The massive story of 2023 has been the surging demand for synthetic intelligence (AI). Nearly each enterprise is taking a look at methods to implement AI of their operations, whereas a number of huge tech corporations are pushing the boundaries of what AI can do.

However a problem lies forward for a lot of corporations pushing the forefront of AI growth. It is more and more costly to construct and practice massive language fashions. Not solely do these AI fashions require numerous very costly chips, however the quantity of vitality these processes devour is staggering. One research discovered, for instance, a easy ChatGPT immediate required 10 instances the electrical energy as a regular Google Search. When multiplied by billions of makes use of, that has a huge effect on prices: each financial and environmental.

And energy calls for are solely getting larger. “Lowering energy consumption is changing into extra necessary as AI energy demand might simply triple in two years,” Taiwan Semiconductor Manufacturing (NYSE: TSM) CEO C. C. Wei stated at a current convention. As such, to ensure that AI builders to maintain pushing us ahead, they want extra environment friendly chips. And TSMC is probably going the corporate that can convey that subsequent huge development to the market.

This is what buyers have to know.

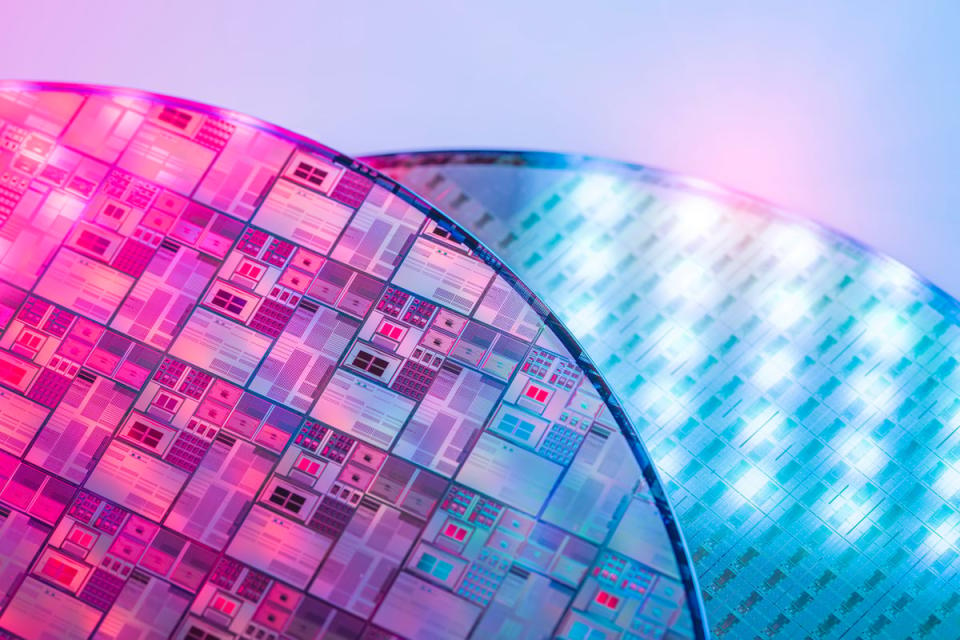

What goes into sooner and extra environment friendly chips

Whereas chip designers like Nvidia (NASDAQ: NVDA) get a whole lot of consideration for his or her chips, it is necessary to know what permits them to make such highly effective chip designs within the first place.

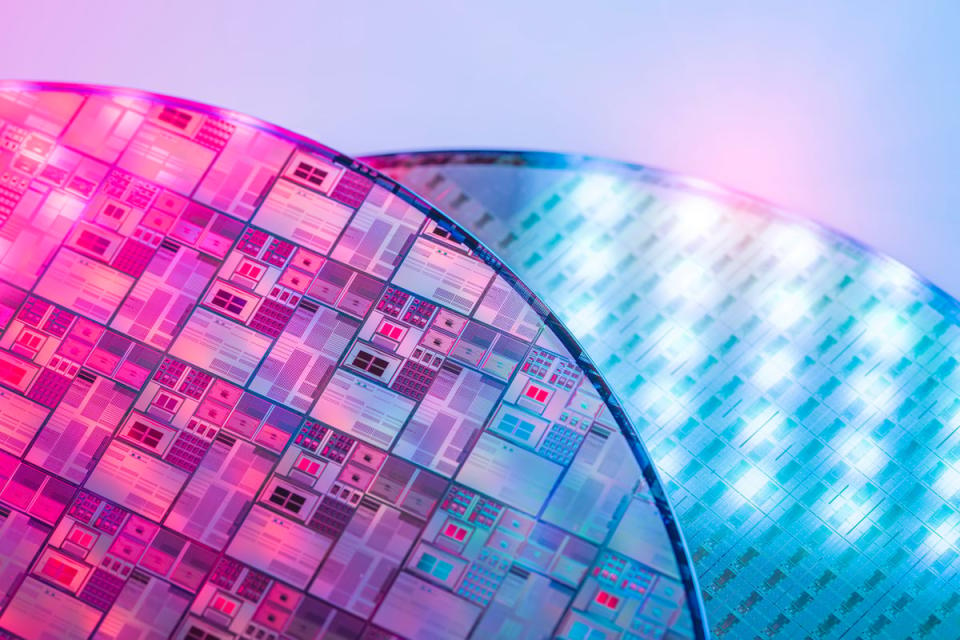

The quantity of processing energy any particular person chip has is essentially decided by the variety of transistors on a chip. Extra transistors means you possibly can run extra processes without delay, providing you with extra computing energy.

However there are limits to how huge you can also make a processor unit to be used in a server (or laptop computer or smartphone). So, the one method to construct chips with extra transistors on them is to suit extra transistors into the identical quantity of area. That is simpler stated than finished.

Essentially the most superior expertise accessible makes use of a course of known as 3-nanometer. It is what Apple (NASDAQ: AAPL) used to suit 92 billion transistors onto its M3 Max MacBook Professional processor, which is roughly 400 sq. millimeters.

The following technology is a 2-nanometer course of, which can improve efficiency 10% to fifteen% over 3nm and reduce energy consumption 25% to 30%. TSMC is competing with Samsung and Intel to convey that course of to market, making certain they’ll print these chips economically with excessive reliability.

TSMC is planning to put in tooling for its 2nm course of in a single facility in April. Quantity manufacturing will not begin till the second half of 2025, although. (Apple is probably going the primary buyer for that course of.) Intel expects to begin producing its 2nm chips by the tip of 2024. However getting a course of in place is one factor, getting yields and pricing to some extent the place it is smart for patrons to change their designs from their current producer is one other.

Why TSMC would be the firm to assist the subsequent technology of AI chips

Regardless of the competitors, TSMC holds a few important benefits on the subject of creating the subsequent technology of chips.

Initially, it can’t be discounted that the one factor TSMC does is manufacture chips for different corporations. Intel designs its personal chips which will compete with different chip designers. Likewise, Samsung makes chips and digital gadgets, so whereas it has an awesome built-in buyer, it curbs its attraction for a lot of different chipmakers.

Furthermore, TSMC has a scale benefit. It accounted for 57.9% of chip-manufacturer income within the third quarter. Samsung, its subsequent closest competitor, managed to draw simply 12.4% of income.

That scale is necessary as a result of creating the processes and tooling for the subsequent technology of chips is changing into more and more costly. TSMC spent $1.6 billion in analysis and growth final quarter. Few different chip producers are even bringing in that a lot income every quarter.

TSMC can justify spending so closely as a result of it has current relationships with enormous corporations like Apple and Nvidia. That creates a virtuous cycle whereby the tech giants purchase from TSMC, TSMC reinvests a few of that cash into creating the next-generation course of, after which it attracts much more prospects as rivals battle to catch up.

The inventory is grime low cost

Regardless of its place as a number one provider of essentially the most superior AI chips out there, TSMC’s inventory does not commerce on the sky-high valuation of lots of the well-known AI shares.

Even after the inventory’s sturdy worth efficiency for the reason that begin of November, shares nonetheless commerce at lower than 17x analysts’ consensus estimate for 2024 earnings. Not solely is that decrease than the ahead earnings a number of of the S&P 500 as a complete, it is nicely beneath TSMC’s historic P/E ratio of round 21.5. So, if the inventory merely sees a number of growth towards its historic norm, it ought to commerce considerably larger by the tip of subsequent yr.

Contemplating the significance of TSMC for the way forward for AI growth, it might see even higher efficiency as demand for highly effective and energy-efficient chips grows.

Do you have to make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Taiwan Semiconductor Manufacturing wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Adam Levy has positions in Apple and Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and quick February 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

This is the Firm Pushing Towards the Subsequent Huge Development in Synthetic Intelligence. And Its Inventory Is Grime Low cost. was initially revealed by The Motley Idiot