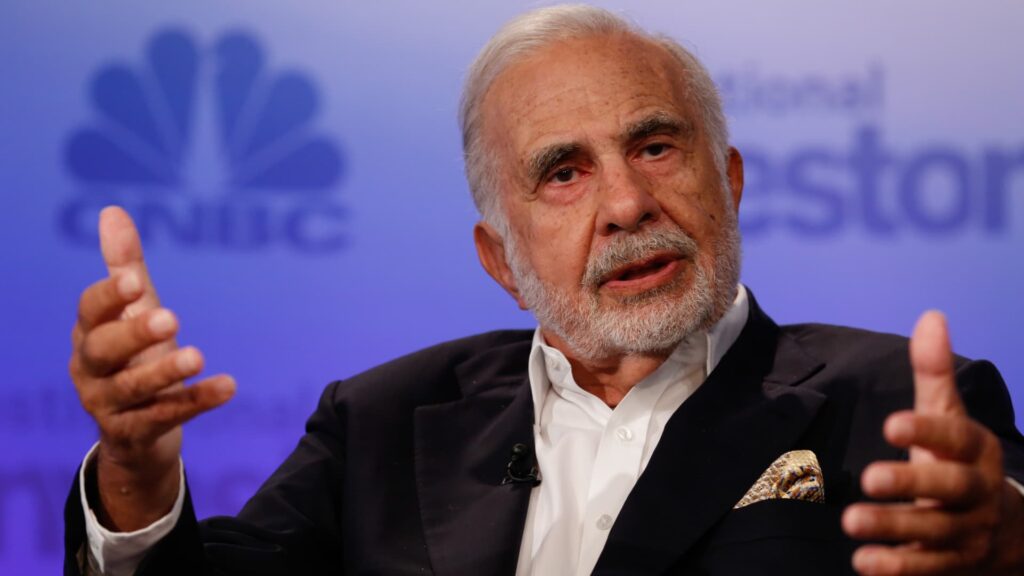

Carl Icahn talking at Delivering Alpha in New York on Sept. 13, 2016.

David A. Grogan | CNBC

Notable quick vendor Hindenburg Analysis goes after famed activist investor Carl Icahn.

The Nathan Anderson-led agency took a brief place in opposition to Icahn Enterprises, alleging “inflated” asset valuations, amongst different causes, for what it says is an unusually excessive internet asset worth premium in shares of the publicly traded holding firm.

“Total, we predict Icahn, a legend of Wall Avenue, has made a basic mistake of taking up an excessive amount of leverage within the face of sustained losses: a mix that hardly ever ends effectively,” Hindenburg Analysis stated in a word launched Tuesday.

The shares fell 9% in premarket buying and selling.

Icahn, essentially the most well-known company raider in historical past, made his identify after pulling off a hostile takeover of Trans World Airways within the Nineteen Eighties, stripping the corporate of its property. Most lately, the billionaire investor has engaged in activist investing in McDonald’s and biotech agency Illumina.

Headquartered in Sunny Isles Seashore, Florida, Icahn Enterprises is a holding firm that entails in a myriad of companies together with power, automotive, meals packaging, metals and actual property.

The conglomerate pays a 15.9% dividend, in response to FactSet. Hindenburg stated it believes the excessive dividend yield is “unsupported” by the corporate’s money circulation and funding efficiency.

CNBC has reached out to Icahn for remark.

Shares of Icahn Enterprises are down 0.5% on the yr as of Monday’s shut.