-

Nvidia is dominating earnings season, and it hasn’t even reported outcomes but.

-

Different mega-cap tech giants have been mentioning on earnings calls that they are boosting funding in AI infrastructure.

-

Nvidia affords the favored H100 GPU chip that many corporations use, and was particularly name-checked in some cases.

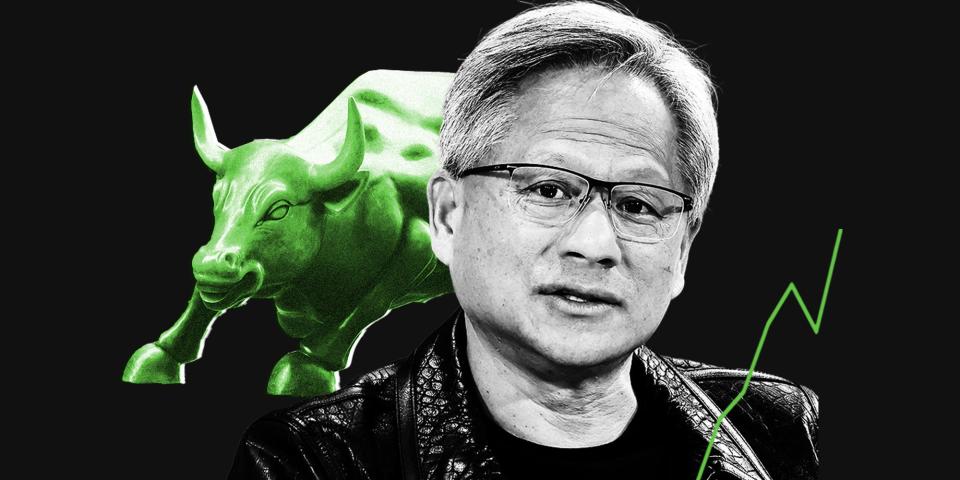

Nvidia is dominating first-quarter earnings season, and it hasn’t even reported its outcomes but.

The corporate has acquired a number of nods, each instantly and not directly, from mega-cap tech corporations that it counts as a few of its largest clients.

Phrases like “AI Infrastructure” and “generative AI” and “infrastructure capex” constantly popped up on the earnings calls of Microsoft, Alphabet, Amazon, and Meta Platforms, and all of it factors to more cash being directed to Nvidia for its extremely well-liked H100 GPU chip.

Nvidia’s H100 GPU, which prices upwards of $40,000, allows the AI applied sciences that make ChatGPT, Anthropic, and different generative AI platforms potential.

The corporate is gearing up for the discharge of its next-generation AI chip, named Blackwell, later this yr.

Elon Musk shouts out Nvidia’s AI chips

Maybe the most important vote of confidence for Nvidia throughout this earnings season got here from Tesla CEO Elon Musk, who stated on his firm’s earnings name that the electrical car producer will greater than double its H100 GPU chips by the tip of the yr.

“We have put in and commissioned, which means they’re really working, 35,000 H100 computer systems or GPUs,” Musk stated final month. “Roughly 35,000 H100s are energetic, and we count on that to be in all probability 85,000 or thereabouts by the tip of this yr.”

Musk stated the H100s are serving to Tesla additional enhance its Full Self-Driving software program.

Mega-cap tech’s AI spending is hovering

Meta Platforms stated it was rising its forecasted capital expenditures for 2024 to a spread of $35 billion to $40 billion from a previous vary of $30 billion to $37 billion. The rise, in response to Meta, is primarily being pushed by the buildout of its “infrastructure investments to assist our AI roadmap.”

In January, Meta stated it might purchase 350,000 H100 GPUs from Nvidia in 2024, however a latest replace from the corporate’s head of AI, Yann LeCun, means that the corporate has purchased much more H100 chips in latest months.

Talking on the Forging the Way forward for Enterprise with AI summit final month, LeCun and host John Werner stated that Meta has purchased a further 500,000 GPUs from Nvidia, bringing its whole to 1 million with a retail worth of about $30 billion.

Microsoft has comparable ambitions and stated it hopes to amass a struggle chest of 1.8 million GPUs by the tip of 2024, in response to an inner doc.

Alphabet stated its first-quarter CAPEX was $12 billion, or about double from the prior yr, pushed “overwhelmingly by funding in our technical infrastructure with the biggest element for servers adopted by information facilities.”

Microsoft stated it expects $50 billion in capital expenditures in its upcoming fiscal yr, and its fiscal third-quarter spending soared nearly 80% to $14 billion.

And whereas Amazon did not element its capital expenditure plans, it did say it expects to spend more cash.

“We anticipate our general capital expenditures to meaningfully improve year-over-year in 2024, primarily pushed by increased infrastructure capex to assist development in AWS, together with generative AI,” Amazon CFO Brian Olsavsky stated.

Altogether, the mixed capex of Microsoft, Alphabet, Meta, and Amazon is anticipated to achieve $205 billion this yr, representing a 40% improve from 2023 ranges, in response to UBS. And a great chunk of that cash will possible be funneled to Nvidia for its H100 and Blackwell AI chips.

Nvidia has competitors, however it nonetheless dominates

Current earnings outcomes from Nvidia’s rival, AMD, recommend that the majority of this enterprise goes to Nvidia and never its rivals.

AMD stated its MI300 AI chip would generate income of about $4 billion in 2024, which pales compared to Nvidia’s anticipated income of greater than $100 billion this yr.

In the meantime, Intel lately unveiled its Gaudi 3 AI chip that may compete with Nvidia, however it stated it expects the chip to generate solely $500 million in gross sales this yr.

Traders should wait till after the market shut on Might 22 to listen to what Nvidia’s earnings outcomes really are.

Learn the unique article on Enterprise Insider