Many traders have an interest within the “Magnificent Seven” shares for good causes apart from excellent returns during the last 12 months. This elite group of tech corporations has robust manufacturers and a rising buyer base, and they’re very worthwhile companies — the whole lot an investor appears to be like for in a strong funding.

Over the past 12 months, the Roundhill Magnificent Seven ETF has returned 51%, beating the Nasdaq Composite‘s 32% and the S&P 500‘s 23% return. There’s some debate about how lengthy this group will proceed to outperform within the close to time period. On a price-to-earnings (P/E) foundation, most of those shares commerce at massive premiums to the typical inventory within the main indexes.

The most costly of the seven is Nvidia (NASDAQ: NVDA), which at the moment has a trailing P/E of 77. Regardless of its excessive valuation, the corporate’s superior progress and future alternative may justify extra new highs for years to come back. This is why the inventory stays a core holding in my portfolio.

Nvidia’s progress runway

Nvidia is benefiting as information facilities swap from central processing models (CPUs) to the way more highly effective graphics processing models (GPUs) for synthetic intelligence (AI) workloads. Traditionally, information facilities spent about $250 billion per 12 months on infrastructure, however this quantity has elevated for the primary time in a few years, which may very well be only the start of a significant spending growth.

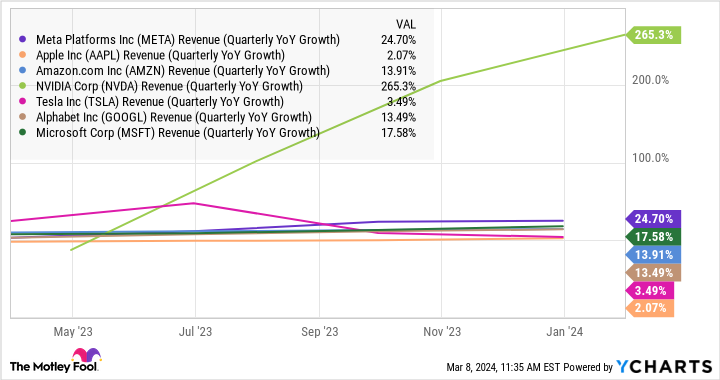

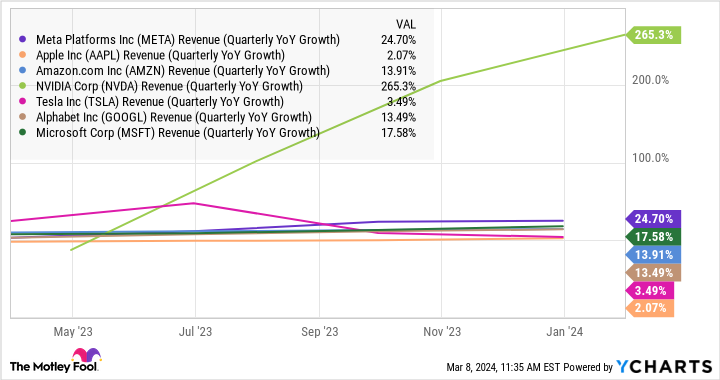

The marketplace for Nvidia’s merchandise is proving to be a lot greater than initially thought a couple of years in the past. Income surged 265% 12 months over 12 months to $22 billion within the fiscal fourth quarter, considerably outpacing the expansion for the opposite Magnificent Seven corporations.

Nvidia is simply scratching the floor of this chance. Firm executives have talked about $1 trillion value of information middle infrastructure that’s beginning to undertake accelerated computing, which is the usage of a number of GPUs operating collectively to deal with giant information workloads.

Nevertheless, the chance may very well be a lot greater. AI is permitting corporations to make use of information in ways in which was not doable earlier than, as Nvidia chief monetary officer Colette Kress mentioned on the current Morgan Stanley expertise convention.

Because of this there are new forms of information facilities rising referred to as GPU-specialized cloud service suppliers. It is one motive Nvidia executives imagine the precise information middle infrastructure market may very well be value nearer to $2 trillion.

Why purchase the inventory?

AI is totally turning conventional computing on its head, which is mirrored within the accelerating demand for Nvidia’s H100 GPU. It is virtually change into a bragging proper for corporations to speak about what number of H100s they’ve bought. Magnificent Seven member Meta Platforms has mentioned it plans to have 350,000 H100s up and operating by the tip of the 12 months.

Demand is already outstripping provide for Nvidia’s H200 GPU, which is on monitor to begin transport within the fiscal second quarter. Firm steerage requires income to be up 234% 12 months over 12 months within the fiscal first quarter.

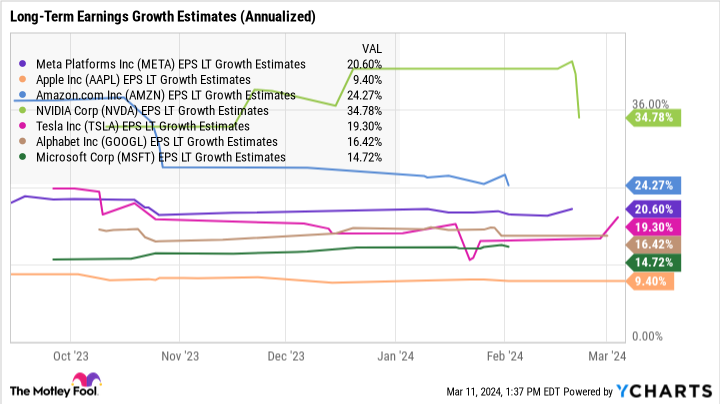

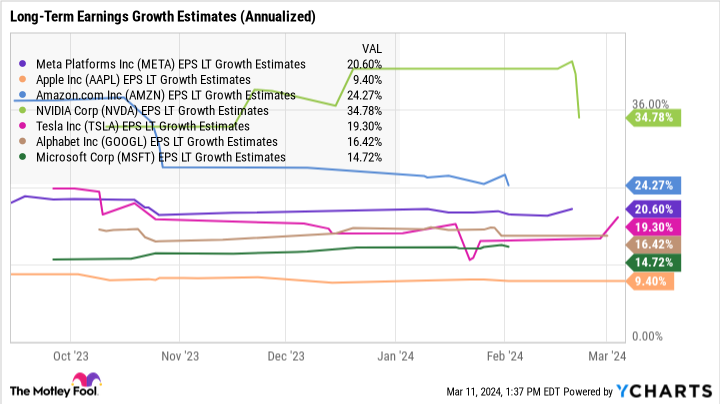

Over the long run, analysts count on Nvidia to develop earnings at 35% per 12 months, which can be larger than the opposite Magnificent Seven.

Nvidia’s main share within the GPU market ought to translate to extra progress as information facilities proceed to improve elements for AI. As this chance unfolds, this GPU inventory gives long-term upside that would outperform the opposite Magnificent Seven over the following decade. Relative to anticipated earnings this 12 months, Nvidia is not all that costly, buying and selling at a ahead P/E of 37.

Nvidia has been the king of GPUs for a few years, so it is principally received the fitting product on the proper time to profit from the AI growth. However what in the end seals the deal for me is how a lot money the enterprise is producing.

Its trailing free money circulate totaled $27 billion, up 10-fold during the last 5 years. This provides the corporate large sources to remain forward in GPU innovation and generate shareholder returns for years to come back.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 11, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Ballard has positions in Nvidia and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

This is My High “Magnificent Seven” Inventory to Purchase and Maintain for the Subsequent 10 Years was initially revealed by The Motley Idiot