Nvidia (NASDAQ: NVDA) has risen to grow to be a virtually $1,000 inventory once more, which is often a threshold the place traders begin to count on a inventory cut up. Whereas there is not any arduous and quick rule about when to count on a cut up (some corporations by no means do), historical past tells us that Nvidia could possibly be contemplating one now.

Moreover, Could 22 will be the day that one is introduced, which is correct across the nook. The final time Nvidia introduced a inventory cut up, the inventory went wild and rose considerably. So, must you purchase forward of this potential announcement?

The final inventory cut up was introduced at an identical time in 2021

The final time Nvidia enacted a inventory cut up was on July 20, 2021. That four-for-one cut up broke every Nvidia share into 4 separate items, thus rising the share depend fourfold and slicing the inventory value to 25% of its unique worth. With out this cut up, Nvidia’s inventory can be round $3,600 at present.

Nevertheless, the timing of this final cut up announcement units the stage for a possible announcement on Could 22 throughout its first-quarter fiscal 12 months 2025 earnings launch. In its Q1 fiscal 12 months 2022 earnings launch (which occurred on Could 26, 2021), Nvidia introduced to shareholders that the board of administrators agreed to separate the inventory. That is good timing, because the annual assembly of stockholders was set to happen only some weeks later in order that shareholders may approve the vote. At the moment, Nvidia was buying and selling at round $600, so the inventory is much costlier at present than when it determined to separate its inventory.

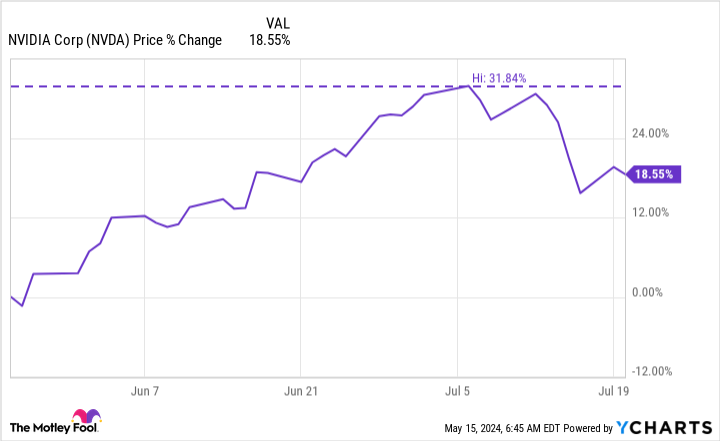

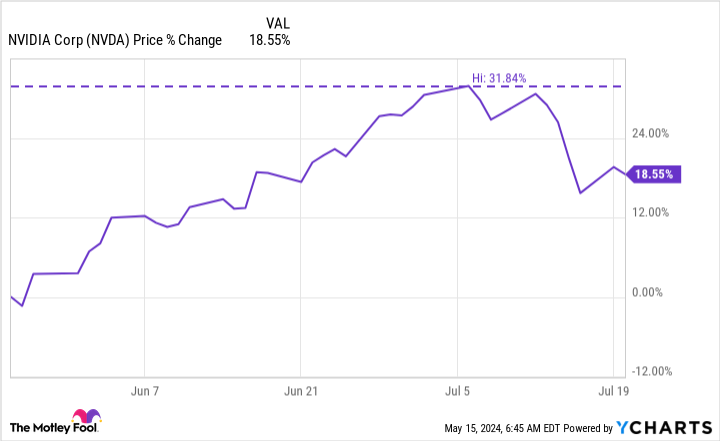

With the stage set for almost the identical situation three years later, I’d not be shocked if Nvidia introduced a inventory cut up on Could 22. The query is, will it ignite a run-up prefer it did final time? After Nvidia’s Q1 outcomes had been introduced, up till the inventory cut up date, the inventory went on a powerful tear.

With the inventory rising 30% within the days after the stock-split announcement, who would not wish to get forward of that motion? Nevertheless, traders mustn’t count on that type of response once more.

Ought to Nvidia’s inventory enhance by 30% from present ranges, its market cap would enhance from $2.3 trillion to roughly $3 trillion. That might enable Nvidia to surpass Apple because the second-largest firm on the planet and put it inside putting distance of Microsoft as the biggest firm on the planet.

I doubt {that a} stock-split announcement will create almost $700 billion in worth. Thankfully, there are different causes to purchase the inventory.

Nvidia’s rising enterprise is driving the inventory value greater

Whereas the brink the place corporations cut up their shares differs for every enterprise, the rationale stays the identical: Their inventory value has gotten too costly. This happens as a result of the enterprise is succeeding — a terrific downside to have.

Nvidia’s enterprise has been on hearth these days, with its graphics processing items (GPUs) promoting at an unbelievable tempo to fulfill the demand for information facilities constructed to energy the synthetic intelligence (AI) arms race.

Any inventory motion from a possible stock-split announcement must be attributed to its GPU enterprise, as it is the driving power behind the inventory. With administration guiding traders for Q1 income of about $24 billion (indicating 234% progress), we’re slated to see a monster quarter reported once more.

Whereas a stock-split announcement could also be coming, traders ought to look past that to find out if Nvidia is a possible purchase (or not).

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $566,624!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Could 13, 2024

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

Historical past Says an Nvidia Inventory-Break up Announcement Would possibly Be Approaching Could 22 was initially printed by The Motley Idiot