A full-scale commerce battle between the US and China is brewing, after American President Donald Trump threatened to impose tariffs of greater than 100 per cent on Chinese language items imports from April 9. For the world, the upcoming slugfest between the world’s two largest economies is certainly unhealthy information, particularly when there’s already widespread upheaval within the commerce world and analysts are upping the percentages of an American recession .

Tariffs of over a 100 per cent on Chinese language exports of products by the US would primarily translate right into a commerce embargo, and will probably set off an unmanaged decoupling of direct commerce between the world’s two largest economies. The US is the only largest importer on the planet, whereas China is its largest vendor of products. An escalatory spiral within the commerce battle between the 2, inextricably interlinked economies would, within the brief time period, convey again market volatility after a brief breather of types.

In the long run, if this had been to fester, this tariff battle will result in a extra bifurcated world. Trump’s financial vandalism may be an enormous alternative for China to stamp its affect over a bigger sphere of nations, given that the majority nations on the planet have a powerful cause now to mistrust America. All of this, as analysts are saying, does make a post-American world a actuality.

Whereas it’s nonetheless unclear how tariffs imposed by the US on different international locations will pan out, there’s at all times the potential for some items from China moving into america by means of third international locations, say Vietnam or Mexico. So whereas American customers may nonetheless get to purchase Chinese language items, what is evident is that, come what may, inflation within the US is ready to go up. The large query, although, is whether or not that is going to finish up hurting the Chinese language greater than it hurts the US, particularly as Trump signalled his openness to speaking to different international locations for de-escalating his tariff menace?

American tariffs and Sino-US commerce

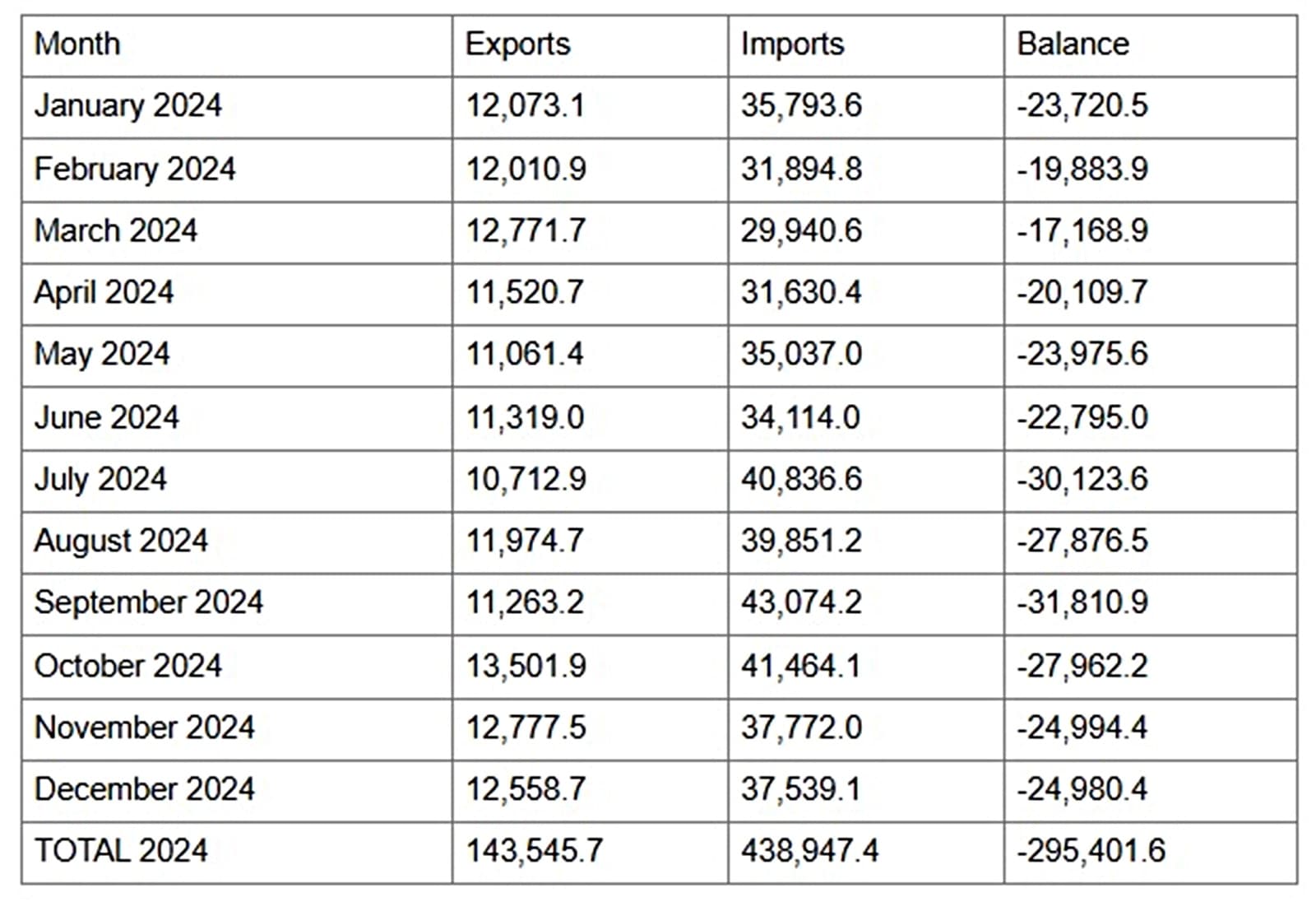

America’s complete items commerce with China was estimated at $582.4 billion in 2024. US items exports to China in 2024 had been $143.5 billion, down 2.9 per cent ($4.2 billion) from 2023 whereas US items imports from China in 2024 totaled $438.9 billion, up 2.8 per cent ($12.1 billion) from 2023. That left the US working a commerce deficit with China – the distinction between what it imports and exports – of round $295bn final yr, which is a substantial commerce deficit amounting to just about 1 per cent of the US financial system, however far lower than the $1trillion determine that Trump has repeatedly claimed this week.

Up to now, neither China nor the US are backing down on their respective tariff actions. China has stated it should “combat to the top” moderately than capitulate to what it sees as US coercion, and has hiked its personal commerce obstacles in opposition to the US in response to American tariff will increase.

Within the brief time period, there’s a probability that these tariffs will undergo as a result of Washington DC is prioritising negotiations with Japan, South Korea and others in China’s neighborhood, earlier than it might sit down with Beijing.

Story continues beneath this advert

The tariffs on China have been progressively mounting, with Trump imposing a ten per cent tariff on all Chinese language items in February, which was doubled to twenty per cent in March final week, after which he introduced one other 34 per cent to take impact on April 9. Trump then threatened an extra 50 per cent levy if China didn’t pull again reciprocal tariffs of its personal, bringing complete US taxes on Chinese language imports to a whopping 104 per cent from April 9. With a cumulative 104 per cent tariffs, two issues may occur. One, these taxes may make numerous issues too costly, and it will likely be prohibitive to import numerous gadgets from China into the US. Two, there are various issues that the US solely imports from China. These tariffs, in the event that they keep, would imply Washington DC will both need to develop various sourcing choices or make do with out this stuff, which embrace important drug elements, key uncommon earth components utilized in army {hardware} and avionics, and high-end shopper gadgets.

For the US, on this drawback of truthful commerce with China, tariffs have traditionally not been the most important bugbear. The extra critical points have been the fixed forex manipulations by Beijing, of pegging the renminbi decrease than what its intrinsic worth should be, to incentivise its exports. The opposite problem features a raft of non tariff obstacles – obstacles to commerce imposed by Beijing on international corporations in sectors reminiscent of shopper banking and high-end manufacturing.

Extra energy, larger leverage

All this triggers a query: who has larger leverage between the 2 and extra endurance? That would maintain the important thing to the query of who backs down first.

Theoretically, the US has extra financial energy, as a result of it imports extra from China than the opposite manner round. Additionally, with Chinese language home consumption nonetheless within the doldrums, Beijing is excessively depending on exterior demand for its items.

Story continues beneath this advert

However in another points, it does appear that Beijing may have larger leverage and the endurance in managing an escalatory tariff spiral, a minimum of within the brief time period. In contrast to Trump, Chinese language President Xi Jinping just isn’t confronted with elections anytime quickly, there’s little or no inner opposition to his administration of the financial system at this cut-off date, and the nation is already in the midst of a stimulus package deal roll out that features a mixture of fiscal and financial measures. China has way more endurance in terms of persevering with its fiscal stimulus package deal properly into the long run. Beijing additionally has the choice of stepping up its inner challenge of deepening the nation’s home consumption market, one thing that can soak up a few of its export surpluses if the tariff battle had been to be lengthy drawn out.

The US is at a drawback in all of this. Aside from strategic imports, People additionally purchase numerous on a regular basis gadgets from China – clothes, footwear, shopper items. Plenty of the price of greater tariffs on these items are already being handed by means of to American customers with the primary spherical of Trump tariffs, and other people typically on decrease incomes are hit tougher than the properly off. So, it’s only a matter of time that stress from home constituents would pile on the Trump administration.

For Washington DC, there’s little firepower on the fiscal aspect, besides the prospect of an extension of company tax concessions that Trump had promulgated in his final time period. Worryingly, there’s additionally an impending showdown that the Trump administration is prone to have with the US Federal Reserve on the problem of chopping rates of interest, which Fed Chair Jerome Powell has indicated is unlikely to occur anytime quickly. It could be more durable for the US to play the lengthy sport with China on this escalatory spiral.

The Chinese language evidently really feel that it is a kind of bullying state of affairs, and when it comes to the notion of their home constituents, strongman Xi wouldn’t wish to seem like seen as yielding. Particularly after Beijing has ratcheted up the rhetoric, it will likely be exhausting to again down till maybe the US provides an olive department.

Story continues beneath this advert

The unsaid benefit that goes with out saying is that in all of this, Trump is extraordinarily malleable and will pivot out of the blue, particularly if he will get a symbolic victory in his said challenge of transferring manufacturing again into the US.

Issues with tariffs

As soon as tariffs come, they’re very troublesome to take away. The tariffs on China imposed by Trump in his first time period as president had been stored in place and added to by his successor President Joe Biden. A research by economists at MIT, Harvard, College of Zurich and the World Financial institution had concluded that Trump’s tariffs in his final time period neither raised or lowered US employment. Regardless of Trump’s 2018 taxes on imported metal, for example, the variety of jobs at American metal vegetation was barely impacted. Then again, the retaliatory taxes imposed by China and different nations on US items had “damaging employment impacts,’’ particularly for farmers, the research discovered. These retaliatory tariffs had been solely partly offset by authorities support that Trump was pressured to dole out to farmers, partly funded by the incremental revenues raised by the tariffs.

This time round, China, after some preliminary restraint, has reacted to the tariffs virtually in full. A protracted commerce battle with the US would imply China would search for alternate markets for its merchandise, which, in keeping with analysis agency GTRI, will increase the potential for dumping into different shopper markets such because the European Union and India.

2025: US commerce in items with China.

Supply: US Census Bureau

Supply: US Census Bureau

2024: US commerce in items with China

Story continues beneath this advert

Supply: US Census Bureau

Supply: US Census Bureau