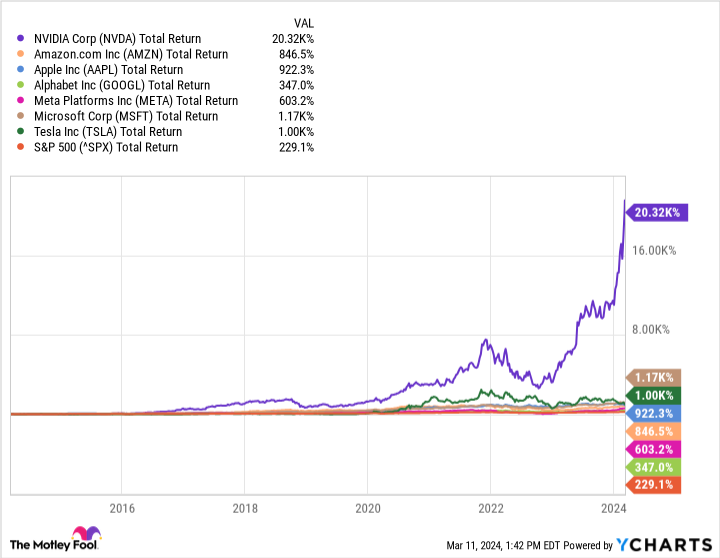

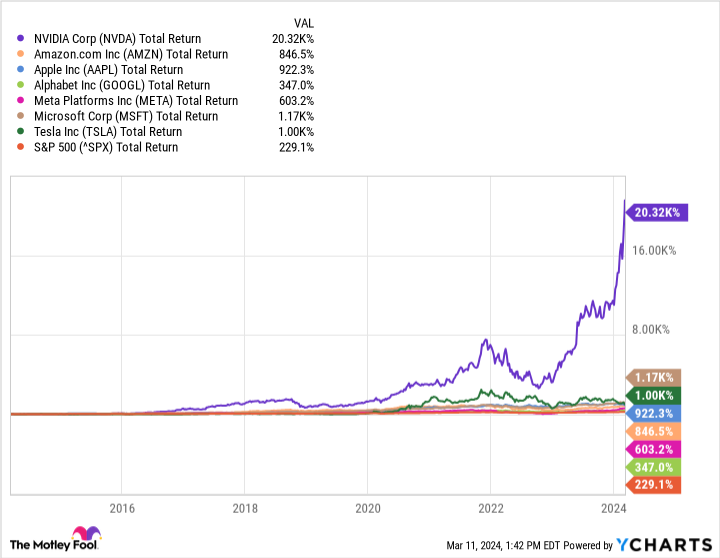

The aptly named “Magnificent Seven” is a gaggle of (largely) expertise corporations which have typically delivered above-average returns, particularly over the previous decade. Right here is each member of this clique: Alphabet, Amazon, Apple (NASDAQ: AAPL), Meta Platforms, Microsoft, Nvidia, and Tesla. Although all have been admirable in delivering outsize returns, one among them, Nvidia, is in a category of its personal.

Not one of the different Magnificent Seven members even get near Nvidia’s efficiency prior to now 10 years. But, I nonetheless would not make investments on this firm.

Heed recommendation from Warren Buffett

When shares of corporations rise as a lot as Nvidia’s have, one of many first issues traders have a tendency to consider is valuation. It is typically the case that these companies’ future success is baked into their inventory costs. Their shares will drop in the event that they fail to stay as much as the market’s lofty expectations. That could be the case with Nvidia, however that is not my rationale for staying away.

There’s a easy and easy motive I would not spend money on Nvidia inventory: My data of the corporate’s enterprise is virtually nonexistent. Nvidia is the main participant in manufacturing graphic processing items, vital digital gadget elements. This seems like an excellent enterprise mannequin, however that’s in regards to the extent of my experience, or lack thereof, on this space.

So, whereas Nvidia seems to be like a terrific firm from an outsider’s perspective, contemplating simply how profitable it has been over the previous decade, I’m in no temper to take a position. Warren Buffett, the world’s best investor, as soon as stated: “Funding have to be rational; if you cannot perceive it, do not do it.”

There isn’t a scarcity of choices

For what it is value, I might additionally keep away from investing in Tesla for a similar motive. Am I lacking out on some huge good points because of this? It is arduous to say. If I made it a behavior to spend money on companies I do know nothing about, I’d find yourself with some glorious shares which have carried out splendidly, like Nvidia and Tesla. However this strategy would virtually definitely lead to some horrible investments, too.

It is unclear whether or not the online impact on my total returns can be constructive. Fortunately, the remainder of the Magnificent Seven shares are all companies I perceive moderately nicely. All of them, I believe, are value critical consideration. Let’s choose Apple for instance. Although not as spectacular as Nvidia’s over the previous decade, Apple’s returns have additionally been glorious.

Additional, the corporate has robust progress prospects. The iPhone is now not the expansion driver it was once, however underestimating Apple’s modern capabilities can be a mistake. In any case, the corporate did not create cellphones — it simply made higher variations of them and made a fortune within the course of.

Apple’s behavior of making a greater mousetrap is nicely established. It now goals to do the identical inside generative synthetic intelligence. Apple is trailing a few of its friends on this space, however that has by no means stopped the corporate. Then, there’s Apple’s providers section, with an put in base of greater than 2 billion lively gadgets. The corporate has sufficient flexibility to monetize its consumer base in varied methods.

The sky is the restrict for Apple regardless of its latest slowing top-line progress. For my part, the corporate’s shares nonetheless appear to be a purchase. I would say the identical about Alphabet, Amazon, Meta Platforms, and Microsoft. Here is the lesson for traders: Lacking out on some probably wonderful corporations on account of a lack of information relating to how they earn money isn’t the tip of the world.

There’ll at all times be different thrilling shares in the marketplace whose companies are rather more understandable to every investor.

Must you make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Apple wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 11, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Prosper Junior Bakiny has positions in Amazon and Meta Platforms. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Nvidia Is the Finest-Performing “Magnificent Seven” Inventory: Here is Why I Would not Purchase was initially revealed by The Motley Idiot