Alistair Berg | Digitalvision | Getty Photographs

Loss of life and taxes are, as Benjamin Franklin famously declared, two of life’s certainties.

Funding charges could also be a worthy addition to that record within the fashionable period — although not all traders are conscious of this near-universal reality.

The charges monetary companies corporations cost will be murky.

One-fifth of customers suppose their funding companies are freed from value, in response to a current Hearts & Wallets survey of about 6,000 U.S. households. One other 36% reported not figuring out their charges.

A separate ballot carried out by the Monetary Trade Regulatory Authority Investor Schooling Basis equally discovered that 21% of individuals imagine they do not pay any charges to spend money on non-retirement accounts. That share is up from 14% in 2018, the final time FINRA issued the survey.

Extra from Private Finance:

Prioritizing retirement, emergency financial savings in shaky economic system

Financial institution disaster inflicting recession might rely on ‘wealth impact’

The IRS plans to tax some NFTs as collectibles

The broad ecosystem of economic companies corporations would not work without spending a dime. These corporations — whether or not an funding fund or monetary advisor, for instance — usually levy funding charges of some type.

These charges might largely be invisible to the common individual. Corporations disclose their charges in positive print however usually do not ask clients to write down a verify or debit cash from their checking accounts every month, as non-financial corporations would possibly do for a subscription or utility cost.

As an alternative, they withdraw cash behind the scenes from a buyer’s funding property — prices that may simply go unnoticed.

“It is comparatively frictionless,” stated Christine Benz, director of private finance at Morningstar. “We’re not conducting a transaction to pay for these companies.”

“And that makes you a lot much less delicate to the charges you are paying — in quantity and whether or not you are paying charges in any respect.”

Small charges can add as much as hundreds over time

Funding charges are sometimes expressed as a proportion of traders’ property, deducted yearly.

Buyers paid a median 0.40% price for mutual and exchange-traded funds in 2021, in response to Morningstar. This price is also called an “expense ratio.”

Which means the common investor with $10,000 would have had $40 withdrawn from their account final 12 months. That greenback price would rise or fall annually in response to the funding stability.

The proportion and greenback quantity could seem innocuous, however even small variations in charges can add up considerably over time as a result of energy of compounding. In different phrases, in paying increased charges an investor loses not solely that more money however the development it may have seen over a long time.

It is comparatively frictionless. We’re not conducting a transaction to pay for these companies.

Christine Benz

director of private finance at Morningstar

The majority — 96% — of traders who responded to FINRA’s survey famous their foremost motivation for investing is to generate profits over the long run.

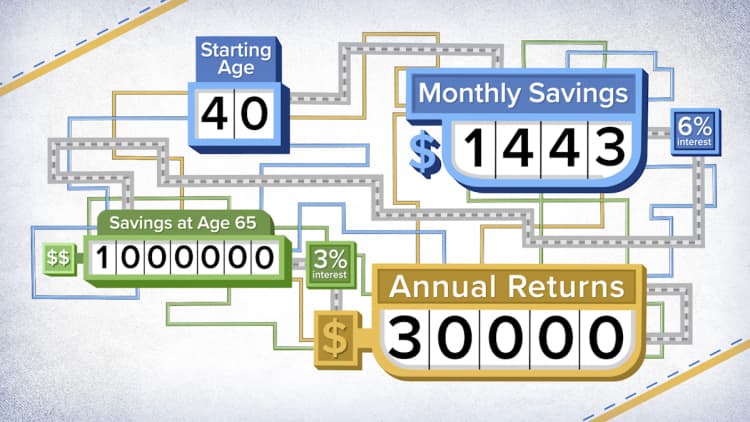

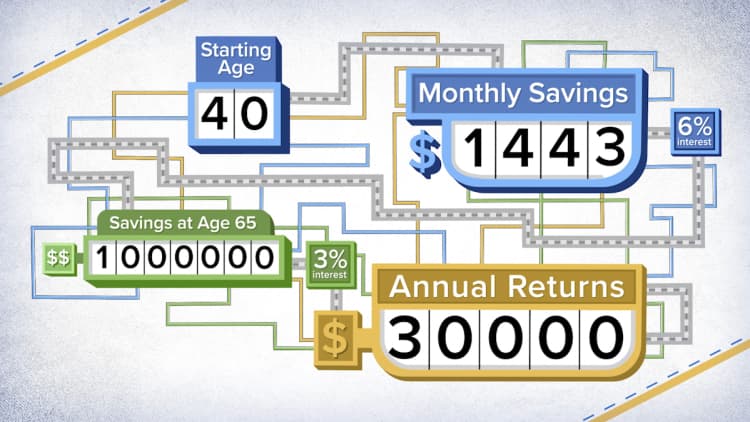

The Securities and Trade Fee has an instance to show the long-term greenback impression of charges. The instance assumes a $100,000 preliminary funding incomes 4% a 12 months for 20 years. An investor who pays a 0.25% annual price versus one paying 1% a 12 months would have roughly $30,000 extra after twenty years: $208,000 versus $179,000.

That greenback sum would possibly nicely symbolize a few 12 months’s price of portfolio withdrawals in retirement, give or take, for somebody with a $1 million portfolio.

In all, a fund with excessive prices “should carry out higher than a low-cost fund to generate the identical returns for you,” the SEC stated.

Charges can have an effect on strikes resembling 401(okay) rollovers

Charges can have a giant monetary impression on widespread selections resembling rolling over cash from a 401(okay) plan into a person retirement account.

Rollovers — which could happen after retirement or a job change, for instance — play a “notably essential” function in opening conventional, or pretax, IRAs, in response to the Funding Firm Institute.

Seventy-six p.c of latest conventional IRAs have been opened solely with rollover {dollars} in 2018, in response to ICI, an affiliation representing regulated funds, together with mutual funds, exchange-traded funds and closed-end funds.

10’000 Hours | Digitalvision | Getty Photographs

About 37 million — or 28% — of U.S. households personal conventional IRAs, holding a collective $11.8 trillion on the finish of 2021, in response to ICI.

However IRA investments sometimes carry increased charges than these in 401(okay) plans. Consequently, traders would lose $45.5 billion in mixture financial savings to charges over 25 years, based mostly solely on rollovers carried out in 2018, in response to an evaluation by The Pew Charitable Trusts, a nonpartisan analysis group.

Charges have fallen over time

This annual price construction is not essentially the case for all traders.

For instance, some monetary planners have shifted to a flat-dollar price, whether or not an ongoing subscription-type price or a one-time price for a session.

And a few price fashions are completely different. Buyers who purchase single shares or bonds might pay a one-time upfront fee as a substitute of an annual price. A uncommon handful of funding funds might cost nothing in any respect; in these instances, corporations are doubtless making an attempt to draw clients to then cross-sell them different merchandise that do carry a price, stated Benz of Morningstar.

This is the excellent news for a lot of traders: Even when you have not been listening to charges, they’ve doubtless declined over time.

Charges for the common fund investor have fallen by half since 2001, to 0.40% from 0.87%, in response to Morningstar. That is largely because of traders’ preferences for low-cost funds, notably so-called index funds, Morningstar stated.

Michaelquirk | Istock | Getty Photographs

Index funds are passively managed; as a substitute of deploying stock- or bond-picking methods, they search to duplicate the efficiency of a broad market index such because the S&P 500 Index, a barometer of U.S. inventory efficiency. They’re sometimes inexpensive than actively managed funds.

Buyers paid a median 0.60% for energetic funds and 0.12% for index funds in 2021, in response to Morningstar.

Benz recommends 0.50% as a “good higher threshold for charges.” It might make sense to pay extra for a specialised fund or a small fund that should cost extra annually because of smaller economies of scale, Benz stated.

The next price — say, 1% — may be cheap for a monetary advisor, relying on the companies they supply, Benz stated. For 1%, which is a standard price amongst monetary advisors, clients ought to anticipate to get companies past funding administration, resembling tax administration and broader monetary planning.

“The excellent news is most advisors are certainly bundling these companies collectively,” she stated.