I come bearing excellent news for many who are lately retired, who’re about to retire quickly, and for anybody else who needs a safe revenue for the remainder of their life.

It’s not superb information, so don’t escape the Champagne fairly but, however it’s nonetheless excellent news—a uncommon sufficient factor proper now.

Lifetime annuities, a sort of do-it-yourself pension that may present you a assured revenue till the day you die, have all of the sudden develop into a a lot, significantly better deal. They’re now paying out month-to-month revenue as a lot as a 3rd larger than related annuities purchased only a yr in the past. After greater than a decade when annuities provided a reasonably meager deal, they’re now providing the most effective payouts because the collapse of Lehman Brothers in 2008.

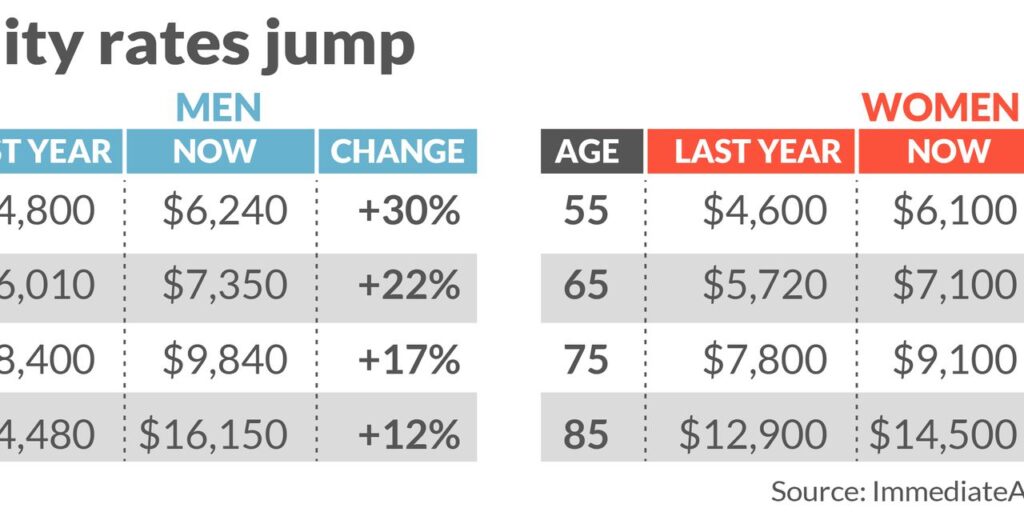

As you possibly can see from our desk, somebody planning to retire early, of their mid-50s, and prepared to pay a one-off premium of $100,000, can lock in a lifetime revenue of greater than $6,000 a yr, whereas a yr in the past they might have gotten considerably lower than $5,000. The proportion rises are much less, although nonetheless substantial, even at older ages.

(The numbers for males are larger, not due to any explicit sexism on the a part of the annuities trade, however as a result of males are inclined to die youthful, to allow them to count on to obtain fewer checks.)

You’ll be able to thank the turmoil within the bond market, which has seen brief, medium and long-term rates of interest all rocket this yr.

These lifetime annuities are technically often called “single premium rapid annuities.” They’re merchandise provided by life insurance coverage firms. They’re the closest factor many people can get to a standard, old school pension: As a substitute of worrying about making our financial savings final for the remainder of our life, we switch our longevity danger to the insurance coverage firm. You ship the insurance coverage firm a giant test at the beginning, let’s say for $100,000, and in return they comply with ship you a small month-to-month test each month till you die, whether or not that sad date is 6 months from now or 30 years. The scale of the month-to-month test, which is mounted at the beginning of the contract, relies in your age and intercourse.

Those that die quickly get a poor deal. The excess cash helps pay for many who live longer than anticipated.

Single premium rapid annuities generally is a approach of stretching your retirement financial savings as a lot as attainable, as long as you aren’t anxious about leaving cash to your heirs. The pooled longevity danger is what makes them so helpful.

The explanation payout charges are up a lot is as a result of insurance coverage firms make investments the upfront premiums in Treasury and funding grade firm bonds, and use the curiosity to finance the month-to-month checks. So larger rates of interest on bonds can produce larger annuity charges.

Naturally, this excellent news comes with the draw back that anybody who purchased an annuity final yr is kicking themselves for lacking out, and is moreover watching their payouts get devalued by persistent inflation. However as we can not change the previous let’s at the very least concentrate on the current (and the long run).

Many economists argue that annuities are beneath owned. “An enormous and wealthy literature” of financial analysis suggests “that rational people of retirement age ought to allocate a considerable portion of their wealth to life annuities,” write finance professors Mohamad Hassan Abou Daya and Carole Bernard within the Swiss Journal of Economics and Statistics. Economists have been making this argument for 50 years, referring to it as “the annuity puzzle.”

There are numerous attainable explanations. Whenever you purchase an annuity you lose management of the lump sum. Many retirees need to depart cash to their youngsters and grandchildren, whereas many annuities (although not all) expire at dying and depart nothing. And annuities could be susceptible to inflation.

One of many key issues because the international monetary disaster has been their desperately low payout charges. Retirees can thank the Federal Reserve, which has pursued a coverage of economic manipulation to maintain brief, intermediate and long-term rates of interest low within the hope of stimulating the economic system. This has disadvantaged older traders and retirees of the possibility to earn first rate returns from decrease danger investments, reminiscent of bonds, certificates of deposit and annuities, driving many into the inventory market because of this. This whole regime has dramatically unwound to this point this yr.

Even at present, annuities include important inflation danger. Many of the annuities available in the market provide mounted month-to-month revenue, with no upward adjustment for the price of dwelling. Consequently your buying energy erodes over time. With shopper inflation at present operating north of 8% a yr, that erosion is going on fairly rapidly. You should buy annuities with annual COLAs, usually value 3% a yr however generally extra, however there’s a hefty worth: Your preliminary payouts begin out a lot, a lot decrease.

“The quantity you’ll obtain on day one is considerably much less” with an inflation-adjusted annuity, says Todd Giesing, an assistant vice chairman in annuity analysis director at insurance coverage trade commerce affiliation Limra. “I believe the issue for a lot of Individuals is taking much less now and extra later…Whenever you consider people who find themselves shopping for single premium lifetime annuities, they’re shopping for revenue for at present.”

Changing at the very least a few of your retirement account into an annuity generally is a sensible transfer for brand spanking new retirees. A minimum of now you’re getting extra to your cash, which must be a great factor.