(Bloomberg Markets) — As soon as seen because the world’s go-to financial disaster fighters, central bankers are actually desperately attempting to include an issue they allowed to occur: inflation. That’s eroded their credibility within the eyes of buyers and society at giant.

Most Learn from Bloomberg

Officers have provided mea culpas. US Federal Reserve Chair Jerome Powell acknowledged in June that “with the advantage of hindsight, clearly we did” underestimate inflation. Christine Lagarde, his counterpart on the European Central Financial institution, has made related concessions, and Reserve Financial institution of Australia Governor Philip Lowe stated in Might that his group’s forecasts had been “embarrassing.” In October, South African Reserve Financial institution Governor Lesetja Kganyago warned at a financial coverage discussion board that it takes a very long time for central bankers to construct credibility—however that it may be misplaced abruptly.

Central banks’ independence is more durable to justify after such a failure of “evaluation, forecasts, motion and communication,” Allianz SE’s chief financial adviser, Mohamed El-Erian, tweeted in October. The tragic consequence, he says, is “probably the most front-loaded curiosity-rate cycle that we’ve got seen in a really very long time, and it didn’t have to be.”

Step one for the newly humbled financial policymakers is getting costs again beneath management with out creating financial havoc. Subsequent they need to rework the way in which central banks function. For some consultants, meaning three issues: paring down their mission, simplifying their messaging and preserving flexibility.

“Do extra by attempting to do much less” is how former Reserve Financial institution of India Governor Raghuram Rajan describes his recommendation to central bankers.

Again to Fundamentals

The Fed’s huge miss on inflation has led Powell to start out invoking the teachings of Paul Volcker, who famously tamed it within the Nineteen Eighties.

Since Volcker stepped down in 1987, the Fed’s remit has expanded. Alan Greenspan, chair till 2006, rode a increase in productiveness to even decrease inflation, but additionally stepped in to help markets at any time when there have been threats to the financial system. When reckless lending finally blew up the housing and credit score markets in 2008, then-chair Ben Bernanke deployed the Fed’s steadiness sheet in ways in which hadn’t been seen for the reason that Nice Despair.

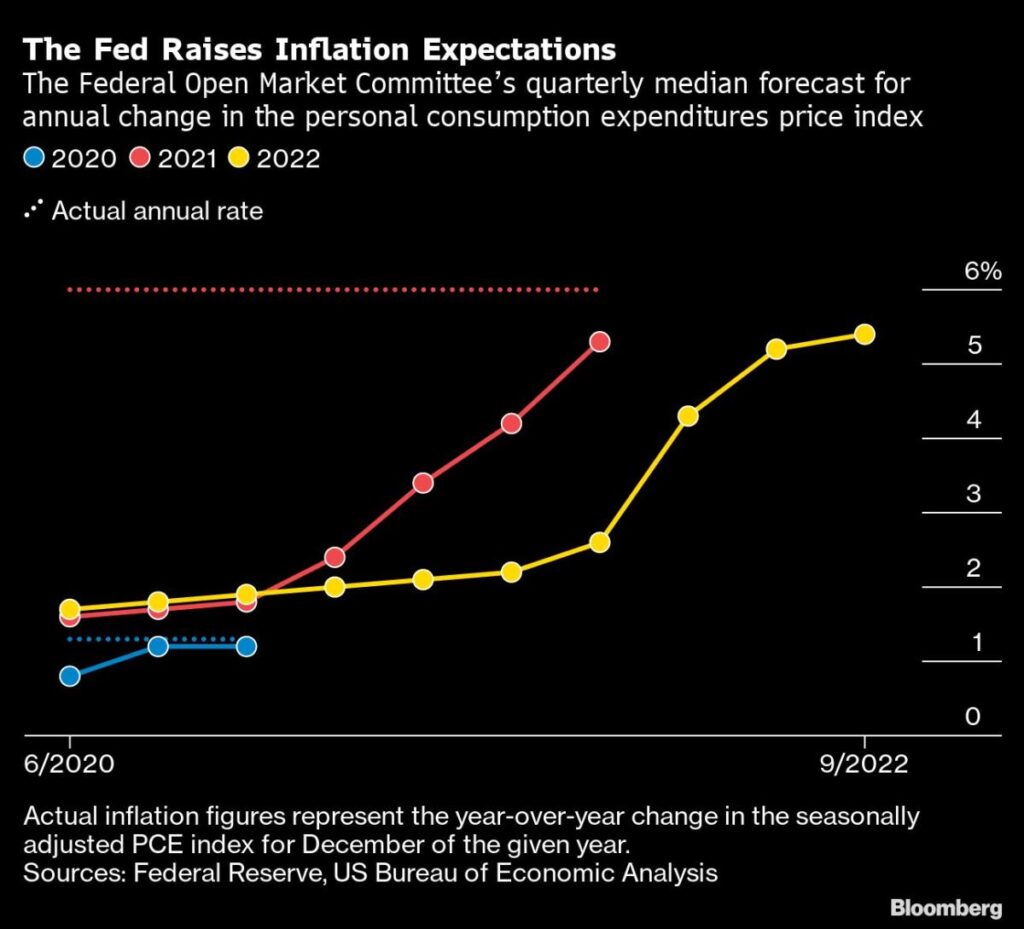

Popping out of the Covid-induced recession, it appeared as if central bankers had pulled it off once more, led by Powell. Their coordinated response in March 2020 put a flooring beneath asset costs and saved bond yields low, serving to governments fund the large spending wanted to help hundreds of thousands of unemployed individuals. With inflation nonetheless tame, central bankers assumed duty for tackling issues equivalent to local weather change and inequality—together with setting a brand new objective of “ broad-based and inclusive” employment. In the meantime, shares, bonds and cryptocurrencies had been racing increased. Then client costs did, too, and central bankers didn’t see it coming.

The Fed’s new coverage framework prevented a extra aggressive strategy to inflation, says Carl Walsh, a College of California at Santa Cruz economist who beforehand labored on the Federal Reserve Financial institution of San Francisco. He quotes the Federal Open Market Committee’s personal phrases, which admitted that targets equivalent to inclusive employment can shift over time and be robust to quantify.

“Making coverage selections ‘knowledgeable’ by employment shortfalls from a objective ‘that’s not immediately measurable’ has the potential to impart an uneven, inflationary bias in coverage,” Walsh says.

Rajan says central bankers merely overlooked their main function, which is sustaining value stability. “In the event you informed them, ‘That’s your job, concentrate on that and depart all this different stuff apart,’ they might do a greater job,” he says.

Maintain It Easy

It follows that the less complicated the mission is, the less complicated the messaging ought to be.

Financial coverage works via central bankers’ manipulation of factors alongside the yield curve—basically the worth of cash over completely different intervals of time. Central bankers present alerts about whether or not to anticipate rates of interest to rise, fall or development sideways, and merchants within the monetary markets purchase and promote huge portions of bonds accordingly. These strikes percolate via the broader society, influencing pension account balances, enterprise and client confidence and views on future value actions. That’s what determines whether or not the central financial institution insurance policies work or not.

“Financial coverage is 90% communication and 10% motion,” says Financial institution of Thailand Governor Sethaput Suthiwartnarueput.

In early 2022, because the Fed, ECB and the Financial institution of England modified their outlooks for the financial system and inflation, there was a “fairly huge failure” to speak how coverage would tackle these modifications, says Athanasios Orphanides, who served on the ECB’s governing council from 2008 to mid-2012. “Tightening of financial coverage shouldn’t be tough. This can be a no-brainer in central banking.”

The crossed wires may very well be seen in wild swings in international bond and foreign money markets all year long. In August the MOVE index of implied bond volatility—often called the US Treasuries concern gauge—jumped to a degree exceeded solely 3 times since 1988. Traders started demanding a premium to carry Australia’s AAA-rated bonds after the central financial institution reversed its pledge to maintain rates of interest on maintain till 2024 and as a substitute started its quickest tightening cycle in a technology.

Some central banks flashed early warning indicators. In October 2021 the Reserve Financial institution of New Zealand began elevating rates of interest and the Financial institution of Canada adopted a extra hawkish stance towards inflation, halting its bond-purchase program. Extra just lately, the Financial institution of Canada introduced it could begin publishing a minutes-like abstract of deliberations by officers after every coverage determination to reinforce transparency.

In contrast, the Financial institution of England, already taking flak for letting inflation get uncontrolled, has additionally been criticized for the way it dealt with a run on Britain’s foreign money and authorities bonds after Prime Minister Liz Truss’s authorities proposed a deficit-busting tax overhaul. First the central financial institution was accused of dragging its ft earlier than serving to to handle the fallout when the pound dropped to an all-time low towards the greenback, after which buyers had been shocked when the BOE pledged an abrupt finish to emergency gilt purchases. Ultimately, it was Truss who took the blame, resigning after simply 44 days.

Stephen Miller, a former head of fastened earnings at BlackRock Inc. in Australia who’s now at GSFM Pty, says he’s been poring over spreadsheets of financial indicators such because the Federal Reserve Financial institution of Cleveland’s client value index measures in a method he hasn’t accomplished for greater than three many years. The rationale: He doesn’t belief the forecasts and steering coming from central banks.

“For me, the alarm bells began ringing on inflation lengthy earlier than central financial institution language modified,” Miller says. “One of many benefits of being 61 is that your childhood had been a interval the place inflation was the norm, oil shocks had been the norm. For the final 12 months, I felt like I used to be paying homage to that interval.”

Miller’s report card is harsh: “The Financial institution of Canada, the Fed and the RBNZ I’d be giving a C+, the RBA a C- and the remainder, together with the BOE, an F.”

For Jérôme Haegeli, the “much less is extra” mantra ought to lengthen to so-called Fedspeak. The previous Swiss Nationwide Financial institution economist says too many officers making public statements causes confusion. He recommends that the Fed take a lesson from the “very lean” Swiss communications.

After the annual summer season gathering of central bankers within the mountain retreat of Jackson Gap, Wyoming, Fed officers fanned out onto the general public circuit. In a single 24-hour interval, three prime Fed officers spoke concerning the financial outlook at three completely different occasions and with three completely different tones. Esther George emphasised steadiness over pace, Christopher Waller signaled help for a 75-basis-point hike on the subsequent assembly, and Charles Evans stated he was open to 50 or 75. It’s an analogous story on the ECB, the place at the very least 19 of its main officers had been out giving speeches within the final week of September alone.

Whereas central banks in most fashionable economies get pleasure from day-to-day independence, their mandates are set by democratically elected governments. In Australia and New Zealand, as an example, authorities are reviewing the parameters of their directives to financial policymakers.

To get their message throughout to the general public, the ECB has launched cartoons and animated movies, a few of which accompany charge selections and technique overview paperwork. And Financial institution Indonesia, which already has huge followings on Fb and Instagram, now additionally has its personal TikTok account.

Attempting to speak to each audiences—the markets and most people—can typically result in confusion.

Keep Flexibility

A 3rd frequent prescription for central banks: Ditch ahead steering. That observe, first adopted within the early 2000s, goals to inform the general public the possible route of financial coverage. The issue: It’s too exhausting to foretell the longer term. And it may lock policymakers into a selected mindset.

In an Oct. 12 speech, Fed Governor Michelle Bowman blamed the FOMC’s ahead steering for its failure to deal with inflation sooner: “The committee’s specific ahead steering for each the federal funds charge and asset purchases contributed to a scenario the place the stance of financial coverage remained too accommodative for too lengthy—at the same time as inflation was rising and displaying indicators of turning into extra broad-based,” she stated.

And damaged guarantees can do actual hurt to buyers’ confidence. GSFM’s Miller cites RBA Governor Lowe’s failed steering for instance.

“Phil Lowe saying no charge will increase to 2024? These sorts of messages are useless,” says Miller. “Markets can not take central bankers at their phrase,” provided that they’ve pretended to be “all-seeing.”

James Athey, funding director of charge administration at Edinburgh-based Abrdn Plc, warns that ahead steering gained’t finish till central bankers cease talking so usually. “The sheer variety of speeches by central financial institution coveragemakers in a given week, and the seeming want of those audio system to expound on their very own subjective expectations for the financial system and financial coverage, signifies that even when the official communication is shying away from particular steering, there may be nonetheless loads for markets to latch on to,” Athey says.

Speaking coverage goals will get harder as inflation climbs, Reserve Financial institution of India Governor Shaktikanta Das stated in a speech in Mumbai in September. “It may be fairly tough to supply coherent and constant steering in a tightening cycle,” he stated. “Central financial institution communication within the present context has thus develop into much more difficult than the precise coverage actions.”

In fact, central banks will proceed to play an important function of their economies, even when they dial again the rhetoric and scrap extra difficult-to-measure targets such because the promotion of inclusive development. They’ll proceed to function guardians of monetary stability, offering money when markets seize. They usually’ll discover methods to stimulate financial development when it’s wanted once more.

But when they heed the teachings of 2022, markets and the general public can anticipate rarer, clearer and fewer bold coverage communication—a brand new period of central financial institution humility stemming from their failure to forestall the inflation shock.

Jamrisko and Carson are senior reporters in Singapore overlaying economics and FX/charges, respectively.

–With help from Theophilos Argitis, Enda Curran, Kathleen Hays, Prinesha Naidoo, Garfield Reynolds, Jana Randow, Anup Roy, Craig Torres and Suttinee Yuvejwattana.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.