In terms of the pharmaceutical business, weight-loss drugs are all the fad proper now. Whereas Ozempic maker Novo Nordisk dominates drugs designed to deal with weight problems and diabetes, two different corporations wish to get their slice of the pie — however just one is succeeding.

Let’s break down some alternate options to Novo Nordisk, and assess why one competitor seems to be like an incredible purchase in 2024 whereas the opposite seems too dangerous.

The inventory to purchase hand over fist: Eli Lilly

Eli Lilly (NYSE: LLY) manufactures a diabetes remedy known as Mounjaro. Chances are high you have seen the commercials for the drug or might even know people who find themselves prescribed it. Though Mounjaro has solely been commercially out there since mid-2022, demand for this medicine is off the charts. Mounjaro generated $3 billion in income by way of the primary 9 months of 2023, making it Eli Lilly’s second-largest top-line contributor.

And simply final month, the Meals and Drug Administration (FDA) accepted Mounjaro’s sister product, Zepbound. Whereas Mounjaro is used to deal with diabetes, Zepbound’s focal space is weight problems. This can be a main improvement for Eli Lilly as the corporate faces a fierce contest with Novo Nordisk.

By some estimates, the marketplace for weight-loss drugs may attain $200 billion by 2030. Though it is most likely too early to know whether or not these forecasts are correct, the principle takeaway is that the demand for merchandise like Ozempic, Wegovy, Rybelsus, or Mounjaro are not going away. Now, with the approval of Zepbound, Eli Lilly is well-positioned to amass further market share within the rising diabetes and weight problems markets.

The factor traders ought to remember is that Eli Lilly’s inventory has rocketed 56% in 2023 due to its all-around profitable portfolio. As of now, Eli Lilly inventory trades at a ahead price-to-earnings (P/E) a number of of 87 — roughly quadruple that of the S&P 500. It is clear that the capital markets are inserting a premium on Eli Lilly and are bullish on the corporate’s development prospects.

However when enthusiastic about the long run, traders ought to take into account that Eli Lilly has but to essentially profit from Zepbound. Proper now, the corporate’s gross sales associated to weight-loss drugs stem from Mounjaro and Jardiance. The approval of Zepbound for weight problems provides a wholly new layer of alternative for Eli Lilly and mustn’t go missed. Though the inventory is not precisely low cost, I’d warning traders about making an attempt to time the proper alternative to open a place.

I see Eli Lilly as far more than a developer of weight-loss drugs given the depth of the corporate’s portfolio along with weight-loss merchandise. The drugmaker additionally has therapies for most cancers and autoimmune illnesses, with each of those areas contributing billions in income. The corporate’s most cancers drug Verzenio grew 62% by way of the primary 9 months of 2023, however an expanded indication approval from the FDA may suggest that its long-term prospects may very well be way more sturdy.

To me, Eli Lilly represents a compelling alternative within the pharmaceutical business on the whole. With its long-term returns in extra of 1,000%, affected person traders have been handsomely rewarded by proudly owning this inventory, and I do not see that altering.

The inventory to keep away from just like the plague: Pfizer

One other pharmaceutical firm that is trying to take part within the race amongst weight-loss therapies is Pfizer (NYSE: PFE).

Whereas the corporate’s vaccine performed a monumental position combating COVID-19, its pursuit of the diabetes and weight problems markets is not wanting too good. Though Pfizer nonetheless has some alternatives in its weight-loss pipeline, I would not maintain my breath. The corporate is much behind Novo Nordisk and Eli Lilly, and even when it makes some inroads ultimately, I believe it will be too little, too late.

Do not get me fallacious. Pfizer has a big portfolio of medicines, and its waning aspirations towards the weight-loss market is not catastrophic. Nevertheless, traders ought to understand that its therapies for COVID-19 are usually not essentially a catalyst anymore.

And as Pfizer enters the closing phases of its Seagen acquisition, I surmise {that a} vital quantity of transaction prices will take a toll on the corporate’s earnings development. The markets are clearly accounting for the corporate’s dwindling prospects provided that shares of Pfizer inventory are buying and selling close to their lowest level in a decade.

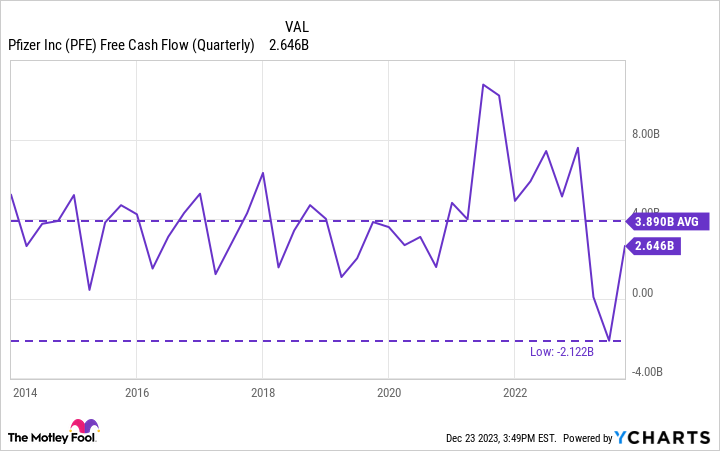

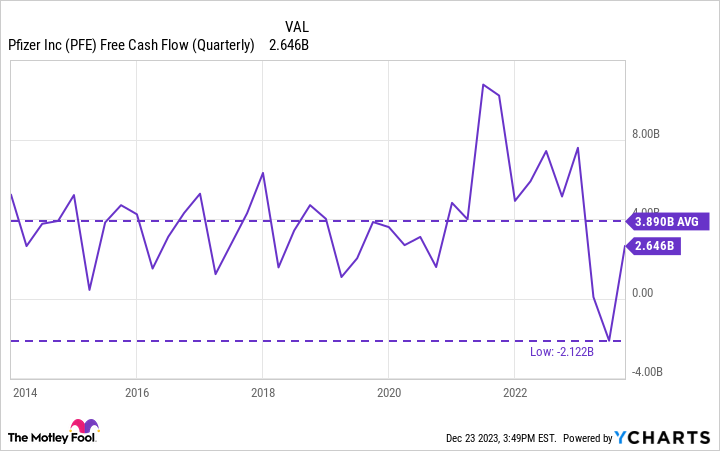

Furthermore, with free money stream era each unpredictable and far decrease than historic ranges, Pfizer might face liquidity constraints because it integrates Seagen subsequent 12 months. Whereas that is purely hypothesis, the corporate could also be compelled to hunt additional cost-saving efforts, which may come within the type of slashing its dividend.

I believe there are just too many dangers related to an funding in Pfizer proper now, and I do not view its present value motion as a chance to purchase the dip. Except Pfizer can show that it is on a extra respectable path for income and revenue development, I might depart the inventory alone and search higher alternatives.

Must you make investments $1,000 in Eli Lilly proper now?

Before you purchase inventory in Eli Lilly, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for traders to purchase now… and Eli Lilly wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Adam Spatacco has positions in Eli Lilly and Novo Nordisk. The Motley Idiot has positions in and recommends Pfizer. The Motley Idiot recommends Novo Nordisk. The Motley Idiot has a disclosure coverage.

within the Weight-Loss Market? Here is 1 Inventory to Purchase Hand Over Fist in 2024, and 1 to Keep away from Just like the Plague. was initially printed by The Motley Idiot