To fulfill the wants of the rising city inhabitants, India wants to extend its annual funding in metropolis infrastructure from a mean of $10.6 billion a 12 months previously decade to a mean of $55 billion a 12 months for the following 15 years, a World Financial institution report launched Monday mentioned.

The report, titled ‘Financing India’s Infrastructure Wants: Constraints to Business Financing and Prospects for Coverage Motion’, estimated that India would wish $840 billion over the following 15 years.

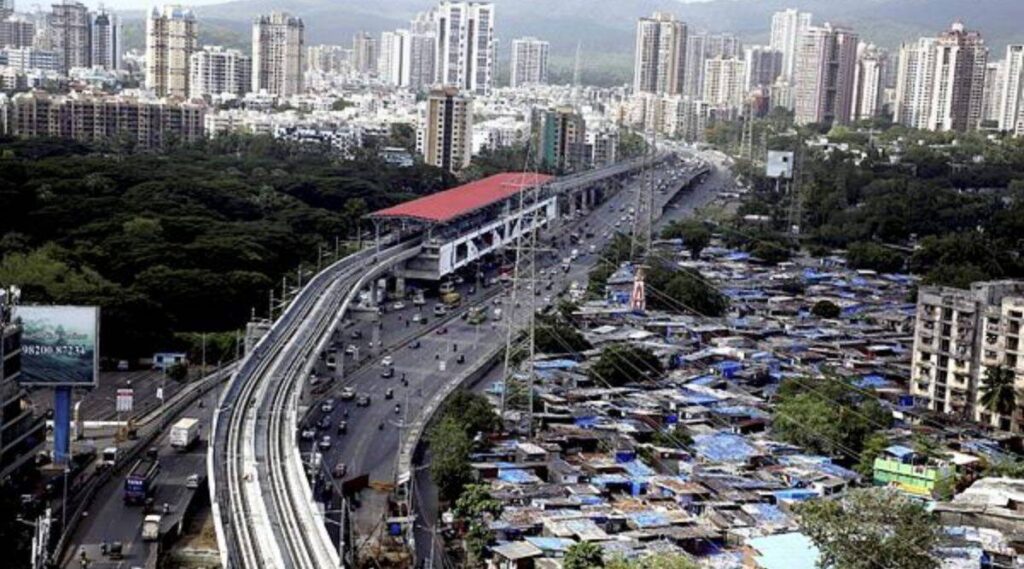

“By 2036, 600 million folks might be dwelling in city cities in India, representing 40% of the inhabitants. That is more likely to put extra strain on the already stretched city infrastructure and companies of Indian cities – with extra demand for clear ingesting water, dependable energy provide, environment friendly and secure highway transport amongst others. At the moment, the central and state governments finance over 75% of metropolis infrastructure, whereas city native our bodies (ULB) finance 15% by their very own surplus revenues,” a World Financial institution assertion mentioned.

About half of the funding wanted – $450 billion – within the subsequent 15 years was within the primary municipal companies sector that features water provide, sewerage, stable waste administration, roads and streetlights, whereas many of the remaining quantity was to handle city transport necessities, the report mentioned.

As of now, solely 5 per cent of the city infrastructure investments had been coming from the non-public sector.

“With authorities’s present (2018) annual city infrastructure investments topping at $16 billion, a lot of the hole would require non-public financing,” the assertion mentioned.

The report studied the ULBs of Tamil Nadu and Gujarat, the place it discovered that all-India tendencies for financing had been mirrored. Over three-quarters of the entire city capital expenditure within the two states got here from the Union and state governments. About 70 per cent of the city capital expenditure in Tamil Nadu and 55 per cent in Gujarat got here from the state governments.

“Business financing was negligible in Gujarat, contributing just one% of complete ULB capex state-wide. ULBs in Tamil Nadu, then again, raised as a lot as 12% of their complete capex from industrial financing – primarily loans from state-controlled FIs [financial institutions],” the report mentioned.

The report mentioned the comparatively low costs for municipal companies and a weak regulatory framework had been including to the challenges.

“Between 2011 and 2018, city property tax stood at 0.15% of GDP in comparison with a mean of 0.3-0.6% of GDP for low and middle-income international locations. Low service costs for municipal companies additionally undermines their monetary viability and attractiveness to personal funding,” the report mentioned.

Amongst its ideas, the World Financial institution report really useful making the switch of funds to cities formula-based and unconditional and rising the mandates of metropolis businesses step by step.

“The Authorities of India can play an essential position in eradicating market frictions that cities face in accessing non-public financing. The World Financial institution report proposes a variety of measures that may be taken by metropolis, state, and federal businesses to bend the arc in direction of a future through which non-public industrial finance turns into a a lot greater a part of the answer to India’s city funding problem,” mentioned Roland White, a co-author of the report and the worldwide lead of metropolis administration and finance at World Financial institution.