The worry of lacking out — aka, FOMO — can result in stunning excesses on Wall Road. So-called bubbles can push shares so excessive that you simply begin to imagine that the sky is the restrict. Proper now, it seems like Nvidia (NASDAQ: NVDA) can do no incorrect, and its share worth has risen accordingly. In the event you take note of Wall Road historical past, nonetheless, you may see that purchasing Nvidia right now may simply find yourself being the incorrect name.

Nvidia’s inventory features have been unimaginable

The large story with Nvidia is that it makes high-powered chips able to operating synthetic intelligence (AI) functions. AI is a large story right now within the expertise sector, with nearly each firm that may achieve this both straight engaged on an AI product or explaining to buyers how AI might be a direct profit to it ultimately (by growing effectivity or automating duties, for instance). Wall Road is extremely enamored of AI and something related to it.

Given Nvidia’s direct connection to the house — and its surging earnings from it — the inventory has superior quickly. Over the previous yr alone the inventory has gained 223%. Over the previous three years, the acquire is greater than 550%. Over the previous 5 years, its acquire is greater than 1,860%.

Scan the 10-year worth chart above and it seems like Nvidia’s inventory is lifting off like a rocket. The mix of that worth rise and the overall AI fever has buyers clamoring to purchase it. However do not soar on this rocket with out contemplating some Wall Road historical past.

Ben Graham’s Despair-era knowledge

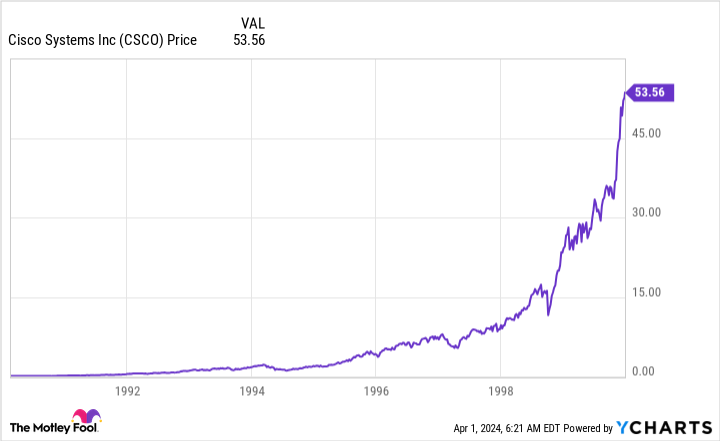

Benjamin Graham is the person who helped to coach Warren Buffett and the writer of iconic investing tome The Clever Investor. To paraphrase that Wall Road big, even firm is usually a dangerous funding in the event you pay an excessive amount of for it. An ideal instance of that’s Cisco Methods (NASDAQ: CSCO). Check out the graph beneath.

It could be laborious to not discover how comparable its rocket-like trajectory is to the Nvidia graph above. However the important thing function of this graph is definitely not the inventory worth — it is the dates. The graph ends with the final buying and selling day of 1999. The subsequent graph brings the story as much as the current, and it ought to be greater than sufficient to frighten any investor who’s presently all-in on Nvidia.

Merely put, after that enormous peak in the course of the dot-com increase there was an enormous crash in the course of the dot-com bust. And Cisco’s share worth nonetheless hasn’t recovered all the floor it misplaced. In the event you purchased close to the height, you’re nonetheless within the crimson in your funding (not factoring in dividends being reinvested).

You may argue that this can be a cherry-picked instance, which is true. However there are not any crystal balls on Wall Road, and there is no solution to know for positive that Nvidia will keep away from an identical destiny. Certainly, whereas it has a dominant place now within the chips that assist AI, rivals are working laborious to catch up. After they do, Nvidia will not be fairly so particular anymore, and buyers will in all probability bitter on the shares. The historical past of Wall Road means that, in some unspecified time in the future, Nvidia’s stunning inventory worth rise will finish, similar to it has for thus many different shares earlier than.

Do not forget about gravity

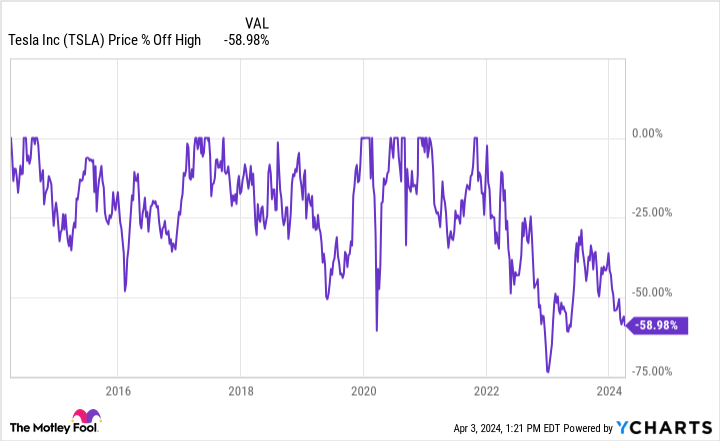

Few corporations can defy gravity perpetually. Tesla‘s (NASDAQ: TSLA) shares, for instance, have fallen by roughly 50% because the electrical car big grew to become sustainably worthwhile round 2020 and are down almost 60% from all-time highs reached in late 2021. That may appear counterintuitive, however tales are sometimes extra highly effective on Wall Road than earnings. And when a narrative will get previous, lofty inventory costs have a painful behavior of crashing again right down to earth.

Do not let FOMO get the higher of you. Nvidia could also be a powerful firm, however it may nonetheless find yourself being a horrible funding in the event you pay an excessive amount of for it.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of April 4, 2024

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Cisco Methods, Nvidia, and Tesla. The Motley Idiot has a disclosure coverage.

Historical past Says Magnificent Corporations Can Turn into Disappointing Shares. Is Nvidia Subsequent? was initially printed by The Motley Idiot