-

A once-in-a-generation alternative is coming for the inventory market, Richard Bernstein says.

-

He says that is as a result of earnings are about to speed up for corporations all through the inventory market.

-

It might usher in a decade of sagging returns for market leaders and big positive factors for others, he says.

Brace for a giant investing alternative that may very well be about to come back for shares — and never in an space of the market traders could also be anticipating.

That is what Richard Bernstein says because the chief funding officer of Richard Bernstein Advisors, a $16 billion asset supervisor.

He argues that whereas the Magnificent Seven mega-cap corporations have dominated the S&P 500’s positive factors in 2023, much less high-profile shares at the moment are primed to see massive returns over the subsequent decade.

That coming pendulum swing in market management is a “once-in-a-generation” shopping for alternative brewing amongst forgotten and under-loved areas of the market, Bernstein says. Talking with Insider, Bernstein stated he noticed it just like a interval within the 2000s when the largest leaders within the S&P 500 shed worth whereas underdog sectors equivalent to power and rising markets noticed “monster returns.”

“Regardless of earnings development turning into extra considerable, traders usually proceed to deal with the so-called Magnificent 7 shares. Such slender management appears completely unjustified and their excessive valuations recommend a once-in-a-generation funding alternative in nearly something aside from these 7 shares,” he wrote in a current notice.

So what makes this time completely different from different intervals of adjusting market management?

Bernstein — who was beforehand the chief funding strategist at Merrill Lynch — says his expectation for a inventory increase is not to be mistaken with one thing like the 2 years of the pandemic market rally, which featured slender management by so-called reopening names, just like what’s now taking place with the Magnificent Seven. His thesis hinges on a broader swath of the market getting a raise from a resilient financial system and surging company profitability.

“Are there actually solely seven development tales in all the world fairness market? After which, the second method to say it’s, are these seven actually the most effective development tales in all the world fairness market? The reply to each of these questions is not any,” he stated.

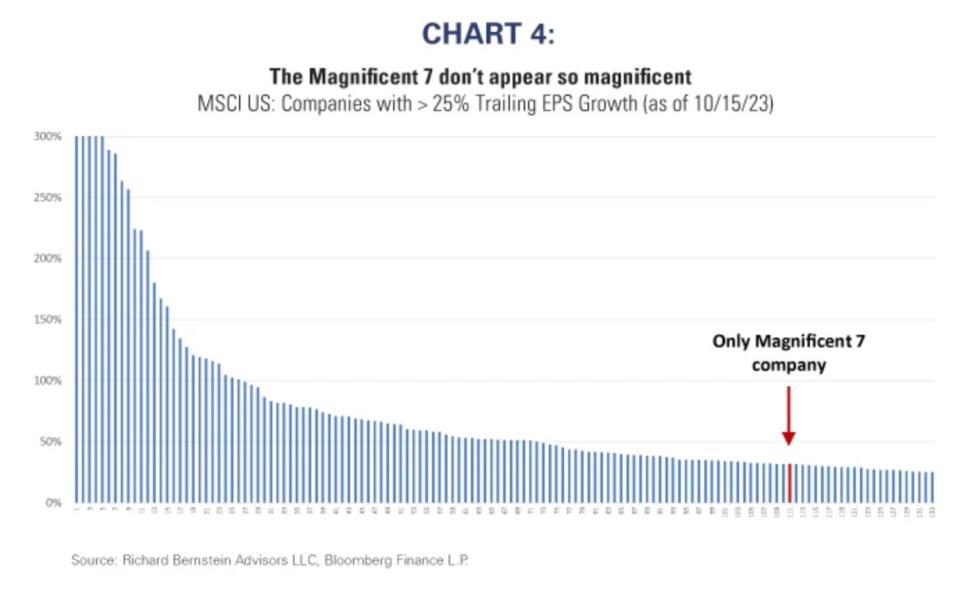

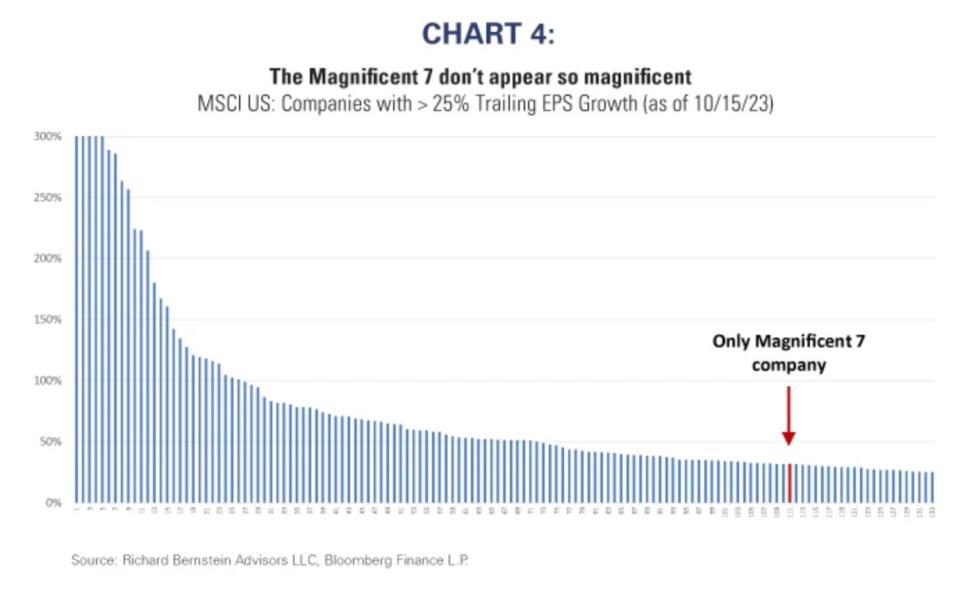

Of the 130 US corporations that noticed a minimum of 25% earnings development within the 12 months by means of October 15, Amazon was the one Magnificent Seven inventory represented.

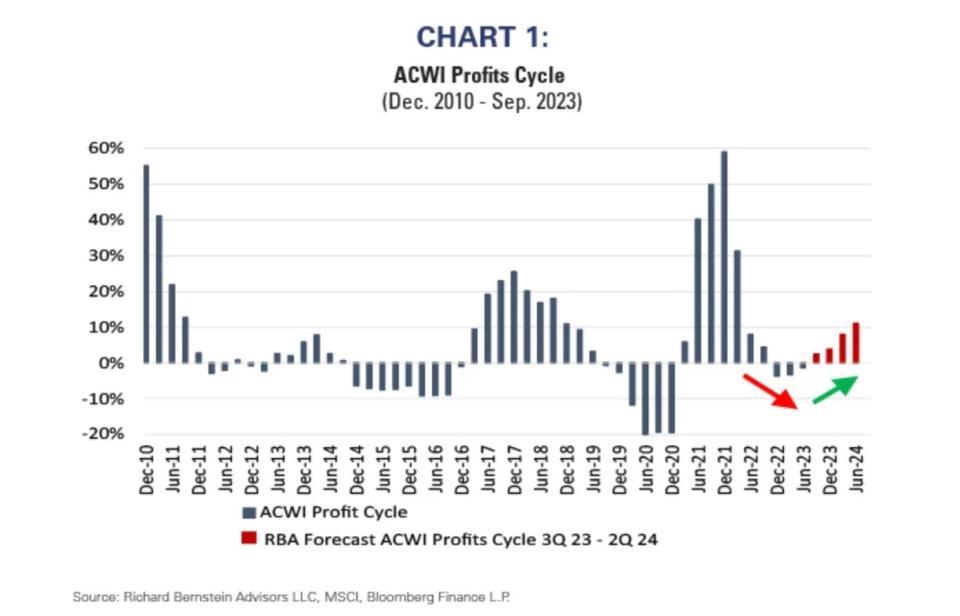

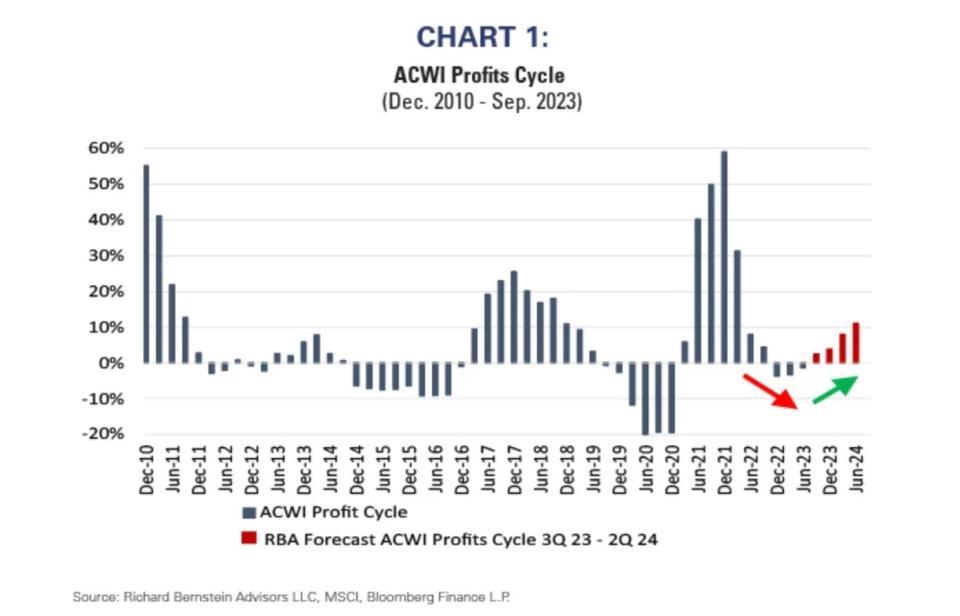

In the meantime, earnings at corporations all through the remainder of the market are on the rise, which places traders ready to ditch super-expensive mega-cap shares for extra attractively priced shares. MSCI All Nation World Index information suggests company earnings hit a trough in 2023 and are heading up into 2024.

“As a result of development is beginning to speed up, it makes much less and fewer sense to pay a premium for development. Historical past means that traders change into comparability buyers for development because it turns into extra considerable, so a motion towards the broader and cheaper market appears in keeping with historical past,” RBA added within the notice.

Bernstein says the big positive factors loved by mega-cap shares will likely be whittled down as traders flock to extra attractively priced areas of the market, equivalent to small-cap and mid-cap shares. The Magnificent Seven corporations wiping out 20% to 25% of their worth whereas the Russell 2000 positive factors 20% to 25% over the subsequent decade can be practical, in his view.

“They’re so depressed on the opposite facet of the seesaw which you could get large returns,” Bernstein stated, including that RBA was chubby in nearly each space of the market aside from the Magnificent Seven shares.

Bernstein is not alone in his bullishness. Different forecasters are pointing to massive positive factors forward for the broader market, with Financial institution of America, Deutsche Financial institution, and Fundstrat not too long ago predicting one other 12 months of report highs for the S&P 500.

This story was initially printed in November 2023.

Learn the unique article on Enterprise Insider