HONG KONG, Could 2 (Reuters) – HSBC (HSBA.L) tripled its revenue within the first quarter as rising rates of interest boosted its revenue, beating analyst forecasts and serving to the financial institution pay its first quarterly dividend since 2019.

The robust outcomes reported by HSBC and Asian rival DBS (DBSM.SI) on Tuesday underscore how aggressive coverage tightening has lifted revenue margins, though it has additionally sparked banking sector turmoil within the U.S. and different markets.

On Monday, regulators seized First Republic Financial institution (FRC.N) and bought its belongings to JPMorgan Chase & Co (JPM.N), in a deal to resolve the biggest U.S. financial institution failure for the reason that 2008 monetary disaster and draw a line underneath the financial institution sector jitters.

With the speed cycle nearing a peak, the problem for the likes of HSBC, Europe’s largest financial institution, can be to maintain its margins this 12 months and past.

CEO Noel Quinn mentioned on a name the outcomes confirmed HSBC’s strengths in a rising price surroundings, and performed down the dangers of additional contagion after First Republic’s rescue.

“We don’t imagine there’s a international banking disaster on the horizon. We don’t see a adverse influence on our enterprise”.

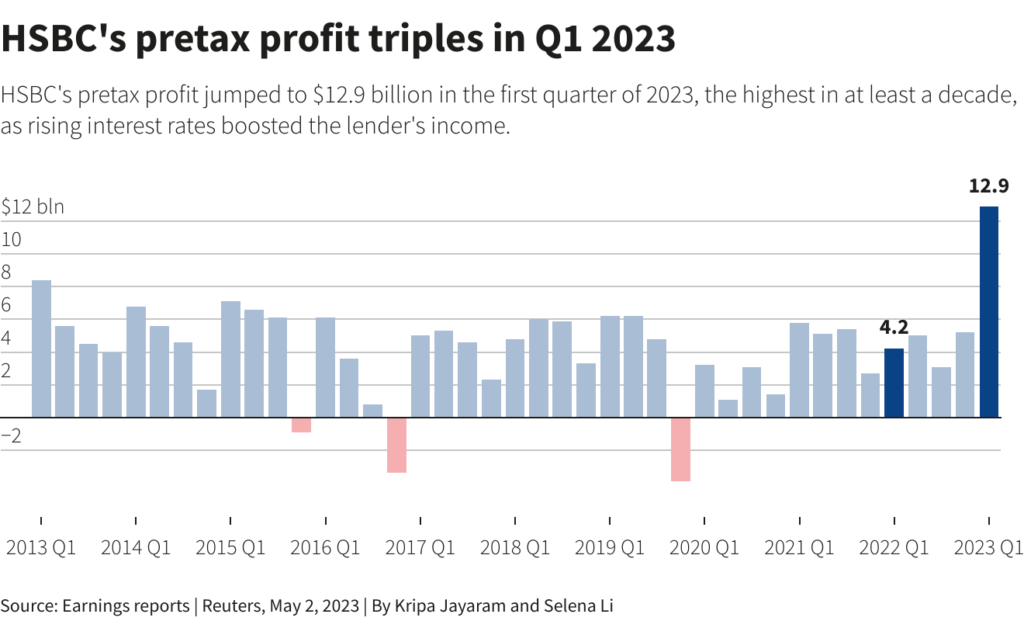

HSBC posted a pretax revenue of $12.9 billion for the quarter ended March, versus $4.2 billion a 12 months earlier. The common estimate of 17 analysts compiled by the financial institution was $8.64 billion.

HSBC shares rose as excessive as 6% in London, the second greatest performer on the benchmark FTSE index (.FTSE).

The financial institution’s income “confirmed energy notably in non-interest revenue”, analysts from Jefferies mentioned, with greater than $1 billion from belongings held for buying and selling and international banking and HSBC’s markets unit, which noticed a 20% income rise from a 12 months in the past.

HSBC’s headline revenue was boosted by a reversal of a $2 billion impairment it took in opposition to the deliberate sale of its French enterprise, reflecting that the deal might not undergo.

It warned final month the disposal might be in jeopardy over regulatory capital considerations for the client.

London-headquartered HSBC additionally reported a delay within the sale of its Canada enterprise, a key a part of its technique to shrink in slow-growing Western markets the place it lacks scale.

HSBC mentioned the deliberate $10 billion sale, initially slated to be accomplished by the tip of this 12 months, will now solely doubtless undergo within the first quarter of 2024.

SHAREHOLDERS’ MEETING

HSBC has tried not too long ago to speed up its Asian pivot, partially to go off calls from its largest shareholder, Ping An Insurance coverage Group Co of China (601318.SS), to spin off the Asia unit to spice up shareholder returns.

Shareholders will vote on the financial institution’s annual assembly on Could 5 on two resolutions filed by a Hong Kong investor and supported by Ping An, calling for increased dividends and a daily replace on strategic proposals.

HSBC, which has opposed the resolutions, criticised the spin-off proposal once more on Tuesday. Shareholder advisory companies Glass Lewis and Institutional Shareholder Providers advisable that traders vote in opposition to the proposal, which wants 75% approval to move.

Norway’s state funding fund, HSBC’s fourth largest shareholder with a 3% stake, has additionally mentioned it’ll vote in step with the financial institution, which introduced a $0.10 per share dividend and flagged the primary of a brand new buyback cycle of as much as $2 billion.

HSBC reported deposits fell 0.6% to $1.6 trillion, excluding these it acquired by bailing out the UK arm of failed U.S. lender Silicon Valley Financial institution and the reclassification of French retail deposits. Quinn mentioned the drop was “nothing vital”.

Large European banks have reported deposits falling as shoppers, confronted with a value of dwelling disaster, eat into financial savings and store round for higher-paying merchandise comparable to fixed-term deposits and funding funds.

Regardless of the surging revenue, HSBC didn’t elevate its key efficiency goal of a return on tangible fairness of not less than 12% from this 12 months onwards, which analysts have been anticipating.

HSBC’s outcomes confirmed a robust total efficiency however a failure to improve its outlook was overly cautious, Citi analysts mentioned.

Reporting by Selena Li ing Kong Kong and Lawrence White in London; Modifying by Muralikumar Anantharaman

: .