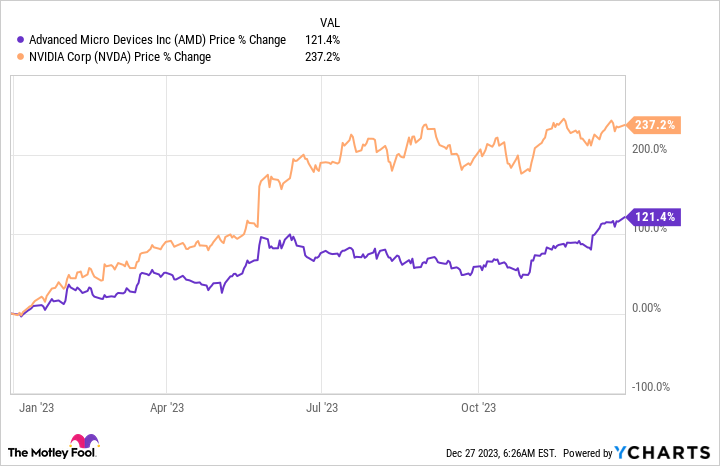

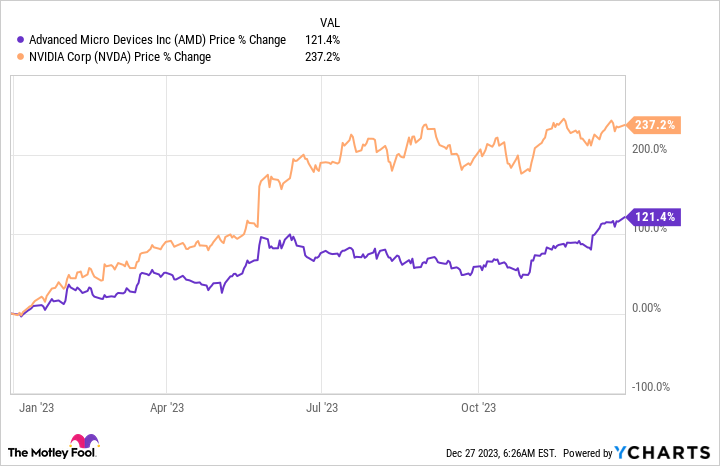

Semiconductor shares outperformed the broader market by a large margin in 2023, which is clear from the 66% achieve clocked by the PHLX Semiconductor Sector index as in comparison with the 24% achieve of the S&P 500 index as of Dec. 27.

Booming demand for synthetic intelligence (AI) chips performed a key function in driving the spectacular surge in semiconductor shares this 12 months. Not surprisingly, outstanding semiconductor corporations reminiscent of Nvidia (NASDAQ: NVDA) and Superior Micro Gadgets (NASDAQ: AMD) have delivered wholesome features to shareholders in 2023.

The nice half is that these semiconductor giants’ shares might proceed hovering in 2024 due to the emergence of a brand new catalyst.

The PC market is about to rebound in 2024

Gross sales of private computer systems (PCs) have been declining each quarter for the reason that starting of 2022. That market skilled a pointy surge in demand in 2020 and 2021 due to the coronavirus pandemic, which led many shoppers to purchase new PCs as they shifted to doing extra studying, working, and enjoying at house. Nonetheless, that demand disappeared in 2022 and the market is estimated to have declined additional in 2023.

The excellent news: 2024 will be the 12 months when PC gross sales rise once more. Market analysis agency IDC is predicting a 3.4% improve in PC shipments within the new 12 months, whereas Canalys is forecasting a leap of 8%.

Each companies assert that the expansion will probably be fueled by the appearance of AI-enabled PCs, an growing older put in base of current computer systems, and the looming necessity for customers to improve to Home windows 11 as Microsoft is about to finish assist for Home windows 10 in October 2025. What’s extra, IDC is anticipating the PC market to clock a compound annual progress charge of three.1% via 2027.

A turnaround in PC gross sales can be nice information for Nvidia and AMD as each corporations provide chips for PCs and depend on this area for vital chunks of their high traces.

Nvidia and AMD would profit

Individuals set up Nvidia’s graphics playing cards in PCs to energy graphics-intensive duties reminiscent of game-playing, 3D rendering, and video modifying. Nvidia has a market share of greater than 80% in discrete graphics playing cards and it is already witnessing a pleasant restoration in gross sales of its PC graphics playing cards as producers restock their inventories in anticipation of a restoration in demand.

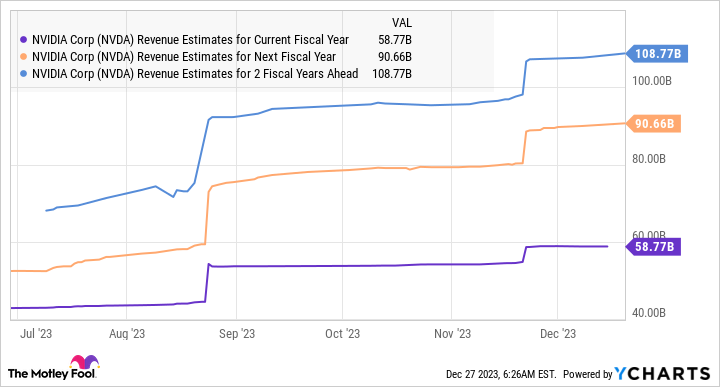

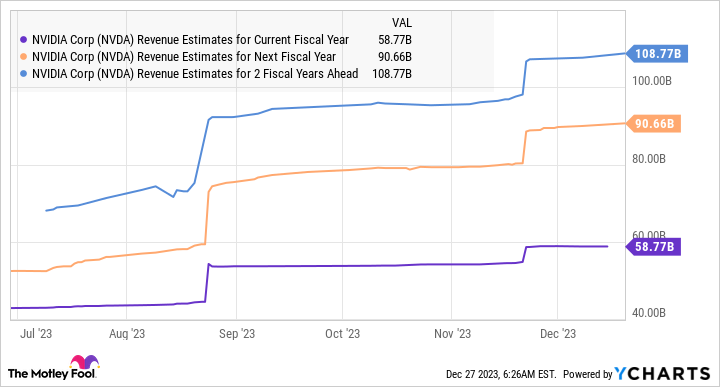

In its fiscal 2024 second quarter, which ended July 30, Nvidia’s gaming income elevated 22% 12 months over 12 months to $2.5 billion. This was adopted by a year-over-year improve of 81% within the following quarter. Gaming accounted for almost 16% of Nvidia’s income in the latest quarter and the gaming enterprise’s spectacular momentum of late is more likely to complement the AI-fueled progress of its information middle enterprise and result in spectacular progress in 2024.

What’s extra, Nvidia administration stated in the course of the November convention name with analysts that “generative AI is rapidly rising as the brand new killer app for high-performance PCs.” The chipmaker is trying to goal this market with a brand new platform that is going to considerably improve the pace of AI inference workloads on PCs, which might result in a leap within the adoption of its graphics playing cards.

AMD has additionally witnessed a pointy turnaround in its PC-focused enterprise, which incorporates central processing models (CPUs) utilized in desktops, laptops, and workstations. The chipmaker’s income from this phase was up 42% 12 months over 12 months to $1.5 billion within the third quarter, and accounted for 26% of its high line.

AMD administration stated in an October convention name with analysts that gross sales of its Ryzen AI PC processors “grew considerably within the quarter as stock ranges within the PC market normalized and demand started returning to seasonal patterns.” CEO Lisa Su additionally added that AMD has launched greater than 50 new pocket book designs powered by the Ryzen AI processors, that are geared up with an on-chip AI accelerator to sort out AI workloads.

Much more thrilling, AMD says that it’s “working carefully with Microsoft on the following technology of Home windows that can reap the benefits of our on-chip AI Engine to allow the largest advances within the Home windows person expertise in additional than 20 years.” AMD appears set to experience the wave of restoration in PC gross sales, particularly contemplating that it has been grabbing an even bigger share of this market.

Analysts expect AMD’s income to extend 17% subsequent 12 months to $24 billion, however the firm’s rising footprint within the AI information middle chip area and a restoration within the PC market might assist it ship a stronger income leap. This, in flip, might ship shares of AMD greater, which is why buyers could wish to load up on this semiconductor inventory immediately.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Microsoft, and Nvidia. The Motley Idiot has a disclosure coverage.

Here is Why Nvidia and AMD Are Set to Skyrocket in 2024 was initially revealed by The Motley Idiot