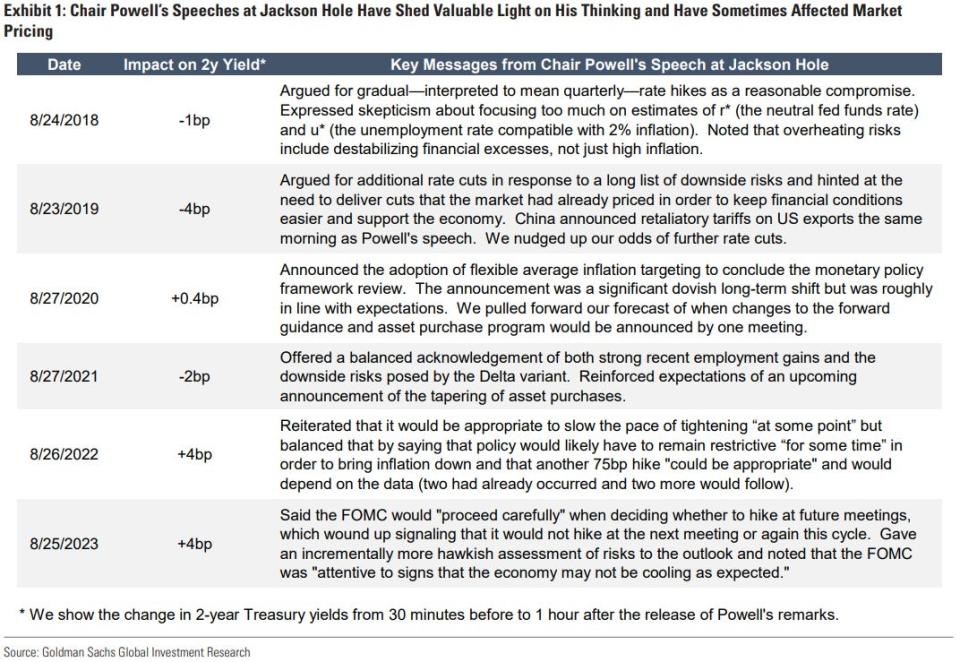

Goldman Sachs additionally gave a rundown of Powell’s Jackson Gap speeches and their impression on Treasury yields since he grew to become the Fed chairman in 2018.

Learn the unique article on Enterprise Insider