Final yr was nice for the Nasdaq Composite, surging 43% to steer all main indexes. This was a notable turnaround after the index misplaced a 3rd of its worth in 2022 amid rising inflation and recession fears.

One factor about historical past is that it typically repeats itself, together with within the inventory market. If that continues to be the case, traders needs to be inspired heading into 2024. The previous few instances the Nasdaq Composite completed a yr within the unfavourable (2002, 2008, 2011, and 2018), it bounced again with no less than two straight constructive years.

|

12 months of Decline |

Decline Proportion |

Positive aspects One 12 months After Decline |

Positive aspects Two Years After Decline |

|---|---|---|---|

|

2008 |

(40.5%) |

43.9% |

16.9% |

|

2011 |

(1.8%) |

15.9% |

38.3% |

|

2018 |

(3.9%) |

35.2% |

43.6% |

|

2022 |

(33.1%) |

43.4% |

TBD |

Knowledge supply: Nasdaq Composite historic knowledge. Percentages rounded to the closest tenth %.

There is no technique to predict market actions, and previous outcomes do not assure future efficiency, however most of the catalysts liable for the Nasdaq’s 2023 bounceback — comparable to AI and cloud computing — are nonetheless comparatively early in what they will develop into and may carry momentum via the yr.

To get forward of the sport, this is an exchange-traded fund (ETF) I might purchase.

Let high tech firms cleared the path for you

The Nasdaq-100 is a subset index of the Nasdaq Composite that tracks the 100 largest non-financial firms buying and selling on the Nasdaq Inventory Market. The Invesco QQQ ETF (NASDAQ: QQQ) is an ETF that mirrors the Nasdaq-100 and is the second-most traded ETF on the U.S. inventory market.

A lot of the attraction of the Invesco QQQ ETF is its composition. Beneath are its high 5 holdings and the way a lot of the ETF they account for (as of Jan. 5, 2024):

-

Apple: 8.95%

-

Microsoft: 8.68%

-

Amazon: 4.77%

-

Broadcom: 4.02%

-

Meta Platforms: 3.95%

The Invesco QQQ ETF is undoubtedly tech-dominant (57% of the fund), however the firms cowl plenty of areas throughout the tech sector. They cowl client electronics (Apple), social media (Meta Platforms), software program and providers (Adobe, Alphabet, Intuit), semiconductors (Superior Micro Gadgets, Intel, Nvidia), digital design automation (Cadence Design Techniques, Synopsys), and a handful of different subsectors of tech.

Most of the Invesco QQQ ETF’s high holdings are {industry} leaders who will probably be shaping the way forward for know-how and innovation — particularly the “Magnificent Seven.”

Investing in particular person firms comes with inherent dangers, together with company-specific and industry-specific points and downturns, however I belief them, as a complete, to drive sustainable long-term progress.

A attain that goes past the tech sector

The Invesco QQQ ETF is usually related to tech, however it goes past that. Beneath are non-tech sectors represented within the ETF and the way a lot of it they make up:

The tech sector will lead the cost, however it’s good to produce other sectors to stability out the ETF. The tech sector is not proof against slumps, so any diversification advantages traders. Vitality, actual property, and fundamental supplies will not have tangible results on the ETF, however sectors like client discretionary and healthcare might be nice to stability out the cyclical nature of different sectors like tech and industrials.

The Invesco QQQ ETF has market-beating potential

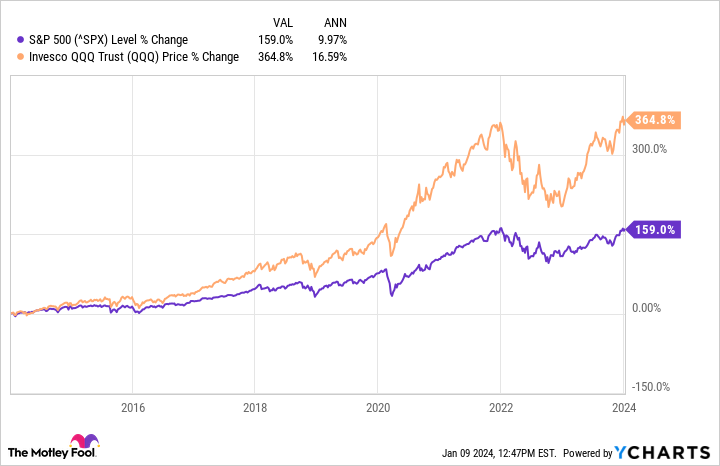

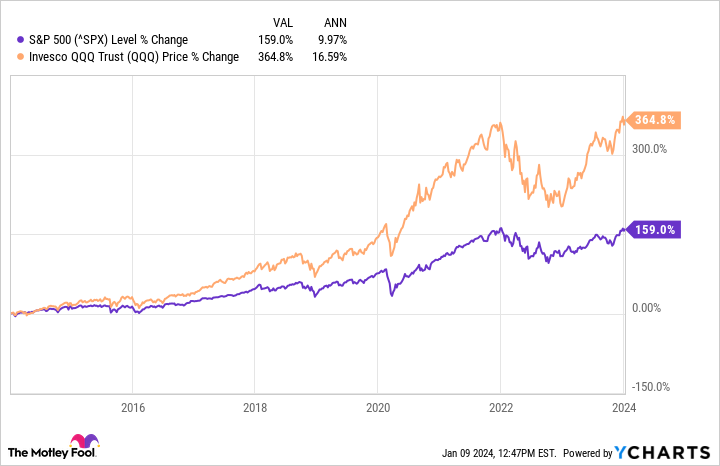

Possibly most essential is that the Invesco QQQ ETF has confirmed outcomes. Since its March 1999 inception, the Invesco QQQ ETF has far outperformed the S&P 500, with 695% features in comparison with the S&P 500’s 270% features over that time-frame. The efficiency is much more spectacular when returns over the previous decade.

There is no technique to predict if the Invesco QQQ ETF’s 16.5% common annual returns from the previous decade will proceed, however it has market-beating potential when contemplating the businesses it has main the way in which.

For traders all for investing in Nasdaq shares in 2024, the Invesco QQQ ETF is a perfect alternative. It comprises notable sector leaders, has non-tech sectors to assist in opposition to downturns, and has confirmed historic outcomes. It is a 3-for-1 ETF that may play a key function in traders’ portfolios.

Do you have to make investments $1,000 in Invesco QQQ Belief proper now?

Before you purchase inventory in Invesco QQQ Belief, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Invesco QQQ Belief wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 8, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Stefon Walters has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Adobe, Superior Micro Gadgets, Alphabet, Cadence Design Techniques, Intuit, Nvidia, and Synopsys. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2024 $420 calls on Adobe, lengthy January 2025 $45 calls on Intel, brief February 2024 $47 calls on Intel, and brief January 2024 $430 calls on Adobe. The Motley Idiot has a disclosure coverage.

Historical past Says the Nasdaq May Soar in 2024: This is What I Would Purchase Earlier than Then was initially printed by The Motley Idiot