Whether or not you’re a seasoned dealer or a novice, the oldest piece of recommendation in economics nonetheless holds true: purchase low and promote excessive. The problem lies in figuring out the precise time to buy shares which are undervalued or to promote these which are overpriced.

There are many indicators to crack that code, however one of many clearest is the insiders’ buying and selling patterns. The insiders are company officers, firms’ higher-ups, whose positions put them ‘within the know.’ Due to this fact, monitoring their trades, particularly once they’re shopping for in bulk, can present priceless insights into the corporate’s potential course.

The majority trades at all times deserve a better look, so we’ve opened up the Insiders’ Scorching Shares software from TipRanks to search out two shares which have each been the topic of million-dollar-plus insider buys.

In accordance with analysts, these shares are Purchase-rated and supply appreciable upside potential. Moreover, they’ve been beaten-down in current months, making them enticing investments for these trying to purchase low and doubtlessly revenue from a rebound.

Enphase Vitality (ENPH)

We’ll begin with Enphase Vitality, a pacesetter within the residential solar energy set up market. The corporate produces, sells, and installs a full vary of small- to mid-scale photo voltaic installations for residential and business properties. Together with the photo voltaic installations, Enphase produces a full vary of ancillary applied sciences wanted to help solar energy era, from the facility inverters that change photovoltaic panels’ direct present to grid-usable alternating present to ‘good’ battery techniques to retailer energy to be used after peak manufacturing occasions.

Enphase presently holds an enormous market share benefit over its competitors, and dominates some 86% of the residential photo voltaic market. The corporate cements its place with the advantageous applied sciences wanted to make its small-scale photo voltaic initiatives viable. The tech options don’t cease with energy inverters and good batteries; Enphase’s clients can management energy hundreds, and even the facility distribution amongst family home equipment or small-business equipment.

Regardless of Enphase’s sturdy product line and dominant market place, the corporate’s inventory is down 38% to date this yr. A lot of the drop got here after the discharge of the 1Q23 monetary outcomes. Though the highest and backside traces exceeded expectations, the corporate’s Q2 income outlook fell in need of the Avenue’s estimates. Administration projected Q2 income to be within the vary of $700 million to $750 million, whereas analysts had anticipated $762 million. This disappointing steering raised issues amongst market watchers a couple of potential decline in demand for photo voltaic merchandise.

Enphase’s sudden share decline didn’t appear to concern insiders or Wall Avenue analysts. The truth is, Enphase board member Thurman Rodgers made two multi-million greenback purchases of ENPH because the Q1 launch, totaling 60,800 shares and costing him over $10 million mixed.

From the Avenue’s analysts, we will verify in with Corinne Blanchard, of Deutsche Financial institution, who writes of Enphase: “We stay patrons of the inventory, particularly after the sturdy pull-off [last week], which we imagine was overdone. We stay constructive on the inventory with sturdy progress in Europe, which might offset any potential softness within the US resi market, however extra importantly we worth the US manufacturing footprint.”

Blanchard’s feedback come together with a Purchase ranking and a $240 worth goal that implies a one-year upside potential of 46% for ENPH. (To observe Blanchard’s observe document, click on right here)

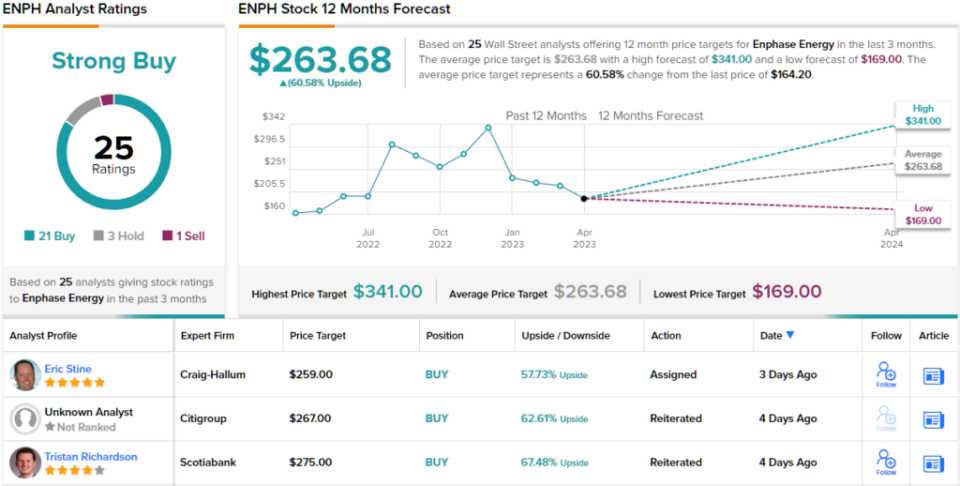

General, the bulls are undoubtedly nonetheless operating for Enphase, which has 25 current analyst evaluations – together with 21 Buys, 3 Holds, and a single Promote. The shares are priced at $164.20, and their $263.68 common worth goal is much more bullish than Blanchard permits, and implies ~61% upside for the approaching yr. (See ENPH inventory forecast)

Cleveland-Cliffs (CLF)

From solar energy we’ll swap to the iron and metal business. Cleveland-Cliffs is likely one of the largest producers of flat-rolled metal working within the US steel-making business, and it dietary supplements the flat-rolled product with a various portfolio of different metal merchandise. The corporate is well-known within the business for its steel stamping, tooling phase, and tubular part manufacturing, and is a significant provider of metal merchandise to the automotive business.

Along with completed metal, Cleveland-Cliffs additionally has its arms in iron mining and iron ore. The corporate has land and mine holdings in Michigan’s Higher Peninsula and in Northern Minnesota which are energetic producers of iron ore, and one other mining website in West Virginia produces industrial-grade coking coal, a significant ingredient within the steel-making course of. Further services for turning uncooked coal into usable coke, are positioned in Ohio, West Virginia, and Pennsylvania. The total product line from Cleveland-Cliffs has functions in a number of industries, together with home equipment, autos, industrial gear, building, vitality, manufacturing, and packaging.

Final week, Cleveland-Cliffs reported its earnings outcomes for Q1 of 2023. The corporate’s income was $5.3 billion, which was 11% decrease than the earlier yr however exceeded forecasts by $90 million. In non-GAAP phrases, earnings per share had been a lack of 11 cents, a big drop from the earlier yr’s EPS of $1.50. Nevertheless, the Q1 earnings beat forecasts by one cent and confirmed enchancment over This autumn 2022, which had a lack of 41 cents per share.

Regardless of beating the forecasts in that final earnings report, CLF’s shares are down 32% from their March excessive level. Headwinds pushing towards the inventory embody worries of a recession later this yr. On the plus facet, the corporate is presently taking a look at excessive demand for its core traces of hot-rolled, cold-rolled, and coated metal merchandise – demand that has been excessive sufficient to help a worth enhance on the order of $100 per internet ton.

With this background, we will flip to the insider trades, the place we discover that a number of board members have been making six-figure purchases. Probably the most notable buy, nonetheless, got here from board chairman Lourenco Goncalves, who purchased 100,000 shares for simply over $1.496 million.

Within the eyes of Argus’ 5-star analyst David Coleman, the present low share worth is a chance for buyers. He writes: “CLF has a historical past of outperforming the market and the business, and is led by an skilled administration workforce. Nevertheless, Cleveland-Cliffs, together with its friends, has seen its share worth drop considerably amid falling metals costs and weaker international financial situations. Nevertheless, we count on metal demand to select up because the automotive sector recovers… We predict that CLF shares are attractively valued at present costs close to $15…”

Quantifying his stance, Coleman charges CLF shares a Purchase, and his $20 goal worth signifies his perception in a 30% upside potential heading out to the following 12 months. (To observe Coleman’s observe document, click on right here)

General, the 8 current analyst evaluations on CLF embody 5 Buys and three Holds, for a Average Purchase consensus ranking. The shares are priced at $15.38 and the $22.13 common worth goal suggests ~44% upside potential on the one-year timeframe. (See CLF inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally essential to do your individual evaluation earlier than making any funding.