For the retail investor, insider trades are probably the greatest indicators of a inventory’s potential future efficiency. The insiders, after all, are much more benign than the connotations of the identify. They’re company officers, residents of the C-suite, or members of the Board. Their positions give them a close-up view of an organization’s internal workings, and that view guides them after they commerce their very own corporations’ shares.

The company insiders’ data offers them a bonus of their buying and selling, offering an edge over different merchants in the identical shares. To take care of a degree taking part in subject, regulators require insiders to publish their trades, permitting the buying and selling public to comply with these transactions. The important thing level to recollect is that insiders usually solely purchase their very own shares when they’re sure the worth will go up.

We’ve used the Insiders’ Scorching Shares software to get the lowdown on a pair of shares that some insiders have splashed out no less than $1 million on. The insiders are cautious of their buying and selling actions, and their purchases of such substantial worth display a transparent willingness to take important dangers. These are the trades that retail traders ought to scrutinize carefully.

Now, let’s take a more in-depth take a look at these trades and what the analysts need to say. This may assist us perceive why following their footsteps might be a sensible transfer.

Oneok, Inc. (OKE)

Let’s start with Oneok, a distinguished midstream firm specializing in pure gasoline. Oneok owns one of many top-rated pure gasoline liquids programs within the US, and its community connects the Permian, Mid-Continent, and Rocky Mountain areas with necessary market facilities. Oneok’s community contains an array of pure gasoline gathering, processing, storage, and transport property, making the corporate a number one supplier of midstream providers.

This previous Could, Oneok made an necessary transfer to broaden its community, with the announcement of its settlement to amass Magellan Midstream Companions. The transfer will make Magellan a fully-owned subsidiary of Oneok, and provides Oneok a presence on the Gulf Coast. The mixed asset web work will embody greater than 25,000 miles of pipeline. The acquisition transaction is valued at $18.8 billion in money and inventory, and is predicted to shut throughout 3Q23.

Heading towards that transaction closing, we will take a look at Oneok’s most up-to-date quarterly report, for a snapshot of how the corporate stands. Revenues for 1Q23 got here in at $4.52 billion, falling nearly 17% y/y and lacking the forecast by $827 million. Earnings, nevertheless, beat the forecast; the EPS determine of $2.34 was 5 cents higher than had been anticipated.

Higher-than-expected earnings helped prop up a stable dividend, which Oneok declared at 95.5 cents per widespread share again in April, and paid out in Could. On the present fee the dividend cost annualizes to $3.82 per share, and provides a yield of 6.3%, contributing considerably to the inventory’s return worth.

Turning to the insider exercise, we discover that the corporate’s President and CEO Pierce Norton not too long ago purchased 24,607 shares of OKE, for which he spent $1.5 million. It was by far the biggest transaction performed not too long ago by a Oneok insider.

All of this has caught the eye of Stifel analyst Selman Akyol, who’s impressed by Oneok’s acquisition exercise and its skill to emulate bigger midstream corporations.

“We view the acquisition of Magellan as offering ONEOK with elevated scale and variety of property whereas sustaining its Gulf Coast and Mid-Con concentric footprint. This may clearly make OKE extra on par with Enterprise Merchandise or Power Switch by way of variety throughout the carbon chain. Equally necessary, it supplies OKE with fast synergies totaling $200 million and probably a runaway to reap complete synergies over $400 million over the subsequent a number of years. OKE has had a want to have the ability to export NGLs and we consider both by way of further property or probably repurposing property OKE could also be a lot nearer to reaching that given Magellan’s entry to the water,” Akyol opined.

These feedback assist the analyst’s Purchase ranking, whereas his $76 value goal means that OKE will recognize ~25% within the coming months. (To look at Akyol’s monitor report, click on right here)

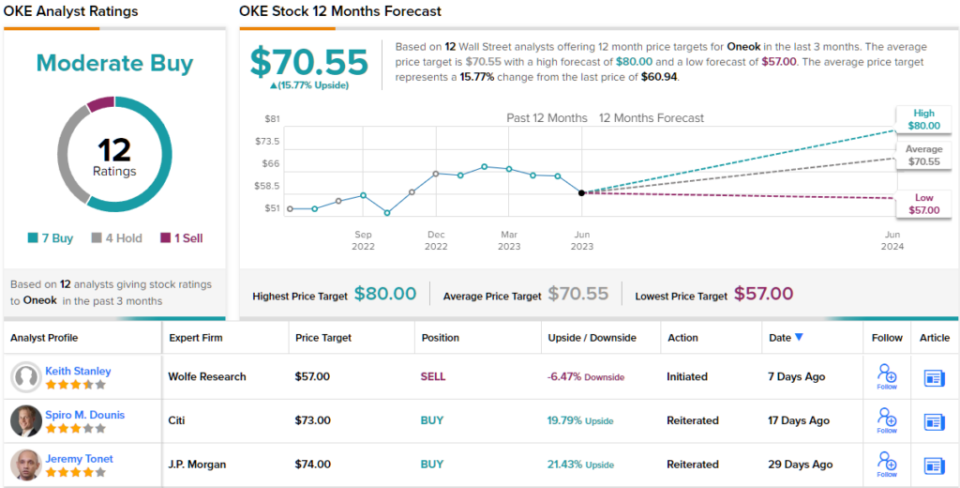

Total, OKE has a Average Purchase consensus ranking, based mostly on 12 current analyst evaluations with a breakdown of seven Buys, 4 Holds, and 1 Promote. The inventory is at present buying and selling at $60.94 and its common value goal of $70.55 implies room for ~16% progress going ahead. (See Oneok inventory forecast)

The Youngsters’s Place (PLCE)

Now we’ll shift gears and transfer from the power business to the realm of kids’s retail, the place we’ll discover the distinguished participant, Youngsters’s Place.

Notably, Youngsters’s Place holds the place of being the biggest kids’s attire retailer within the North American market. The corporate designs its personal clothes traces for youngsters from start by way of toddlerhood to highschool age, and it contracts out the manufacturing of those designs. Moreover, the corporate controls each the retail and wholesale advertising and marketing and gross sales.

Youngsters’s Place sells its merchandise beneath a number of model names, together with the well-known eponymous Youngsters’s Place label, Child Place, and Gymboree, amongst others. On the finish of the corporate’s first quarter – the top of this previous April – Youngsters’s Place was working 599 shops throughout the US, together with Puerto Rico, and Canada. On the worldwide facet, the corporate had 5 worldwide franchise companions, controlling 212 distribution factors in 15 international locations.

The financial turmoil of the previous a number of years has been arduous on Youngsters’s Place, and the corporate’s inventory is down 28% for the reason that starting of this 12 months. Latest weeks have been higher, nevertheless, and PLCE has joined the general bullish development – the inventory has gained 81% from its June 1 trough.

Turning to the monetary outcomes, we discover that Youngsters’s Place final report, for Q1 of fiscal 2023, ending on April 29, confirmed a top-line income determine of $321.64 million. This was down 11% year-over-year, and missed the estimates by $16.82 million. On the backside line, earnings additionally missed the forecast, with the non-GAAP EPS of -$2.00 coming in 22 cents beneath expectations. The EPS determine was a poor comparability to the $1.05 EPS revenue reported in 1Q22.

Regardless of the monetary misses, the CEO of Youngsters’s Place, Jane Elfers, bought 43,000 shares of the inventory early this month. This was a major insider purchase, for which Elfers laid out $1.019 million. Her stake within the firm now totals greater than $8.8 million.

She is just not the one bull right here, both. Jeff Lick, overlaying PLCE for B. Riley, sees Youngsters’s Place as an undervalued progress alternative, and recommends that traders purchase in now. In his phrases, “We proceed to love the elemental, transformational story of PLCE. From a inventory set-up perspective, we’d be remiss if we didn’t spotlight the notion that it seems to us PLCE now has 4 consecutive quarters of low expectations, probably explosive upside catalysts and seemingly simple compares.”

“We don’t imply to dismiss the results that the present and extended financial headwinds can and has had on PLCE’s monetary outcomes. In our view, the company-specific, transformative components to the PLCE story at the side of its confirmed money stream technology and low valuation based mostly on our 2024 estimates symbolize just too significant of an outsized return potential along with an inexpensive degree of draw back safety to go up,” the analyst added.

Along with his Purchase ranking on the shares, Lick offers PLCE a $43 value goal, implying a one-year achieve of 64%. (To look at Lick’s monitor report, click on right here)

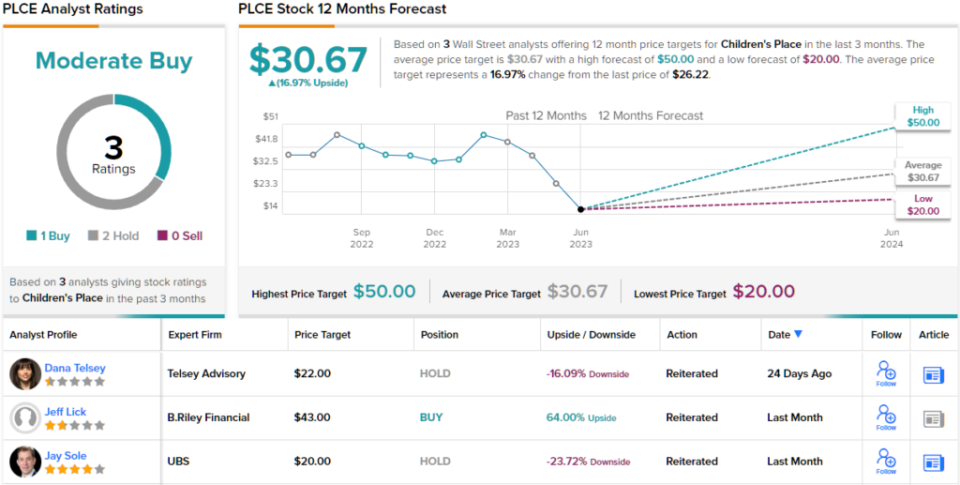

Total, Youngsters’s Place inventory will get a Average Purchase ranking from the analyst consensus, based mostly on 3 current evaluations that embody 1 Purchase to 2 Holds. The inventory is promoting for $26.22 and its common goal value, at $30.67, suggests it should achieve ~17% within the subsequent 12 months. (See PLCE inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your personal evaluation earlier than making any funding.