If you wish to make investing straightforward on your self, top-of-the-line methods to do it’s by shopping for an ETF that tracks the S&P 500. By buying shares of an exchange-traded fund just like the Vanguard 500 Index ETF or the SPDR S&P 500 ETF, you possibly can acquire on the spot entry to a diversified group of 500 of the most important U.S. corporations.

It is not straightforward to beat the S&P 500. The truth is, most hedge funds and mutual funds underperform the S&P 500 over an prolonged time period. That is as a result of the S&P 500 selects from a big pool of shares and repeatedly refreshes its holdings, dumping underperformers and changing them with up-and-coming development shares.

For instance, the index simply swapped growing older equipment maker Whirlpool for the explosive AI server firm Tremendous Micro Laptop. Proudly owning solely worthwhile, large-cap U.S. shares is one more reason why the S&P 500 tends to be such a powerful performer over time.

Nevertheless, some funds do handle to beat the broad-market index. Maintain studying to see one ETF that has a long-term observe report of outperforming the S&P 500.

Development at an inexpensive value

Most shares are usually grouped into one in all two buckets: development or worth. Development shares typically have larger development charges than the broad market, whereas worth shares commerce at a reduction to the S&P 500, usually measured by the price-to-earnings ratio.

Nevertheless, there’s additionally a hybrid group of shares which have parts of each development and worth often known as “development at an inexpensive value,” or GARP. And there is one ETF that makes a speciality of these shares.

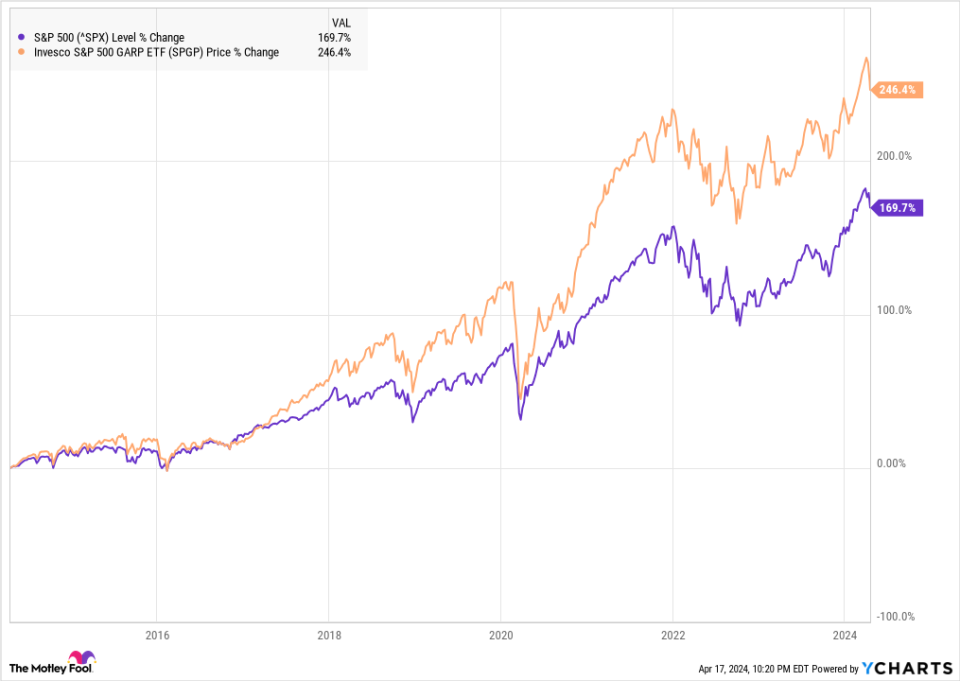

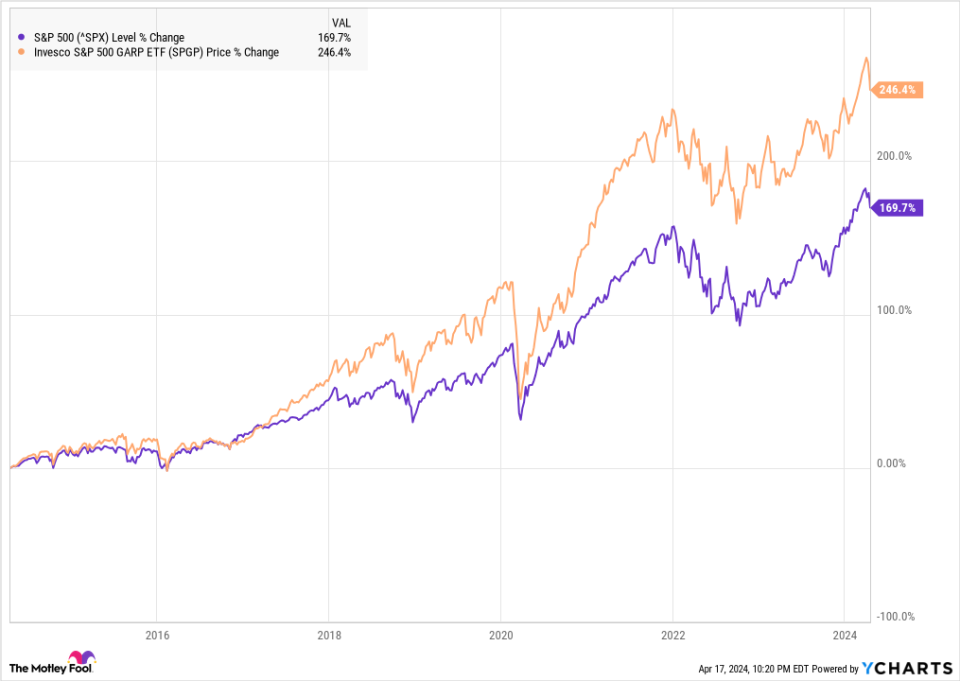

That is the Invesco S&P 500 GARP ETF (NYSEMKT: SPGP), which has crushed the S&P 500 in seven of the final 10 years and has steadily outperformed it during the last decade, as you possibly can see from the chart beneath.

As you possibly can see, not solely has the Invesco GARP ETF crushed the S&P 500, however it’s moved alongside the identical trajectory because the S&P 500, that means it has been capable of outgain with out a lot further threat.

What’s the Invesco GARP ETF?

The Invesco S&P 500 GARP ETF tracks the S&P 500 Development at a Affordable Worth Index, which is made up of about 75 shares which were ranked as having the very best “development scores,” which relies on earnings and sales-per-share development during the last three years, and “high quality and worth composite rating,” which relies on monetary leverage, return on fairness, and price-to-earnings ratio.

The fund’s five-biggest holdings are Diamondback Vitality, an exploration and manufacturing power firm within the Permian Basin; Metal Dynamics, one of many largest metal producers and metallic recyclers within the nation; Marathon Petroleum, an oil refiner and transportation firm; CF Industries, a maker of nitrogen fertilizer and different agricultural merchandise; and Nucor, the metal producer that popularized mini-mills.

4 of the following 5 prime holdings are power shares as effectively. The truth is, the index’s greatest sector presently is power, which makes up 26.1% of the fund, adopted by data know-how at 22%.

Why the GARP ETF might proceed to outperform

The requirements of the GARP ETF display screen out each overvalued shares and people who aren’t rising quick sufficient, making the ETF a great wager to beat the bigger index.

A lot of the Magnificent Seven shares which have pushed the brand new bull market look stretched, and the S&P 500’s valuation is excessive, particularly at an early stage of a brand new bull market, in response to numerous standard metrics. For instance, the S&P 500 trades at a price-to-earnings ratio of 25.2, in comparison with a P/E of simply 15.3.

Barring a crash in oil costs, which might hammer the power shares that make up a good portion of the GARP ETF, the fund appears well-positioned to beat the S&P 500 because the early positive factors from the Magnificent Seven shares ought to unfold to the remainder of the inventory market because the bull market matures. In the meantime, its valuation must also cushion it from any sell-off within the broad market.

Do you have to make investments $1,000 in Invesco Trade-Traded Fund Belief – Invesco S&P 500 Garp ETF proper now?

Before you purchase inventory in Invesco Trade-Traded Fund Belief – Invesco S&P 500 Garp ETF, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Invesco Trade-Traded Fund Belief – Invesco S&P 500 Garp ETF wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $466,882!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 15, 2024

Jeremy Bowman has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Vanguard S&P 500 ETF. The Motley Idiot has a disclosure coverage.

How Do You Beat the S&P 500? Purchase This ETF That Has Achieved It in 7 of the Final 10 Years was initially printed by The Motley Idiot