Traders are continuously searching for methods to generate stable returns, in any case, that’s the entire level of investing. Reaching that purpose is simpler stated than carried out, nonetheless. As with something, if it have been actually easy, buyers would solely have success tales to inform.

That stated, there are methods to realize an edge available in the market, and one frequent route is to maintain observe of insiders’ actions. Insiders are the high-level firm officers, Board members, CFOs and COOs, as much as CEOs, whose positions give them a close-up data of their companies’ interior workings – and so they do commerce on that data.

Now, their trades can contain each shopping for and promoting, and what buyers want to recollect is that insiders solely have one purpose to purchase their very own inventory – they assume it’ll acquire worth. It’s as clear a sign as any investor might need.

And when the insiders begin spending hundreds of thousands on their shares, that sign will get even clearer.

That’s what we’re seeing now, utilizing the Insiders’ Scorching Shares device. Insiders have been pouring hundreds of thousands into two dividend shares, signaling a powerful confidence of their long-term potential.

In truth, these insiders are usually not the one ones considering the time is true for loading up. A number of Wall Avenue analysts are additionally bullish on these equities, additional bolstering the case for funding. Let’s take a better look.

ExxonMobil (XOM)

The primary inventory we’ll have a look at is ExxonMobil, a frontrunner among the many world’s prime ten largest oil corporations. With a market cap of $433 billion, Exxon reported revenues within the neighborhood of $390 billion final 12 months.

The corporate is a serious operator within the discovery, manufacturing, and supply of hydrocarbon power assets, with a diversified portfolio that features varied different important actions. ExxonMobil is a key provider of commercial chemical compounds, and its gas merchandise are extensively used within the development and manufacturing sectors. Moreover, it’s contributing to the event of latest, light-weight plastics utilized in a large number of merchandise, from smartphones to airliners.

ExxonMobil operates in each the US and worldwide markets. Earlier this 12 months, it introduced a major growth in its oil manufacturing off the coast of Guyana. The corporate has acquired authorities approval for the Uaru, the fifth mission within the Stabroek block, an enhancement anticipated to generate a further quarter-million {dollars} in income per day, with a deliberate startup in 2026.

In July, Exxon introduced its acquisition of Denbury, an modern firm within the carbon seize and oil restoration section. The Denbury acquisition will improve ExxonMobil’s capability for low carbon options, reflecting the oil firm’s dedication to a cleaner future.

Turning to the monetary facet, we discover that Exxon posted $82.9 billion in whole income for 2Q23, reported on the finish of July. This whole was down by 28% from the year-ago quarter, and missed the forecast by $7.4 billion. The underside line earnings additionally got here in beneath expectations. The EPS determine of $1.94 per share was 8 cents decrease than had been anticipated. The misses have been influenced by headwinds within the hydrocarbon business, together with falling costs within the first half of this 12 months.

Though revenues and earnings have been down, ExxonMobil retained its potential to generate sturdy money flows. The corporate had $9.4 billion in money stream from operations in Q2, and a free money stream of $5 billion.

Sound money flows assist to keep up the dividend, which Exxon will subsequent pay out to frequent shareholders on September 11. The fee is ready at 91 cents per frequent share, and the annualized charge of $3.64 offers an above-average yield of three.4%.

Taking a look at insider exercise, we uncover a notable purchase made by Jeffrey Ubben, a member of the Board of Administrators, earlier this week. Ubben dropped a formidable $48.97 million to purchase 458,000 shares of XOM. Ubben stake within the firm totals over $175 million.

On the analyst entrance, Piper Sandler’s 5-star analyst Ryan Todd notes the disappointing headlines from the earnings report – but in addition notes that the corporate has strengths, together with its potential to generate money and the chance of upper power costs in 2H23.

“Whereas each the headline earnings and upstream efficiency are disappointing, this was offset barely by money stream dynamics that have been stronger than anticipated. Much like friends, world fuel headwinds have been vital, nonetheless we anticipate many 2Q headwinds to reverse in 2H23, together with fuel pricing, refining margins (already +15%-30% vs. 2Q), and chemical compounds. And with structural value financial savings ($8.3B thus far) driving practically 2x the profitability, we anticipate XOM to proceed to drive relative outperformance,” Todd opined.

These feedback again up Todd’s Obese (i.e. Purchase) ranking on XOM, and his $127 worth goal signifies his perception in an 18.5% upside potential for the shares. Based mostly on the present dividend yield and the anticipated worth appreciation, the inventory has ~22% potential whole return profile. (To observe Todd’s observe report, click on right here)

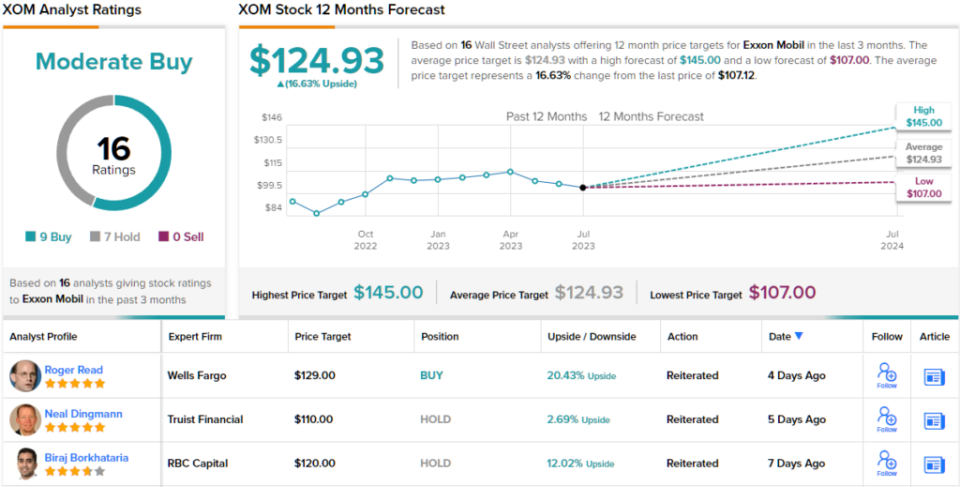

General, this oil main will get a Reasonable Purchase ranking from the Avenue’s consensus, primarily based on 16 current analyst evaluations that embrace 9 Buys and seven Holds. The shares are priced at $107.12, with a mean worth goal of $124.93 to recommend ~17% one-year upside potential. (See XOM inventory forecast)

Agree Realty Company (ADC)

From oil majors, we’ll shift focus to the actual property funding belief (REIT) section, the place Agree Realty, primarily based within the Metro Detroit space, operates via the acquisition, possession, and administration of a variety of actual properties.

Agree’s portfolio is each invaluable and extremely diversified. As of the tip of 2Q23, Agree had 2,004 properties in its portfolio, situated in 49 states, and totaling 41.7 million sq. ft of leasable space. The corporate’s portfolio was 99.7% leased on the finish of Q2, with the investment-grade retail tenants producing 67.9% of the annualized base rents.

Along with conventional actual properties, Agree additionally invests in floor leases, and in Q2, the corporate acquired three extra of those properties for a complete buy worth of $25.8 million. These introduced the corporate’s floor lease portfolio as much as 210 leases, with a complete of 5.7 million sq. ft of gross leasable space. The bottom lease portfolio was totally occupied on the finish of Q2 and had a weighted common remaining lease time period of practically 11 years.

This all interprets to a portfolio able to producing stable income – Agree posted a prime line of $129 million for Q2, up 24% year-over-year and modestly $58K higher than the estimates. The corporate’s internet revenue per share, at 42 cents, was down over 7% y/y, and was a penny decrease than anticipated.

One in all Agree Realty’s standout options is its popularity for offering a dependable month-to-month dividend payout. The most recent declared dividend stands at $0.243 per frequent share, leading to an annualized fee of $2.916 and a lovely yield of 4.5%.

Current insider exercise additional reinforces a constructive outlook on the corporate. Three insiders, together with the CEO and government chairman of the board, made ‘informative purchase’ transactions earlier this week, investing a complete of over $3.25 million within the firm’s inventory. Particularly, Board member John Rakolta spent $1.89 million on 30,000 shares of ADC inventory, CEO Joey Agree spent $627,900 to purchase 10,000 shares, and eventually, government chairman – and firm founder – Richard Agree picked up 11,751 shares for $739,725.

Truist analyst Ki Bin Kim additionally shares a good view of Agree Realty. Kim is impressed by the corporate’s share worth, and its stability sheet – and by administration’s confirmed competence. He says of this inventory, “We stay BUY rated as a consequence of: 1) enticing valuation, 16.5x 2023 P/AFFO; 2) inventory has already considerably underperformed triple internet friends this 12 months -8.9% vs. -2.4%; 3) draw back safety by way of 68% IG tenancy; 4) sturdy stability sheet and mgmt. observe report.”

Wanting forward, Kim charges ADC a Purchase, and his $77 worth goal means that he sees a 20% upside on the one-year horizon. (To observe Kim’s observe report, click on right here)

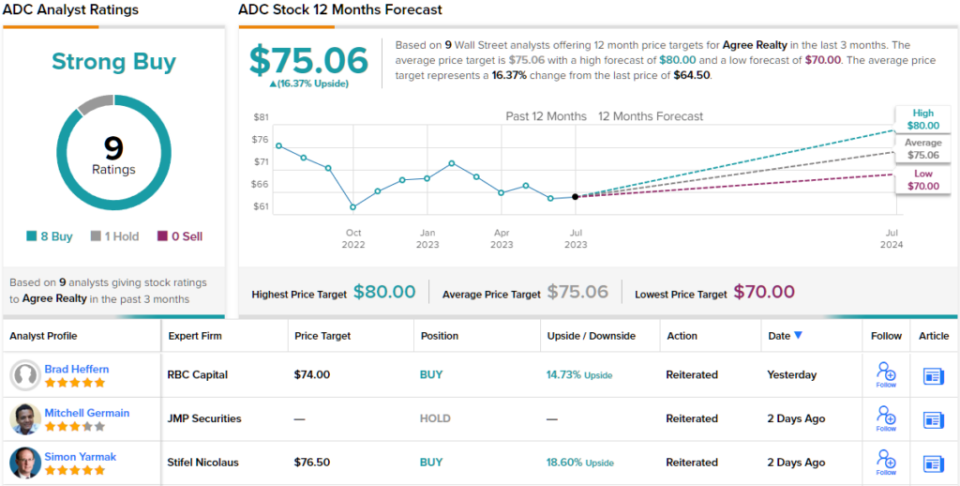

General, the 9 current analyst evaluations right here break down 8 to 1 in favor of Buys over Holds, giving ADC its Sturdy Purchase consensus ranking. The shares are at the moment buying and selling for $64.50 and their $75.06 common worth goal implies a 16% upside for the following 12 months. (See ADC inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather vital to do your personal evaluation earlier than making any funding.