The investing sport can seem difficult as there are a lot of points to contemplate earlier than leaning right into a inventory: Is the time proper to load up? Are the shares overvalued? Will a beaten-down inventory ever get well?

All of those issues are legitimate, however there are methods to simplify the method, equivalent to analyzing insiders’ actions. By insiders, we confer with company officers who function “on the within” and are chargeable for the efficiency of the businesses they work for. In spite of everything, they’ve information not obtainable to the informal investor. And when they’re seen choosing up shares of their very own companies’ inventory, particularly in bulk, it sends a transparent message to traders they suppose the shares provide good worth at present ranges.

If that isn’t convincing sufficient, when the identical shares get the thumbs up from analysts working at one of many world’s greatest banks, equivalent to J.P. Morgan, it actually warrants a better look.

So, we’ve completed simply that. Utilizing TipRanks’ Insiders Scorching Shares instrument, we have now homed in on two names into which insiders have been pouring hundreds of thousands just lately, and which JPMorgan inventory consultants additionally imagine have room for additional progress – with one probably boasting an upside of a big 175%. Furthermore, the analyst consensus charges each of them as Sturdy Buys. So, let’s see why you may need to take note of these two shares proper now.

Akoya Biosciences (AKYA)

We’ll first head to the life sciences area and get the lowdown on Akoya Biosciences, a agency that calls itself “the Spatial Biology firm.” That’s, it’s a pioneer in spatial phenotyping know-how that permits researchers and clinicians to achieve deeper insights into the complicated biology of illnesses on the mobile degree.

Mixed, the corporate’s single-cell imaging merchandise, equivalent to The PhenoCycler (beforehand referred to as CODEX), and the PhenoImager (identified earlier than as Phenoptics), provide a whole resolution that caters to the wide-ranging wants of researchers within the fields of discovery, translational, and scientific analysis.

The merchandise have been steadily gaining traction, and that was the case once more in essentially the most just lately reported quarter – for 1Q23. Income elevated by 26.7% year-over-year to $21.4 million, surpassing the forecast by $1.08 million. On the different finish of the size, EPS of -$0.49 met Avenue expectations. For the outlook, the corporate maintained its prior full-year 2023 steerage, with income projected to be within the vary of $95-98 million. The midpoint of this vary is above the consensus estimate of $95.92 million.

Regardless of the first rate readout, AKYA shares have suffered badly this 12 months, shedding 32% year-to-date. It appears time for the insiders to behave, and there are a complete of six of them. Evidently, a number of within the C-suite imagine the shares are undervalued. This week, board members Thomas Raffin, Matthew Winkler, and Chairman Robert Shepler have all been loading up, buying 2,020,000, 203,388, and 120,000 shares, respectively. Moreover, board members Myla Lai-Goldman and Scott Mendel, together with CFO Johnny Ek, purchased smaller quantities of 20,000 shares every. Mixed, these purchases are presently valued at $15.74 million.

They don’t seem to be the one ones exhibiting confidence. Scanning the most recent print, J.P. Morgan analyst Julia Qin has loads of good issues to say concerning the Spatial Biology firm.

“AKYA delivered one other sturdy quarter on the again of PhenoCycler-Fusion new product cycle, with a number of merchandise within the pipeline equivalent to PhenoCycler Fusion 2.0 area improve, PhenoCode panels and RNA menu enlargement to speed up progress in 2023 and past… With a big $17B TAM for spatial biology, differentiated worth proposition, sturdy positioning within the scientific market, and a powerful administration crew, we imagine AKYA is effectively positioned to execute and ship engaging income progress and margin enlargement,” Qin opined.

Qin backs up these feedback with an Obese (i.e., Purchase) ranking and an $18 value goal, indicating the inventory has room for progress of 175% over the subsequent 12 months. (To observe Qin’s observe document, click on right here)

That take isn’t any anomaly. All 6 different latest analyst critiques are optimistic, naturally making the consensus view right here a Sturdy Purchase. Analysts see shares rising by a hefty 142% within the months forward, contemplating the typical goal stands at $15.86. (See AKYA inventory forecast)

Topgolf Callaway Manufacturers (MODG)

For our subsequent insider/JPM-backed title will pivot away from medical units to devices of an altogether totally different hue. Topgolf Callaway Manufacturers is a number one title within the world golf trade. Shaped from the 2021 merger of high-quality golf gear maker Callaway Golf and golf leisure model Topgolf, the corporate’s portfolio of manufacturers presents a spread of merchandise that cater to each newbie {and professional} golfers – spanning golf gear, attire, and leisure.

This golf specialist delivered beats on each the top-and bottom-line in its newest quarterly readout. Income reached $1.17 billion, amounting to a 12.5% year-over-year improve and outpacing the Avenue’s name by $30 million. Adj. EPS of $0.17 beat the $0.15 forecasted by the analysts.

Nevertheless, the corporate supplied a disappointing outlook, with Q2 income anticipated within the vary between $1.175 to $1.195 billion, a ways beneath consensus at $1.22 billion.

Administration emphasised that they’ve a number of initiatives anticipated to drive progress within the latter a part of the 12 months, however they didn’t present an excessive amount of data concerning these.

That didn’t provide a lot comfort for traders, who despatched shares down sharply as soon as they digested the main points. Nevertheless, director Adebayo Ogunlesi should suppose the long run bodes effectively for MODG, as he just lately scooped up 100,000 shares, which at the moment are value $1,966,000.

Additionally assured within the firm’s ongoing success is JPM analyst Matthew Boss, who thinks Topgolf Callaway stands out in its area.

“Administration sees ‘extraordinarily sturdy’ demand inside the social/walk-in enterprise (80% of gross sales combine), continued tailwinds to experiential actions, and advantages from PIE, with CFO Lynch assured within the FY23 SVS (same-venue-sales) outlook and multi-year progress potential of Topgolf (low-single-digit SVS long-term with plentiful new unit white area)… We imagine the corporate represents the ‘progress’ title in golf with an accelerating multiyear monetary profile together with ~10-12% income progress translating to +Mid/Excessive-Teenagers EBITDA progress,” Boss opined.

Accordingly, Boss charges MODG an Obese (i.e., Purchase) whereas his $25 value goal suggests the shares will climb 27% larger over the approaching months. (To observe Boss’s observe document, click on right here)

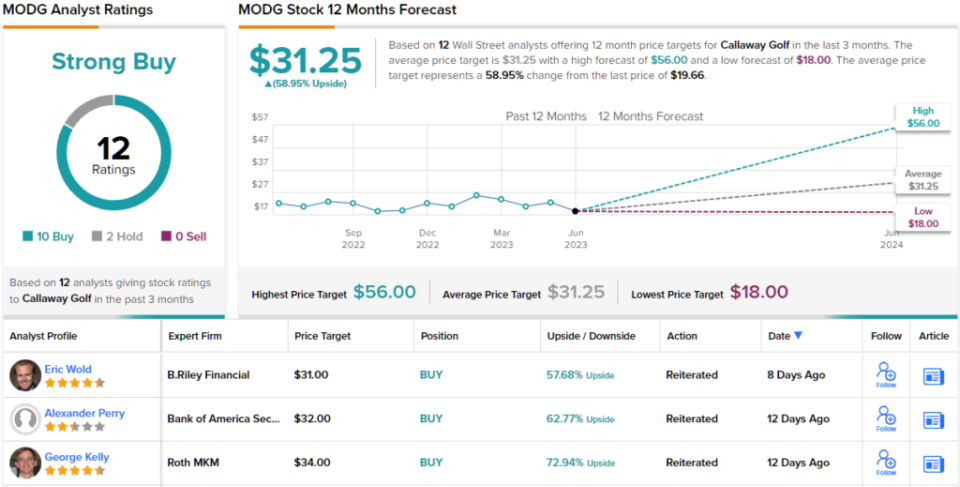

The JPMorgan view might become the conservative take a look at Valens – the inventory’s Sturdy Purchase consensus ranking, and the typical value goal of $31.25 suggests ~59% upside from the present share value of $19.66. (See MODG inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely vital to do your individual evaluation earlier than making any funding.