Chipotle Mexican Grill (NYSE: CMG) captured the highlight not too long ago with its announcement that it’ll challenge a 50-for-1 inventory break up. The is smart on condition that the inventory not too long ago achieved a brand new all-time excessive of over $3,000 a share (earlier than slipping again barely).

Here is why Chipotle and two different main restaurant, meals, and beverage dividend shares are all value shopping for now.

Chipotle is a superb story with room to run

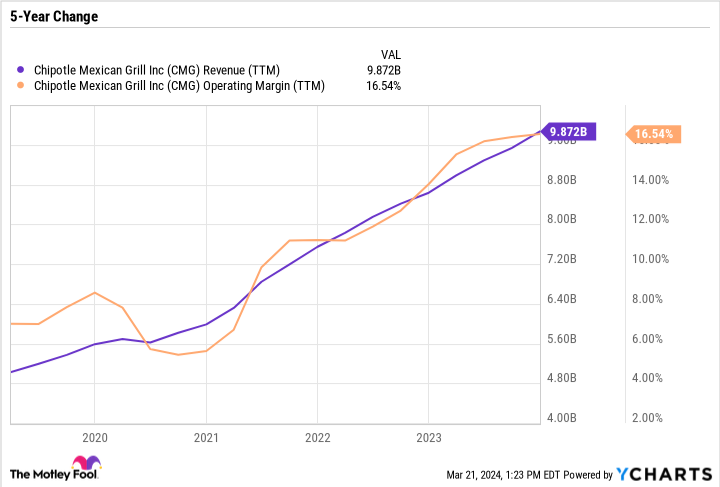

Chipotle has development — plain and easy. Its prime line continues to develop at a breakneck tempo, however it’s the corporate’s margins which have actually improved in recent times. Chipotle now has roughly the identical working margin as Starbucks however is rising at a far quicker fee.

Nonetheless, not like different restaurant chains, Chipotle does not pay a dividend as a result of it prefers to pour earnings again into the enterprise. This daring technique can amplify features, however it additionally places strain on the funding thesis when there is a slowdown.

What’s extra, Chipotle is a really costly inventory — particularly for its measurement and business. It at present trades at a price-to-earnings (P/E) ratio of practically 66. Granted, the ahead P/E is a bit decrease at about 55.

Analysts’ consensus estimates name for $64.78 in fiscal 2025 earnings per share (pre-split) — which might suggest 21% development in comparison with fiscal 2024 expectations of $53.45 per share.

If Chipotle retains rising its backside line by 15% to twenty% per yr, then its costly valuation might begin to look way more cheap over time. However there is no denying the inventory is priced to perfection and may solely be thought-about by buyers who consider within the firm’s sustained development and have a multi-year outlook.

McDonald’s has a near-perfect enterprise mannequin

Chipotle is not a horrible purchase, however McDonald’s (NYSE: MCD) could possibly be even higher. For one, buyers are getting the possibility to purchase McDonald’s at a 24.5 P/E, a reduction to its five-year median P/E of 27.1.

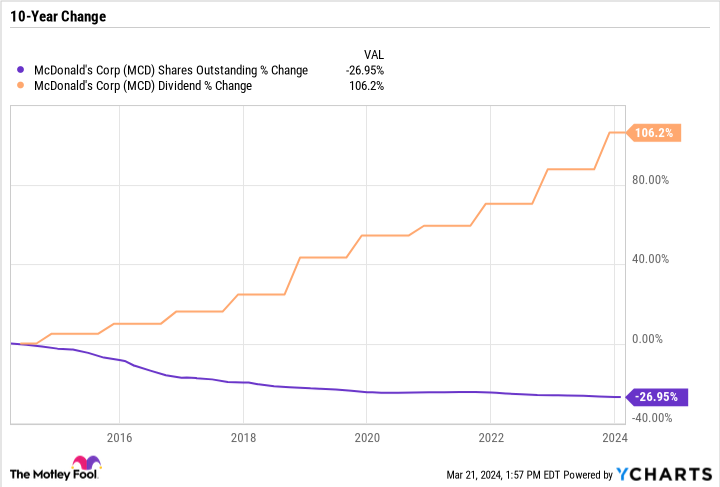

McDonald’s has been elevating its dividend at a reasonably fast fee. The present quarterly dividend is $1.67 — roughly double what it was 10 years in the past. In October, McDonald’s raised its dividend by 10%, which is a large enhance for a corporation of its measurement. The elevate places McDonald’s on monitor to grow to be a Dividend King by 2026.

McDonald’s has an underrated enterprise mannequin. In contrast to Chipotle, which owns and operates all its U.S. places, 95% of McDonald’s places worldwide are franchised. McDonald’s owns the true property and collects hire income, royalties, franchise charges, and extra. The corporate’s construction makes its model and the perceived income that franchisees can generate over time extra essential than its short-term efficiency and even the enterprise cycle.

McDonald’s might not have Chipotle’s development, however it’s a greater funding in case you’re on the lookout for consistency. The corporate has an in depth monitor document of rewarding its shareholders. As talked about, the dividend has roughly doubled during the last decade, however it’s your complete capital return program that basically stands out.

During the last decade, McDonald’s has purchased again over 1 / 4 of its excellent shares, which illustrates the effectiveness of its enterprise mannequin and the way it rewards shareholders utilizing dividends and buybacks on prime of potential capital features.

In sum, McDonald’s has all of it, and is value shopping for now.

Coke presents a compelling, dependable yield

Coca-Cola (NYSE: KO) hasn’t purchased again shares at practically the speed as McDonald’s. And it does not have nearly as good development prospects as Chipotle or McDonald’s. Nonetheless, what Coke has is stability and the ever-important high quality of not overextending itself.

Coke was instrumental in globalizing soda. However as we speak, the corporate is mature. There’s solely a lot it may do to develop with out overspending. To its credit score, it has made measured and principally efficient acquisitions. It has additionally stayed nearly solely inside its core competency of nonalcoholic drinks, which is way totally different from an organization like PepsiCo, which owns Frito-Lay, Quaker Oats, and loads of different manufacturers throughout product classes.

When the market has a nasty yr, Coke tends to outperform. However when the market has a terrific yr, Coke normally underperforms. Unsurprisingly, Coke has underperformed as a result of the market has finished very nicely in recent times.

The perfect method to put money into Coke is not since you’re making an attempt to beat the market, however since you need to restrict draw back threat and acquire passive revenue. Nothing is assured within the inventory market, however Coke is about as shut because it will get to predictability. The corporate has raised its dividend for 62 consecutive years.

The inventory yields 3.2% — which is sort of a bit greater than different dependable Dividend Kings. Coke’s reliability is likely one of the the reason why Warren Buffett-led Berkshire Hathaway has owned the inventory for over 30 years.

One thing for everybody

It is easy to get enamored with a development story like Chipotle, particularly when the entry level (with out fractional shares) turns into decrease, because of a inventory break up. Nonetheless, to have the conviction to carry a inventory over time, it is important to put money into firms you perceive and that align together with your funding goals.

Chipotle’s lack of a dividend and its lofty valuation will not attraction to everybody. When you’re extra revenue and worth oriented, McDonald’s and Coke could possibly be higher decisions.

However in case you’re a balanced investor, then choosing up shares of all three shares is a good way to get a little bit of development, worth, and revenue.

Must you make investments $1,000 in Chipotle Mexican Grill proper now?

Before you purchase inventory in Chipotle Mexican Grill, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Chipotle Mexican Grill wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 21, 2024

Daniel Foelber has the next choices: lengthy Could 2024 $90 calls on Starbucks. The Motley Idiot has positions in and recommends Berkshire Hathaway, Chipotle Mexican Grill, and Starbucks. The Motley Idiot has a disclosure coverage.

If You Like Chipotle and Its Inventory Break up, Then You will Love These 2 Dividend Shares was initially printed by The Motley Idiot