Benzinga and Yahoo Finance LLC might earn fee or income on some objects by way of the hyperlinks beneath.

Doubling your cash is a big milestone for any investor, and the time it takes to realize this objective is dependent upon the speed of return your investments generate. An 8% yield, specifically, is usually a highly effective device for rising your wealth over time. To find out how lengthy it could take to double your cash with an 8% yield, we’ll have a look at two situations – doubling your funding with compounding returns and doubling your cash with out compounding returns

Understanding the Fundamentals

An 8% yield refers back to the annual return in your funding paid again to you in money, expressed as a proportion of your preliminary funding. For instance, should you make investments $10,000 in a safety that yields 8%, you may count on to earn $800 in returns over the course of a yr.

Compounding returns consult with the method of reinvesting your earnings again into the funding, permitting your cash to develop exponentially over time. Non-compounding returns, however, contain taking your earnings out of the funding every year, leading to a linear development of your cash.

Doubling Cash with Compounding Returns

Compound curiosity is a robust idea that enables your cash to develop at an accelerating charge. The formulation for compound curiosity is:

A = P(1+r)^n

The place A is the ultimate quantity, P is the preliminary principal, r is the annual rate of interest, and n is the variety of years.

A fast and simpler technique to estimate the time it takes to double your cash with compound curiosity is the Rule of 72. Merely divide 72 by your annual rate of interest. Within the case of an 8% yield, it could take roughly 9 years to double your cash (72 / 8 = 9).

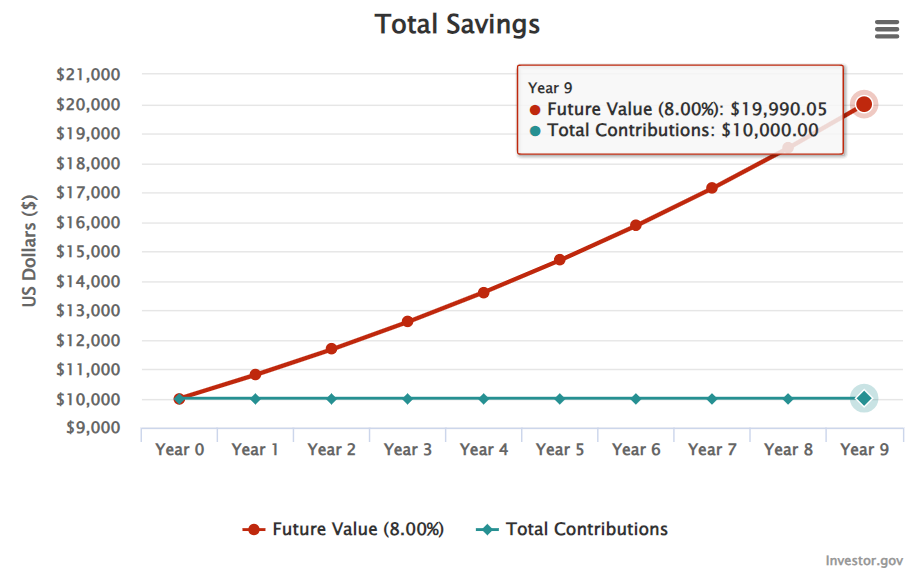

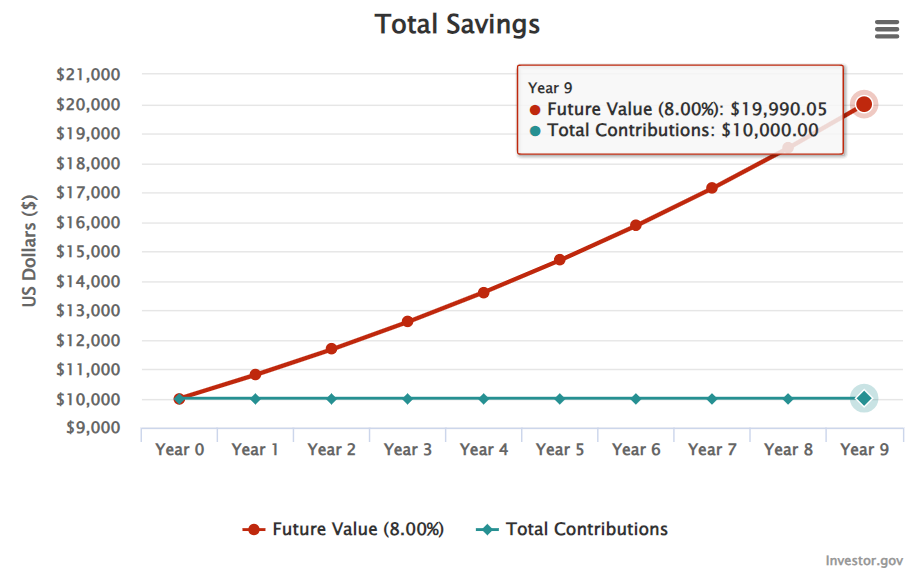

Let’s see how this works with an in depth instance. If you happen to make investments $10,000 at an 8% annual yield, compounded yearly, right here’s how your cash will develop:

-

Yr 1: $10,800

-

Yr 2: $11,664

-

Yr 3: $12,597

-

Yr 4: $13,605

-

Yr 5: $14,693

-

Yr 6: $15,869

-

Yr 7: $17,138

-

Yr 8: $18,509

-

Yr 9: $19,990

By the tip of the ninth yr, your preliminary $10,000 funding would have practically doubled to $19,990. This exponential development is the results of reinvesting your returns every year, permitting your cash to compound over time.

This instance reveals how your funding would develop with returns compounded yearly. If compounded quarterly or month-to-month, it could develop barely quicker. That very same $10,000 compounded quarterly can be $20,398.87 after 9 years and $20,495.30 if compounded month-to-month.

Trending: If there was a brand new fund backed by Jeff Bezos providing a 7-9% goal yield with month-to-month dividends, would you put money into it?

Doubling Cash with out Compounding Returns

Easy curiosity, however, entails incomes a hard and fast charge of return in your preliminary funding every year, with out reinvesting your earnings. The formulation for easy curiosity is:

A = P(1+rt)

The place A is the ultimate quantity, P is the preliminary principal, r is the annual rate of interest, and t is the variety of years.

If you happen to had been to take a position $10,000 at an 8% easy rate of interest, your cash would develop by $800 every year. To double your preliminary funding, it could take 12.5 years ($10,000 / $800 per yr = 12.5 years).

In comparison with the compounding state of affairs, the place it took solely 9 years to double your cash, the easy curiosity state of affairs requires an extra 3.5 years to realize the identical objective.

The Energy of Compound Curiosity

The distinction between compounding and non-compounding returns turns into much more pronounced over longer intervals. For instance, should you had been to take a position $10,000 at an 8% yield for 30 years, your cash would develop to:

– $100,627 with compound curiosity

– $34,000 with easy curiosity

This stark distinction highlights the significance of reinvesting your returns. By placing your earnings again into your funding, you permit your cash to work more durable for you over time, leading to considerably larger wealth accumulation.

Discovering Investments with an 8% Yield

To attain the objective of doubling your cash with an 8% yield, it’s essential to decide on the suitable investments. Let’s have a look at two potential choices: a dividend inventory and an alternate high-yield funding.

Dividend Inventory

Discovering a dependable high-yield dividend inventory is one technique to earn an 8% annual yield. Many dividend shares have a historical past of accelerating their payout every year, that means the yield will proceed to develop. Shares even have the potential for worth development, offering even larger returns over time. Nonetheless, high-yield dividend shares are inclined to see slower worth development since a big portion of their earnings are paid out to shareholders as a substitute of getting used to develop the corporate.

One possibility price contemplating is Altria Group, Inc. (NYSE:MO), a well-established firm within the tobacco trade recognized for its robust dividend yield and constant payout historical past. With a ahead dividend yield of 8.57% and 54 consecutive years of dividend development, Altria is a compelling possibility for income-focused traders.

The corporate’s annual dividend payout is at the moment $3.92 per share, with a payout ratio of 78.86%. Whereas the tobacco trade faces some regulatory challenges, Altria’s robust model portfolio and pricing energy have allowed it to keep up its spectacular dividend monitor document.

Various Excessive-Yield Funding

Buyers looking for to diversify past conventional dividend shares might discover that the Ascent Revenue Fund from EquityMultiple provides an intriguing alternative. This fund focuses on non-public credit score investments, focusing on steady earnings from senior industrial actual property debt positions.

Traditionally, the Ascent Revenue Fund has delivered a 12.1% distribution yield, considerably greater than the 8% benchmark we’ve been discussing. If the fund can keep this degree of efficiency, it might drastically cut back the time it takes to double your cash. In reality, it could solely take about six years. In simply 10 years, you would greater than triple your preliminary funding.

EquityMultiple’s robust monitor document and concentrate on capital preservation make the Ascent Revenue Fund a pretty possibility for traders looking for greater yields and probably quicker wealth accumulation. Click on right here to be taught extra and declare a first-time investor bonus.

The Backside Line

The time it takes to double your cash with an 8% yield is dependent upon whether or not your returns are compounding or not. With compound curiosity, you would count on to double your cash in roughly 9 years, whereas it could take 12.5 years with easy curiosity.

The ability of compound curiosity lies in reinvesting your returns, permitting your cash to develop exponentially over time. By selecting investments that provide robust yields and the potential for compounding, akin to high-quality dividend shares or different investments just like the Ascent Revenue Fund, you may speed up your wealth-building journey.

To discover extra high-yield funding alternatives, try the record of Benzinga’s favourite high-yield investments and uncover a spread of fastidiously curated funding choices throughout numerous asset courses and threat profiles.

Maintain Studying:

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

This text How Lengthy Does It Take To Double Your Cash On An Funding With An 8% Yield? initially appeared on Benzinga.com