Homeownership has lengthy been considered an integral a part of the American dream, symbolizing independence, monetary safety and prosperity — aspirations shared by many.

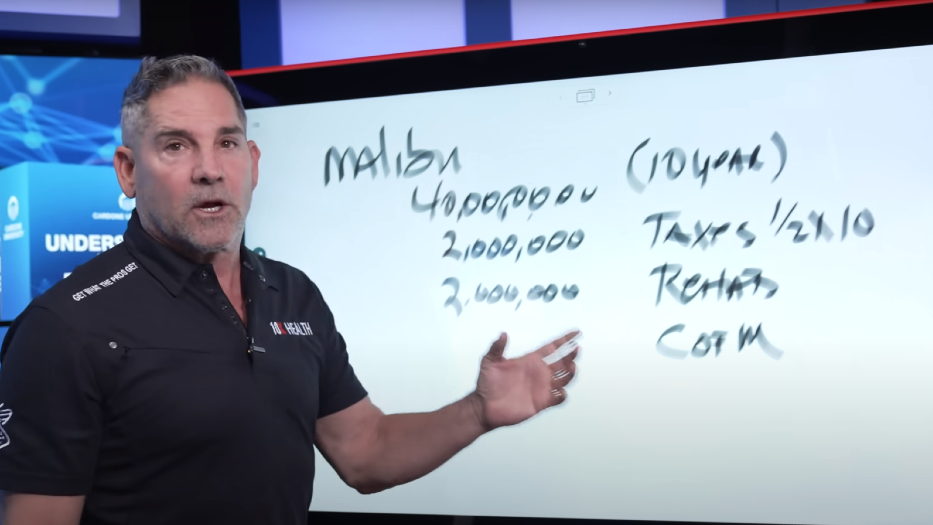

However famend actual property funding guru Grant Cardone challenges this notion. In an Instagram put up earlier this month, he wrote, “Shopping for a house for sure is the WORST funding individuals could make, but it’s additionally the most typical one.”

Cardone, also referred to as Uncle G, goals to change this attitude and alter the trajectory of individuals’s monetary choices. Somewhat than plunging into deep debt to buy a house, he advocates for various approaches. What does Uncle G discover problematic with shopping for a house? He shares his causes within the Instagram put up.

Cardone presents a situation the place you spend $576,000 on a house and preserve it for 10 years. Along with the preliminary value, he highlights the assorted bills you’ll incur over the last decade:

-

12% ($69,120) in dealer charges

-

10% ($57,600) in upkeep charges

-

20% ($115,200) in property taxes

-

70% ($403,200) to the financial institution

The extra prices quantity to $645,120, which, when added to the unique value of the house, totals $1,221,120. Uncle G asserts, “A $576,000 dwelling must be offered for $1.2 million in 10 years. You’re not going to promote it for that, to interrupt even.”

Take a look at: ‘That One Deal Made Me A Millionaire’: Former Airline Pilot Ryan Tseko Reveals His Investing Technique That Anybody Can Comply with

He characterizes this funding as “useless cash,” a time period used to explain an funding that reveals minimal worth appreciation or stays tied up for an prolonged interval with restricted returns.

Current stories present 78% of Individuals nonetheless strongly hyperlink homeownership with the cherished idea of the “American dream,” and 65% of individuals view proudly owning a house as a strategic method to setting up intergenerational wealth.

Though the monetary benefits of homeownership maintain vital weight, the influence of turning into a home-owner extends past monetary concerns. In response to Mark Fleming, chief economist for First American Monetary Corp., buying a house isn’t solely a monetary determination but in addition a way of life selection. This attitude sheds gentle on the enduring fixation with homeownership because the embodiment of the revered “American Dream.”

However based on Cardone, people pursuing homeownership are serving a grasp by borrowing cash from establishments like Financial institution of America Corp. They might construct a small retirement account that in the end funds Wall Avenue. He perceives this as half of a bigger sport.

Cardone goes on to emphasise the necessity for a $100,000 down cost, referring to the 20% down cost traditionally required by lenders to keep away from mortgage insurance coverage.

What does Cardone suggest instead?

Somewhat than shopping for a home, he suggests renting your residence and utilizing the $100,000 saved for a down cost to spend money on actual property that generates passive revenue.

He endorses multifamily actual property, which has maintained its sturdy fundamentals amid latest financial turmoil, in contrast to different segments of economic actual property corresponding to places of work, accommodations and retail.

Investing in actual property doesn’t essentially require buying a rental property outright or coping with the challenges of being a landlord. Cardone highlights the choice of investing in residential actual property funding trusts (REITs), publicly traded corporations that acquire lease from tenants and distribute it to shareholders as common dividends.

One other avenue he helps is actual property crowdfunding, which permits on a regular basis buyers to pool their cash and collectively buy property or shares of property as a bunch (even with as little as $1,000). Cardone has raised over $1 billion by way of crowdfunding for his firm Cardone Capital, which primarily invests in school A multifamily properties.

No matter your chosen path, Cardone stresses the significance of producing money move, which could be reinvested and grown till sufficient funds are accrued to beat the monetary challenges of homeownership.

“I simply don’t must personal a house on the way in which up,” Cardone stated. “I must personal property that pay me on the way in which up. And as soon as I’ve sufficient money move from the property, then if I need to go purchase a home or a watch or a automobile, I purchase it out of the passive revenue.”

By specializing in property that present ongoing returns, people can accumulate sufficient money move to meet their needs and aspirations, whether or not it’s proudly owning a house, buying luxurious gadgets or having fun with monetary freedom.

Within the pursuit of economic safety and independence, understanding the ability of passive revenue and aligning investments accordingly can pave the way in which for higher flexibility and achievement of long-term targets.

Learn subsequent:

Picture supply: Screenshot from “Grant Cardone Proves why private properties are BAD Investments” on YouTube

Do not miss real-time alerts in your shares – be part of Benzinga Professional at no cost! Attempt the instrument that can enable you to make investments smarter, sooner, and higher.

This text ‘The Worst Funding You Can Make’ That Individuals Are Obsessed With: How To Keep away from The ‘Lifeless Cash’ Lure, In response to Billionaire Monetary Guru Grant Cardone initially appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.