Wholesale worth inflation dropped to a 13-month low of 0.85 per cent in April with softening in costs of meals articles, gas and manufactured merchandise, with specialists projecting additional easing within the information of subsequent month, authorities information confirmed on Wednesday.

WPI-based inflation was 2.05 per cent in March. It was 1.19 per cent in April final yr.

WPI inflation decrease than 0.85 per cent was final recorded in March, 2024, when it was 0.26 per cent.

“Constructive price of inflation in April, 2025 is primarily attributable to a rise in costs of manufacture of meals merchandise, different manufacturing, chemical compounds and chemical merchandise, manufacture of different transport tools and manufacture of equipment and tools, and so on,” the business ministry stated in an announcement.

As per the WPI (Wholesale worth index) information, deflation in meals, and gas and energy WPI, together with disinflation in manufactured merchandise drove the moderation.

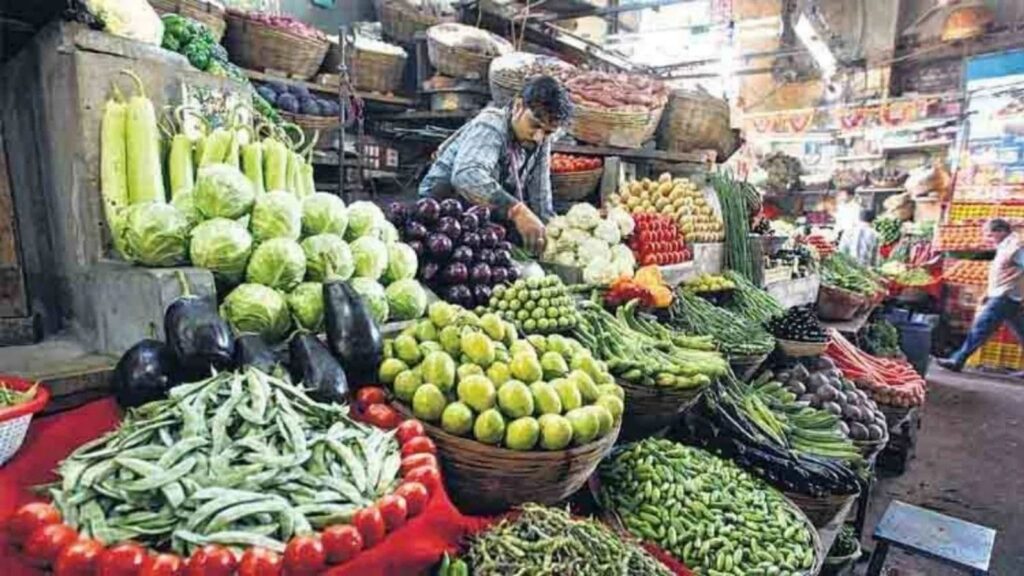

Meals articles noticed a deflation of 0.86 per cent in April, towards an inflation of 1.57 per cent in March. Deflation in greens was 18.26 per cent throughout April in comparison with deflation of 15.88 per cent in March.

In onion, inflation eased to 0.20 per cent in April, as towards 26.65 per cent in March. Inflation in fruits softened to eight.38 per cent, from 20.78 per cent within the earlier month.

Story continues under this advert

Potato and pulses noticed a deflation of 24.30 per cent and 5.57 per cent, respectively.

“Beneficial base results to maintain WPI inflation low in coming months,” Barclays stated in a analysis be aware.

Deflation in gas and energy was 2.18 per cent in April, in comparison with a 0.20 per cent inflation in March.

“Sharp sequential decline in costs of mineral oils comparable to kerosene (which was additionally mirrored in shopper costs) and ATF and motor fuels, drove this fall,” Barclays stated.

Story continues under this advert

Crude oil costs have typically remained within the USD 60-65/ barrel deal with in April, with downward strain arising from OPEC+ saying manufacturing will increase. OPEC+ is a gaggle of 23 oil-producing nations that work collectively to handle the provision of oil on this planet market with a view to affect international oil costs.

Manufactured merchandise, nonetheless, noticed inflation at 2.62 per cent in April, in comparison with 3.07 per cent in March.

ICRA Senior Economist Rahul Agrawal stated the IMD’s expectation of an early monsoon onset in Kerala and an above regular monsoon within the nation is a constructive for crop output, and consequently, the meals inflation outlook, though the spatial and temporal distribution of the identical stays key.

“We count on the WPI to common sub-2 per cent in FY2026, which, together with our CPI inflation and actual GDP projections for the fiscal implies that nominal GDP development could also be capped at 9 per cent,” Agrawal stated.

Story continues under this advert

Knowledge launched on Tuesday confirmed retail inflation eased to a close to 6-year low of three.16 per cent in April primarily due subdued costs of greens, fruits, pulses, and different protein-rich objects.

Easing of inflation would create sufficient room for the Reserve Financial institution, which primarily takes under consideration retail inflation whereas formulating financial coverage, to go in for an additional spherical of price reduce within the June financial coverage overview.

In April, the RBI reduce the benchmark coverage price by 0.25 per cent to six per cent. This was the second reduce throughout the yr to stimulate the financial system, dealing with the specter of US reciprocal tariffs. The RBI sees retail inflation averaging 4 per cent within the present fiscal from the earlier estimate of 4.2 per cent.