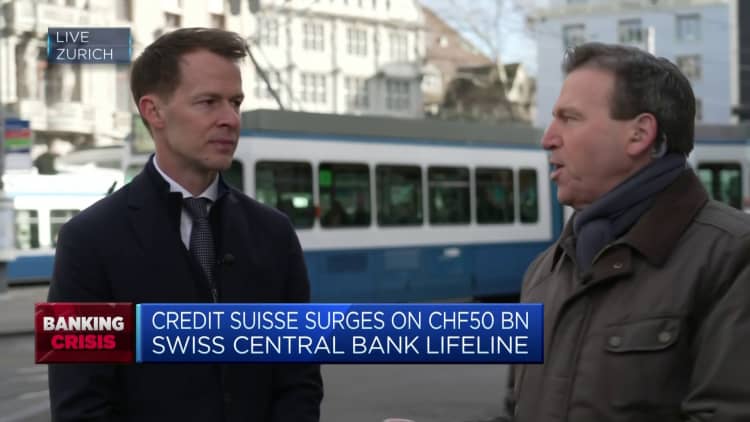

The brand of Swiss financial institution Credit score Suisse is seen at an workplace constructing in Zurich, Switzerland February 21, 2022.

Arnd Wiegmann | Reuters

Credit score Suisse obtained a liquidity lifeline from the Swiss Nationwide Financial institution this week after its share value plunged to an all-time low, however the embattled lender’s path to the brink has been a protracted and tumultuous one.

The announcement that Credit score Suisse would borrow as much as 50 billion Swiss francs ($54 billion) from the central financial institution got here after consecutive periods of steep drops in its share value. It made Credit score Suisse the primary main financial institution to obtain such an intervention for the reason that 2008 World Monetary Disaster.

The financial institution’s shares ended Wednesday at 1.697 Swiss francs — down virtually 98% from the inventory’s all-time excessive in April 2007, whereas credit score default swaps, which insure bondholders towards an organization defaulting, soared to new document highs this week.

It comes after years of funding banking underperformance and a litany of scandals and threat administration failures.

Scandals

Credit score Suisse is at the moment present process an enormous strategic overhaul in a bid to handle these continual points. Present CEO and Credit score Suisse veteran Ulrich Koerner took over from Thomas Gottstein in July, as poor funding financial institution efficiency and mounting litigation provisions continued to hammer earnings.

Gottstein took the reins in early 2020 following the resignation of predecessor Tidjane Thiam within the wake of a weird spying scandal, by which UBS-bound former wealth administration boss Iqbal Khan was tailed by personal contractors allegedly on the course of former COO Pierre-Olivier Bouee. The saga additionally noticed the suicide of a personal investigator and the resignations of a slew of executives.

The previous head of Credit score Suisse’s flagship home financial institution extensively perceived as a gradual hand, Gottstein sought to put to relaxation an period affected by scandal. That mission was short-lived.

In early 2021, he discovered himself coping with the fallout from two large crises. The financial institution’s publicity to the collapses of U.S. household hedge fund Archegos Capital and British provide chain finance agency Greensill Capital saddled it with huge litigation and reimbursement prices.

These oversight failures resulted in an enormous shakeup of Credit score Suisse’s funding banking, threat and compliance and asset administration divisions.

In April 2021, former Lloyds Banking Group CEO Antonio Horta-Osorio was introduced in to wash up the financial institution’s tradition after the string of scandals, saying a brand new technique in November.

However in January 2022, Horta-Osorio was compelled to resign after being discovered to have twice violated Covid-19 quarantine guidelines. He was changed by UBS government Axel Lehmann.

The financial institution started one other expensive sweeping transformation venture as Koerner and Lehmann got down to return the embattled lender to long-term stability and profitability.

This included the spin-off of Credit score Suisse’s funding banking division to kind U.S.-based CS First Boston, a major lower in publicity to risk-weighted belongings and a $4.2 billion capital increase, which noticed the Saudi Nationwide Financial institution take a 9.9% stake to turn into the most important shareholder.

March insanity

Credit score Suisse reported a full-year internet lack of 7.3 billion Swiss francs for 2022, predicting one other “substantial” loss in 2023 earlier than returning to profitability in 2024.

Reviews of liquidity considerations late within the yr led to large outflows of belongings beneath administration, which hit 110.5 billion Swiss francs within the fourth quarter.

After one more sharp share value fall on the again of its annual leads to early February, Credit score Suisse shares entered March 2023 buying and selling at a paltry 2.85 Swiss francs per share, however issues had been about to worsen nonetheless.

On March 9, the corporate was compelled to delay its 2022 annual report after a late name from the U.S. Securities and Change Fee regarding a “technical evaluation of beforehand disclosed revisions to the consolidated money circulation statements” in 2019 and 2020.

The report was finally revealed the next Tuesday, and Credit score Suisse famous that “materials weaknesses” had been present in its monetary reporting processes for 2021 and 2022, although it confirmed that its beforehand introduced monetary statements had been nonetheless correct.

Having already suffered the worldwide risk-off jolt ensuing from the collapse of U.S.-based Silicon Valley Financial institution, the mix of those remarks and affirmation that outflows had not reversed compounded Credit score Suisse’s share value losses.

And on Wednesday, it went into freefall, as prime investor the Saudi Nationwide Financial institution stated it was not capable of present any more money to Credit score Suisse attributable to regulatory restrictions. Regardless of the SNB clarifying that it nonetheless believed within the transformation venture, shares dived 24% to an all-time low.

On Wednesday night, Credit score Suisse introduced that it will train its choice to borrow as much as 50 billion Swiss francs from the Swiss Nationwide Financial institution beneath a coated mortgage facility and a short-term liquidity facility.

The Swiss Nationwide Financial institution and the Swiss Monetary Market Supervisory Authority stated in a press release Wednesday that Credit score Suisse “meets the capital and liquidity necessities imposed on systemically essential banks.”

The help from the central financial institution and reassurance on Credit score Suisse’s monetary place led to a 20% pop within the share value on Thursday, and should have reassured depositors for now.

Nevertheless, analysts recommend questions will stay as to the place the market will place the inventory’s true worth for shareholders within the absence of this buffer from the Swiss authorities.