This yr has been an important one for the broader indexes just like the S&P 500 and the Nasdaq Composite, which have been pushed larger by outsize positive factors in megacap progress shares. However different pockets of the market have finished pretty poorly, like industry-leading dividend payers whose consistency and stability shine in a downturn however are getting neglected in in the present day’s market.

PepsiCo (NASDAQ: PEP), Deere (NYSE: DE), and Chevron (NYSE: CVX) stand out as three dividend shares which were underperforming the S&P 500 however appear to be glorious buys now. Here is why.

Put some pep within the step of your passive-income stream

In her 12-year stint as PepsiCo CEO, Indra Nooyi helped enhance its model and develop income. Since taking up as CEO in October 2018, Ramon Laguarta has finished a superb job navigating many sudden challenges, together with the U.S.-China commerce struggle, the worst of the pandemic, inflation, and provide chain bottlenecks. Efficient administration is extraordinarily vital, since each share level in margin can imply a whole lot of tens of millions of {dollars}.

For Pepsi, progress normally comes from new product developments, strategic acquisitions, or effectivity enhancements. Nooyi was instrumental in serving to Pepsi purchase Quaker Oats and Gatorade. However arguably the most important deal below Laguarta’s tenure has been with the vitality drink firm Celsius (NASDAQ: CELH).

The corporate entered a partnership with the upstart beverage firm in August 2022. It included a $550 million money funding in change for convertible inventory, an estimated 8.5% possession in Celsius on a transformed foundation, and a 5% annual dividend. As with different shopper items corporations, Celsius shares have pulled again not too long ago, however there’s loads of purpose to suppose the deal will repay over the long run.

Celsius additionally advantages from utilizing PepsiCo’s strategic distribution community. It’s a sophisticated enterprise — arguably much more sophisticated than its peer, Coca-Cola — as a result of PepsiCo operates its personal manufacturing services in comparison with Coke’s royalty/franchise mannequin. PepsiCo can be concerned in much more product classes apart from drinks, like snacks and breakfast gadgets, whereas Coke focuses on what it does finest: drinks.

Pepsi has a decrease market capitalization than Coke however generates roughly double the income and half the working margin. Attributable to its measurement and enterprise mannequin, it is a little more susceptible than Coke. Nevertheless, the corporate’s previous administration and present management have a observe document of efficient capital allocation.

Hovering round a 52-week low with a 3.3% yield, over 50 years of consecutive dividend raises, and a 24.5 price-to-earnings (P/E) ratio, PepsiCo stands out as a superb inventory to purchase and maintain for years to come back.

Deere could also be cyclical, however the inventory is a cut price

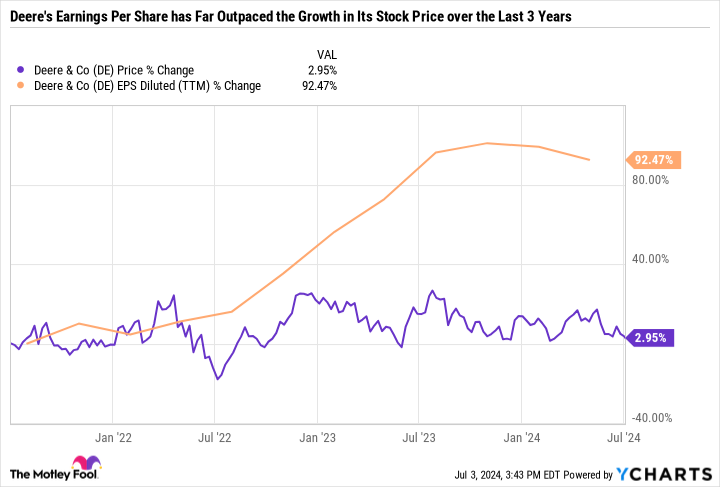

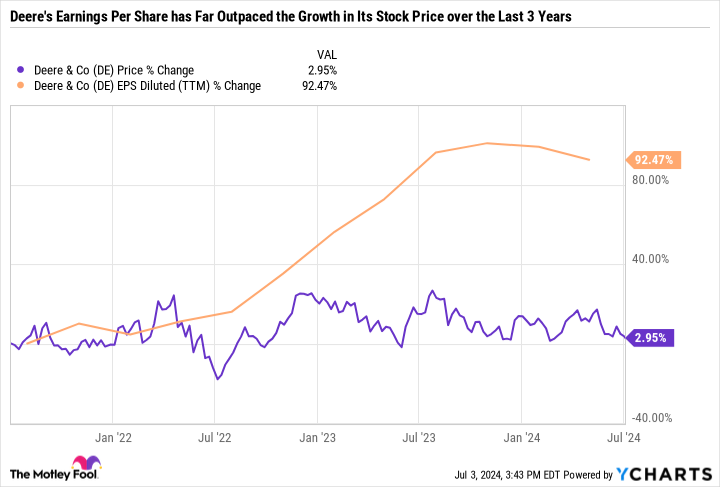

After an preliminary surge in early 2021, Deere inventory has gone virtually nowhere regardless of attaining document income final yr. Sadly, there have been obvious indicators that Deere might enter a downturn.

It’s a extremely cyclical inventory. When the corporate’s prospects are in growth mode (and financing is cheap), they is perhaps inclined to make a giant buy of its industrial equipment like farming and forestry tools.

However when the cycle turns, Deere’s gross sales can fall in a flash. The trick is to pay an affordable a number of primarily based on an organization’s mid-cycle earnings. Its P/E will look low when it’s coming off a powerful yr and can be excessive coming off a foul yr. Understandably, its P/E appears dust low cost at simply 10.9 — however earnings are anticipated to say no over the medium time period.

Consensus analyst estimates have Deere incomes $22.79 per share in fiscal 2024 and $22 in fiscal 2025, in comparison with $33.17 in fiscal 2023.

It might be one factor if Deere’s inventory surged in lockstep with its earnings progress, however it did not. The truth is, earnings have almost doubled over the past three years whereas the inventory is up simply 3%. Deere’s earnings could possibly be lower in half, and it might nonetheless have a P/E of about 22. It is just too good an organization to be this low cost.

One more reason to get enthusiastic about Deere is its earnings trajectory and automation and synthetic intelligence developments. The corporate has been ramping up analysis and improvement spending, investing in autonomous tractors, and automating farm duties, equivalent to crop spacing and really useful fertilizer use that may save operators cash. It’s making sizable product enhancements which may not influence its backside line till the subsequent uptick within the cycle.

The inventory solely yields 1.6%, however that is primarily as a result of it makes use of each dividends and buybacks to reward shareholders. During the last 5 years, the dividend is up over 93% whereas its excellent share rely is down 12.5%. That is roughly the identical tempo of buybacks that Apple has finished within the final 5 years, which is spectacular contemplating Apple is known for getting again a boatload of its inventory.

Add all of it up, and Deere appears like a superb worth inventory to purchase now.

A comparatively protected method to put money into the vitality sector

Chevron is one other inventory that has gone virtually nowhere over the past yr or so. There are a number of elements at play. The primary is uncertainty concerning Chevron’s acquisition of Hess, whose crown jewel is its stake within the Stabroek drilling block off the shores of Guyana. The opposite companions within the Guyana three way partnership — ExxonMobil and CNOOC, a Chinese language nationwide oil firm — want to stymie the deal and preserve Chevron out of Guyana.

The excellent news is that Chevron would not want the deal to undergo to be an important funding. It might proceed ramping up spending in its present performs, particularly the Permian Basin. It might additionally proceed shopping for again its inventory, which stays a superb worth with a 14.4 P/E ratio.

It is also vital to understand how the market can reward or overlook sure qualities at completely different occasions. Proper now, sentiment is optimistic, and friends like ExxonMobil are rewarded for larger spending and daring acquisitions.

Many different corporations have adopted go well with. Even ConocoPhillips, which is understood for being a conservative capital allocator, introduced it’s buying Marathon Oil in a blockbuster $22.5 billion deal. With Chevron’s main deal in limbo, there’s only one extra field left unchecked.

Chevron’s monetary well being and prudence is also getting neglected proper now. When oil costs are falling, traders typically gravitate towards protected, stodgy, dividend-paying names like Chevron. And for good purpose. Its monetary well being helped it purchase a number of corporations at compelling valuations through the COVID-induced downturn when different producers have been struggling to remain afloat.

For the final three years or so, oil costs have been remarkably steady and powerful, which could persuade some traders to gravitate towards riskier, more-leveraged performs. It might work out, however long-term traders know the easiest way to compound positive factors is to purchase high quality corporations and maintain them so long as the funding thesis stays intact.

In sum, Chevron has the qualities of a superb long-term holding. Its best power is its monetary well being, which is especially vital given the unstable nature of commodities like oil and gasoline. With its 4.2% dividend yield, the corporate stands out as a compelling alternative for producing passive earnings no matter oil costs.

Must you make investments $1,000 in PepsiCo proper now?

Before you purchase inventory in PepsiCo, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for traders to purchase now… and PepsiCo wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $771,034!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 2, 2024

Daniel Foelber has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Celsius, and Chevron. The Motley Idiot recommends Deere & Firm. The Motley Idiot has a disclosure coverage.

I Have Excessive Hopes for These 3 Grime Low-cost Dividend Shares within the Second Half of 2024 (and Past) was initially printed by The Motley Idiot