At a sure level in its lifecycle, each trade faces its second of reckoning with rising strain to rework as a result of elements akin to growing competitors, altering client preferences, authorities coverage and different secular headwinds. The transformation often takes the form of improved provide chain self-discipline in addition to streamlining enterprise operations so as to obtain higher working margins.

For the oil and pure gasoline trade, the second of fact arrived a couple of years in the past after years of weak benchmark costs, shrinking margins and big capital flight pressured the sector to significantly rethink the way in which it does enterprise with vitality firms more and more turning towards tech heavyweights for assist in chopping prices and streamlining operations.

An excellent living proof is a partnership struck between Haliburton Co. (NYSE:HAL), Microsoft Inc. (NASDAQ:MSFT) and Accenture Plc. (NYSE:ACN) in 2020. For years, Haliburton, one of many world’s largest oilfield providers firms, has been affected by shrinking margins and persistent underperformance. The corporate ultimately made a cope with the 2 cloud giants emigrate its present knowledge facilities to cloud and improve digital choices.

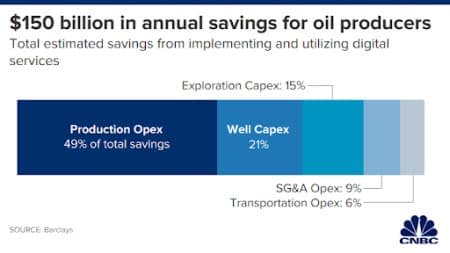

Large financial savings

Supply: CNBC

Halliburton is hardly alone.

After years of dilly-dallying, oil and gasoline firms at the moment are quickly shifting their IT infrastructure out to the Cloud in addition to adopting Enterprise Course of Administration (BPM) methods. This incessantly ends in a leaner, extra agile organizational mannequin while delivering vital value financial savings.

Barclays estimates that the upstream market digital providers trade will develop from lower than $5 billion in 2020 to a greater than $30 billion annual tab by 2025, thus enabling $150 billion in annual financial savings for oil producers. Alternatives for value financial savings embody chopping capital expenditures (capex) in addition to promoting, basic and administrative (SG&A) prices and transportation working prices.

In response to Barclays, the digital age is lastly dawning for the vitality sector with the market poised to erupt over the following 5 years. Over the previous few years, Microsoft has struck cloud partnerships with a number of Large Oil firms together with ExxonMobil (NYSE:XOM), Chevron Inc. (NYSE:CVX) and Haliburton whereas Google’s mum or dad firm Alphabet Inc. (NASDAQ:GOOG) has considerably expanded its partnership with Schlumberger Ltd. (NYSE:SLB), one other oilfield providers big. In the meantime, Amazon Inc. (NASDAQ:AMZN) gives digital providers to the trade by way of Amazon Net Providers oil and gasoline division, and counts BP Plc. (NYSE:BP) and Shell Plc (NYSE:SHEL) amongst its prime purchasers.

In lots of circumstances, Large Oil’s digital makeover is sort of intensive.

As an illustration, Halliburton kicked off a number of digital transformation tasks in the course of the pandemic. Thailand’s PTT Exploration and Manufacturing and Kuwait Oil Firm have been among the many notable oil and gasoline firms that have been awarded Halliburton contracts to implement digital transformation and improve effectivity and manufacturing at their oilfields.

For years, Large Oil has been utilizing tech firms’ enterprise software program of their extremely complicated working systems–including rig administration operations and exact drilling methods. Nevertheless, they’ve historically been considerably reluctant handy over their treasure troves of beneficial knowledge primarily on cyber safety considerations in addition to the necessity to keep aggressive benefits, preferring as a substitute to develop most of their software program developed in-house or by firms inside the oilfield providers sector akin to Haliburton.

Nevertheless, that is now altering as they search for methods to enhance operational efficiencies in a bid to squeeze greater money flows and income from their present operations.

Is the brand new strategy working? The proof appears to counsel so, with shale drilling prices on an encouraging downtrend. J.P. Morgan estimates that Permian’s Delaware Basin oil drillers now require oil costs of simply ~$33/bbl to interrupt even down from $40/bbl in 2019.

Synthetic Intelligence (AI)

Let’s face it: Our electrical grids are merely ill-suited for the vitality shift. In any case, renewable energy is very intermittent by nature whereas our grids are designed for near-constant energy enter/output. Certainly, wind and photo voltaic vitality have the bottom capability elements of any vitality supply.

For the vitality transition to achieve success, our energy grids should turn into rather a lot smarter. Fortunately, there’s an encouraging precedent.

5 years in the past, Google introduced that it had reached 100% renewable vitality for its world operations together with its knowledge facilities and places of work. Right this moment, Google is the most important company purchaser of renewable energy, with commitments totalling 2.6 gigawatts (2,600 megawatts) of wind and photo voltaic vitality.

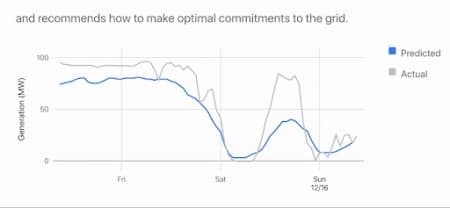

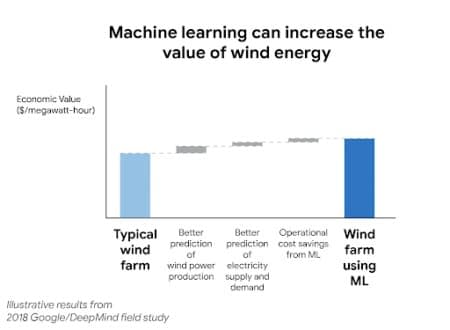

In 2017, Google teamed up with IBM to seek for an answer to the extremely intermittent nature of wind energy. Utilizing IBM’s DeepMind AI platform, Google deployed ML algorithms to 700 megawatts of wind energy capability within the central United States–enough to energy a medium-sized metropolis.

IBM says that through the use of a neural community educated on broadly obtainable climate forecasts and historic turbine knowledge, DeepMind is now in a position to predict wind energy output 36 hours forward of precise technology. Consequently, this has boosted the worth of Google’s wind vitality by roughly 20 p.c.

The same mannequin can be utilized by different wind farm operators to make smarter, quicker and extra data-driven optimizations of their energy output to higher meet buyer demand.

IBM’s DeepMind makes use of educated neural networks to foretell wind energy output 36 hours forward of precise technology

Supply: DeepMind

Houston, Texas-based Innowatts, is a startup that has developed an automatic toolkit for vitality monitoring and administration. The corporate’s eUtility platform ingests knowledge from greater than 34 million sensible vitality meters throughout 21 million prospects together with main U.S. utility firms akin to Arizona Public Service Electrical, Portland Normal Electrical, Avangrid, Gexa Power, WGL, and Mega Power. Innowatts says its machine studying algorithms are in a position to analyze the information to forecast a number of important knowledge factors together with short- and long-term hundreds, variances, climate sensitivity, and extra. Innowatts estimates that with out its machine studying fashions, utilities would have seen inaccuracies of 20% or extra on their projections on the peak of the disaster thus inserting monumental pressure on their operations and finally driving up prices for end-users.

Additional, AI and digital options will be employed to make our grids safer.Three years in the past, California’s largest utility, Pacific Fuel & Electrical, discovered itself in serious trouble after being discovered culpable for the tragic 2018 wildfire accident that left 84 individuals useless and, consequently, was slapped with hefty penalties of $13.5 billion as compensation to individuals who misplaced houses and companies and one other $2 billion tremendous by the California Public Utilities Fee for negligence. Maybe the lack of lives and livelihood might have been averted if PG&E had invested in some AI-powered early detection system like Innowats.By using digital and AI fashions, our energy grids will turn into more and more smarter and extra dependable and make the shift to renewable vitality smoother.

Blockchain

Regardless of its monumental potential to rework the worldwide vitality sector, blockchain expertise has largely remained confined to the monetary sector with the vitality trade persistently catalyzed by improvements in sub-sectors akin to rooftop photo voltaic, offshore wind, sensible metering, battery storage, and electrical autos.

However that is now starting to vary due to the Enterprise Ethereum blockchain rising as the latest expertise to spur development within the vitality sector throughout a raft of verticals from peer-to-peer (P2P) vitality buying and selling and sensible contracts to inexperienced vitality provenance and methods interoperability.

Certainly, a International Blockchain in Power Market analysis doc says blockchain expertise within the vitality trade is about to report explosive development over the following 5 years with blockchain vitality startups akin to Energy Ledger, WePower, UAB, and LO3 Power set to open up new potentialities for the vitality trade, starting from cost-savings for the buyer by eliminating third events in vitality offers and quicker transaction settlements, all the way in which to the emergence of a brand new marketplace for peer-to-peer and extra renewable vitality buying and selling.

By Alex Kimani for Oilprice.com

Extra Prime Reads From Oilprice.com:

Learn this text on OilPrice.com