-

The present bull market in shares is extra of the slow-and-steady selection than the high-octane sort, in line with DataTrek.

-

The analysis agency in contrast the present rally in shares to prior bull markets, and the outcomes recommend sluggish beneficial properties forward.

-

“If that analog continues, the [S&P 500] could also be principally flat over the following three months till it anniversaries its October 2022 low.”

The inventory market’s present bull rally is more likely to be of the slow-and-steady selection if historical past is a information, and meaning sluggish beneficial properties forward, in line with a Wednesday be aware from DataTrek Analysis.

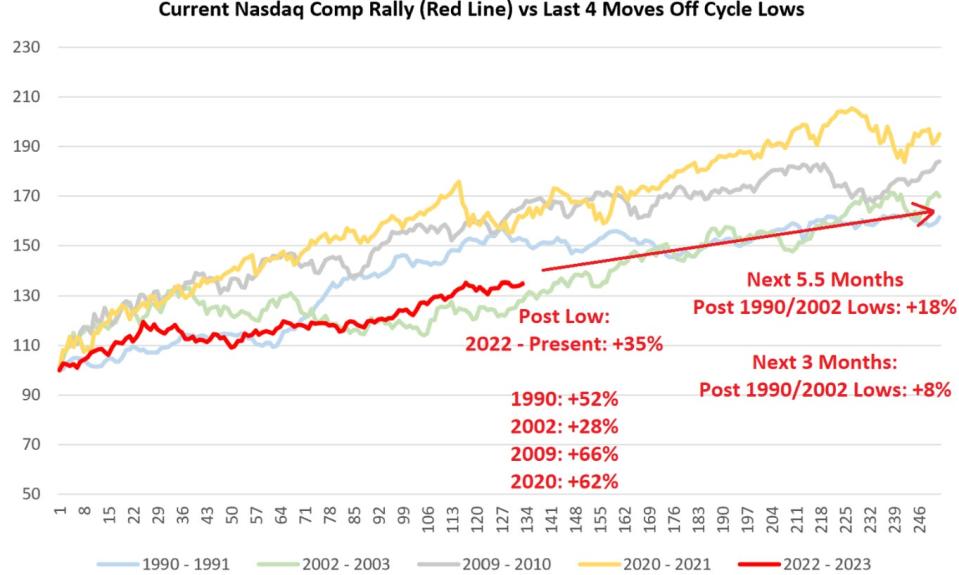

The analysis agency in contrast the present inventory market surge to 4 prior bull market cycles that started in 1990, 2002, 2009, and 2020, and located that there are two varieties of rallies.

One sort is a high-octane rally, like was seen within the 2009 and 2020 bull markets when the S&P 500 surged greater than 60% after 185 buying and selling days from its backside.

The opposite sort is slow-and-steady, like was seen within the 1990 and 2002 bull markets when the S&P 500 jumped about 30% after 185 buying and selling days from its backside.

With the S&P 500 having bottomed in mid-October, or 185 buying and selling days in the past, it has since rallied 24%, placing it within the slow-and-steady class, in line with DataTrek co-founder Jessica Rabe.

“If that analog continues, the index could also be principally flat over the following three months till it anniversaries its October 2022 low. The S&P solely gained 1.3% over the following 66 buying and selling days from right this moment when taking the typical of our 1990 – 1991 and 2002 – 2003 comparisons,” Rabe defined.

It is a related story for the Nasdaq Composite, which is up about 35% since its bear market low. Rabe highlighted that the acquire is nearer to the 1990 and 2002 bull markets than the 2009 and 2020 bull markets, which noticed beneficial properties of greater than 60% this far faraway from the underside.

If the Nasdaq follows the identical sample of the 1990 and 2002 bull markets, because it has thus far, it may see beneficial properties of about 8% over the following three months and beneficial properties of 18% over the following six months.

However there may be one catalyst that would shake the present slow-paced bull market right into a faster-paced, higher-octane sort of rally, and that is the Federal Reserve altering its stance on rates of interest, in line with the be aware.

“The slower tempo of the present rallies within the S&P and Nasdaq Comp off their 2022 lows relative to historical past is unlikely to vary till the Fed shifts its present hawkish stance on charges,” Rabe mentioned. “Whereas we stay optimistic on US shares for the second half, the work we have now offered right here says markets are in ‘sluggish rally’ mode.”

Learn the unique article on Enterprise Insider