Saying ‘insider buying and selling’ conjures up pictures of smoky again rooms and shady offers, however that’s just for the films. In actual life, insiders consult with company officers, comparable to CEOs, CFOs, COOs, and administrators, who’re chargeable for working their corporations profitably. They don’t take buying and selling their very own corporations’ shares calmly. Whereas they could promote for numerous causes, they solely purchase once they anticipate an increase within the share worth.

That makes the insiders’ buying and selling strikes one of many surest indicators that traders can search for to foretell a inventory’s near- to mid-term actions. The insiders, by advantage of their positions, have advance info on the components that can influence the shares, and regulatory authorities stage the taking part in discipline by requiring insiders to publish their trades. Traders can look ahead to these publications, and shares with robust insider shopping for are at all times price a more in-depth look.

You can provide the constructive insider indicators a lift by combining them with different components intently linked to robust returns – like excessive dividend yields. Passive revenue is at all times boon for traders, and when that passive revenue is yielding 8% or higher, and the insiders are shopping for massive, it’s a mixture that calls for consideration.

So let’s give some consideration to those double-barreled shares they deserve. Utilizing the Insiders Sizzling Shares instrument on TipRanks, we’ve discovered two shares which can be exhibiting robust insider shopping for in latest days, together with dividend yields beginning at 8% and going up from there. If that’s not sufficient, each shares have additionally obtained help from Wall Road analysts. Let’s take a more in-depth look.

Owl Rock Capital (ORCC)

We’ll begin on the earth of Enterprise Improvement Corporations, or BDCs. These monetary corporations provide their clients entry to credit score and capital. Their buyer base consists of small- and medium-sized enterprises which have lengthy been the drivers of the US financial system. These corporations don’t at all times have entry to main banks, however Owl Rock and its friends present the capital, credit score, and mortgage amenities that these companies want for development, acquisitions, and market or product expansions.

There are 187 of those mid-market corporations in Owl Rock Capital’s funding portfolio, with a complete honest market worth in extra of $13 billion. Of Owl Rock’s investments in these corporations, 98% are floating price, and 85% are senior secured investments.

It’s a high quality portfolio that has contributed to ORCC’s rising earnings over the previous yr. In truth, the corporate’s newest quarter, 1Q23, showcased robust revenue that exceeded the Road’s forecasts by a large margin. ORCC’s whole funding revenue reached $377.6 million, representing a 42% enhance in comparison with the year-ago quarter. Even higher, the full funding revenue got here in $12 million greater than had been anticipated.

On the backside line, the online funding revenue (NII) got here in at $177.8 million, or 45 cents per share. This was 14 cents per share increased than the 1Q22 determine – and it was 2 cents greater than the analysts had predicted.

The robust funding revenue supported a beneficiant dividend. For the second quarter, the corporate has declared a daily dividend of 33 cents per frequent share, which is scheduled for cost on July 14. This common dividend, when annualized, quantities to $1.32 and gives a formidable yield of 9.8%.

On the insider trades, we discover that firm President and CEO Craig Packer, purchased 75,600 shares of the corporate in Might, paying about $1 million.

The corporate’s prime officer is hardly the one bull right here; RBC Capital’s 5-star analyst Kenneth Lee writes of this inventory: “ORCC may very well be on observe to delivering 12%+ ROE this yr. Credit score efficiency in portfolio continues to be stable, in our view. We count on to achieve additional perception into ORCC’s funding strategy and potential return profile via cycles on the upcoming investor day. We proceed to favor ORCC as one of many few atscale BDCs, with a pretty valuation (0.85x NAV) and dividend yield (~10%).”

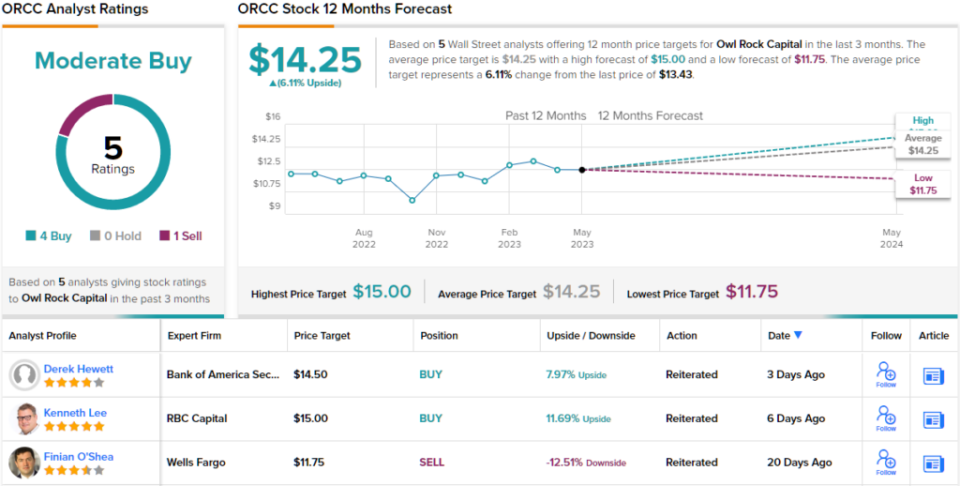

In Lee’s view, this provides as much as an Outperform (i.e. Purchase) score, and he units a worth goal of $15 to indicate a one-year upside potential of ~12%. Based mostly on the present dividend yield and the anticipated worth appreciation, the inventory has 22% potential whole return profile. (To look at Lee’s observe report, click on right here)

So far as Wall Road usually is anxious, ORCC will get a Average Purchase consensus score, primarily based on 5 latest critiques that embody 4 Buys and 1 Promote. (See ORCC inventory forecast)

Boston Properties (BXP)

From BDCs we’ll shift gears and take a look at an organization from one other sector which is understood for prime dividends, an actual property funding belief. The REIT at hand is Boston Properties, a serious participant within the US office actual property section. Boston Properties is the most important publicly traded developer, proprietor, and supervisor of such properties within the US.

A take a look at some numbers will give the dimensions. Boston Properties counts 177 workplace properties in its portfolio, totaling 50 million sq. toes of leasable house. These properties are situated in six city areas, effectively referred to as among the most fascinating actual property within the US. BXP has holdings in its eponymous metropolis of Boston, together with New York Metropolis, Washington DC, Seattle, San Francisco, and Los Angeles. The corporate’s largest presence, with 49 places and 15.9 million sq. toes, is in Boston; Washington and New York are subsequent, with 42 properties and 22.6 million sq. toes between them.

Business actual property, particularly in city areas, is feeling strain post-COVID. With many staff nonetheless commuting remotely, corporations are attempting to downsize their workplace areas. However even in that troublesome setting, BXP has saved up its revenues and earnings. The corporate’s prime line in the newest quarter, 1Q23, got here to $803.2 million, capping practically two years of constant quarter-over-quarter income development. The Q1 whole was additionally up 6.5% year-over-year, and beat expectations by $24.4 million.

On the backside line, there are a number of metrics to contemplate. BXP’s GAAP earnings of fifty cents missed the forecast by 4 cents and had been 45% decrease than the year-ago quarter’s EPS of 91 cents. Of extra curiosity to dividend traders, nevertheless, BXP reported funds from operations (FFO) in 1Q23 of $1.73 per share, derived from a complete of $272 million. Whereas down from the year-ago quarter’s outcomes ($1.82 per share and a complete of $286.1 million), the present FFO was greater than sufficient to totally fund the corporate’s dividend.

The dividend was paid out close to the top of April, for 98 cents per frequent share. BXP has held the dividend at this stage since late 2019; the annualized price of $3.92 per frequent share provides a powerful yield of 8%.

Taking a more in-depth take a look at this agency’s insider trades, we uncover that Carol Einiger, a member of the Board of Administrators, just lately acquired 10,000 shares, paying $474,100.

Additionally bullish on the inventory is Evercore ISI analyst Steve Sakwa, who focuses on the corporate’s skill to generate funds.

“After a few tweaks to our mannequin, our ‘23 FFO est will increase from $7.15 to $7.18 pushed by barely increased base lease and decrease op bills which compares to our new FY24 estimate of $7.58 which displays barely extra conservative working bills… We keep our Outperform score given the corporate’s high quality portfolio, wholesome steadiness sheet and sturdy growth pipeline to drive long-term worth in an in any other case challenged workplace sector,” Sakwa opined.

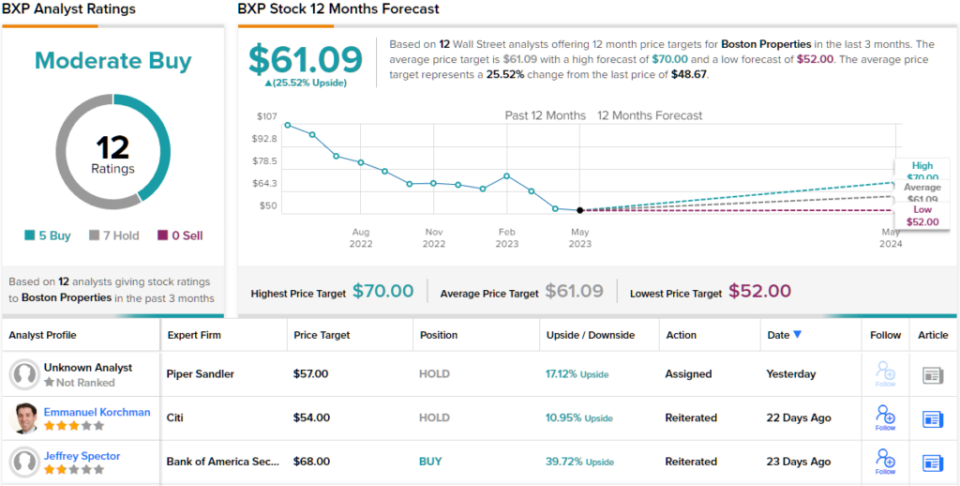

That Outperform (i.e. Purchase) score comes with a $67 worth goal that suggests development of ~38% for the yr forward. (To look at Sakwa’s observe report, click on right here.)

General, of the 12 most up-to-date analyst critiques on report right here, 5 are to Purchase and seven to Maintain – giving the inventory its Average Purchase consensus score. (See BXP inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your personal evaluation earlier than making any funding.