Since its IPO in January 1999, Nvidia (NASDAQ: NVDA) has established itself as one of many world’s most profitable firms. It has been notably adept at adapting its know-how to broaden into new markets.

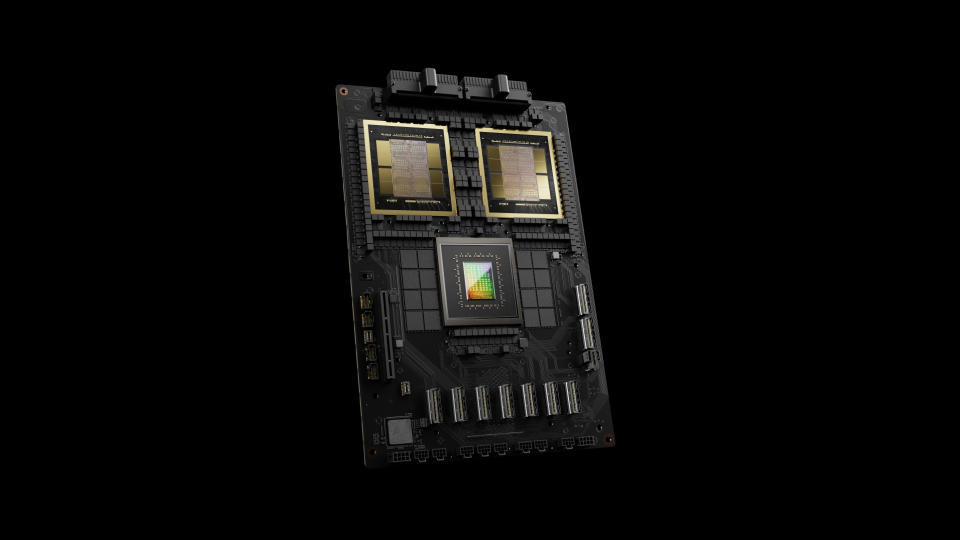

The corporate pioneered the graphics processing models (GPUs) that revolutionized the gaming trade, turning boxy figures into lifelike photographs. The key to its success was parallel processing, which allowed the chips to conduct a large number of mathematical calculations concurrently. Nvidia’s processors at the moment are used for product design, autonomous techniques, cloud computing, information facilities, synthetic intelligence (AI), and extra.

The flexibility to adapt its know-how has been a boon to shareholders. Even when buyers did not get in on the IPO itself, Nvidia shares fell under their difficulty value quite a few instances in early 1999. For buyers lucky sufficient to get shares at (or under) the $12 IPO value, the inventory has returned 493,940%.

Multiplying like rabbits

Whereas a single share of inventory may appear inconsequential at first look, one share of the proper inventory can have a huge effect on an investor’s success. In Nvidia’s case, the corporate’s efficiency and hovering inventory value have resulted in quite a few inventory splits, turning one share into many extra.

This is a listing of Nvidia’s inventory splits over time:

-

2-for-1 cut up, June 27, 2000

-

2-for-1 cut up, Sept. 12, 2001

-

2-for-1 cut up, April 7, 2006

-

3-for-2 cut up, Sept. 11, 2007

-

4-for-1 cut up, July 20, 2021

-

10-for-1 cut up, June 10, 2024

On account of the a number of inventory splits, an investor who purchased only one share of Nvidia inventory close to its IPO in 1999 would now be the proud proprietor of 480 shares.

Nevertheless, it took quite a lot of self-discipline and self-control to carry Nvidia for greater than 25 years and reap this windfall. The inventory has misplaced greater than half its worth on quite a few events, which despatched fair-weather buyers scrambling for the exits.

That mentioned, contemplate this: A $1,000 funding in Nvidia made in early 1999 would now be price greater than $4.9 million.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 23, 2024

Danny Vena has positions in Nvidia. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

If You Purchased 1 Share of Nvidia at Its IPO, This is How Many Shares You Would Personal Now was initially printed by The Motley Idiot