Over any significant time span, Nvidia (NASDAQ: NVDA) has been a blockbuster funding. It is up nearly 1,800% during the last 5 years, and it has greater than tripled up to now 12 months alone, fueled by traders’ pleasure for synthetic intelligence (AI).

There’s good motive to consider Nvidia is a high AI inventory. Administration attributes its surging income to AI-related services. For example how sturdy demand is, the corporate expects to report income of $20 billion in its fiscal 2024 fourth quarter. That may be a 231% year-over-year improve — merely astounding for an organization of this measurement.

AI is the highest funding development proper now, and Nvidia inventory is among the hottest methods to trip the development increased. Nevertheless, for its half, the corporate is shopping for shares of 5 different AI corporations.

This fascinating improvement made the information on Feb. 14 with Nvidia’s first 13F submitting with the Securities and Change Fee. This type is for institutional funding managers to report their inventory holdings.

In line with its 13F, Nvidia has a inventory portfolio price $230 million, and these are the AI shares it has been shopping for.

A glimpse inside Nvidia’s inventory portfolio

Nvidia’s 13F reveals it owns solely 5 shares, however all 5 have a connection to AI in some capability. Here is a fast overview of every firm, from the most important funding all the way down to the smallest.

-

Arm Holdings (NASDAQ: ARM) licenses its AI semiconductor chip designs to different corporations, and this enterprise is in excessive demand proper now. Nvidia tried to amass Arm again in 2020 however lastly referred to as it off in 2022 after pushback from regulators. Now, it can look to profit as an investor. That is Nvidia’s largest inventory place, valued at $147 million as of the SEC submitting.

-

Subsequent in Nvidia’s portfolio is Recursion Prescription drugs (NASDAQ: RXRX). This early-stage biotechnology firm is utilizing AI fashions to course of genetic knowledge and discover new medication. It is an concept that may very well be game-changing for the medical discipline, which is why the inventory has additionally caught the eye of progress investor Cathie Wooden.

-

SoundHound AI (NASDAQ: SOUN) presents an AI voice assistant that is much like what’s already provided by main tech corporations. Nevertheless, SoundHound AI believes its AI is extra able to understanding regular language. And based mostly on its rising buyer listing, there appears to be help for administration’s declare.

-

Of Nvidia’s shares, traders may wish to disregard TuSimple Holdings, contemplating it is delisting from the Nasdaq. That mentioned, this firm has an AI angle as nicely — it is working to allow autonomous driving for trucking corporations.

-

Lastly, Nano-X Imaging (NASDAQ: NNOX) — or simply Nanox — is Nvidia’s smallest inventory place. This firm hopes to transition the world to a brand new digital X-ray know-how. It intends to make use of AI to undergo these digital pictures and discover patterns that medical doctors may overlook, main to raised outcomes for sufferers.

In terms of AI shares, I personally consider the development, as an entire, is overhyped. And inventory market historical past is affected by previous traits that finally fizzled out. Subsequently, traders have to be discerning.

That mentioned, I consider AI can unlock numerous prospects in terms of the medical discipline. For this reason I am notably intrigued with Nvidia’s investments in Recursion Prescription drugs and Nanox.

These two shares are notably high-risk and high-reward

Full disclaimer earlier than I’m going any additional: I’m not a medical skilled within the slightest. I am only a common investor on the surface wanting in. Investing nice Warren Buffett says to remain within your circle of competence. And fellow nice Peter Lynch says to put money into what you recognize. Medical shares aren’t that for me.

Nevertheless, I do know sufficient to grasp datasets are monumental on this discipline, and processing giant quantities of knowledge is the place AI actually shines.

Contemplate certainly one of Recursion Pharmaceutical’s latest partnerships for instance. Within the third quarter of 2023, it partnered with Tempus to realize entry to twenty further petabytes (over 20,000,000 gigabytes) of oncology knowledge. It now has a staggering 50 petabytes at its disposal for most cancers analysis. And to course of this a lot data, the corporate will maintain working with Nvidia to make its BioHive-1 supercomputer extra highly effective.

Nanox solely has a restricted variety of medical gadgets in operation proper now. However when it went public in 2020, the corporate hoped to finally deploy 15,000 machines, which might make greater than 150 month-to-month digital scans every.

Nanox continues to be a good distance from that purpose, and it might by no means get there. However hitting its targets would signify almost 2.3 million medical pictures per 30 days. This might shortly grow to be the most important medical-imaging dataset on the planet, and the corporate might want to use AI to make any kind of discovery.

Recursion Prescription drugs and Nanox want to use AI to unlock vital medical breakthroughs through the use of monumental medical datasets. For this reason I say these two shares have engaging upside.

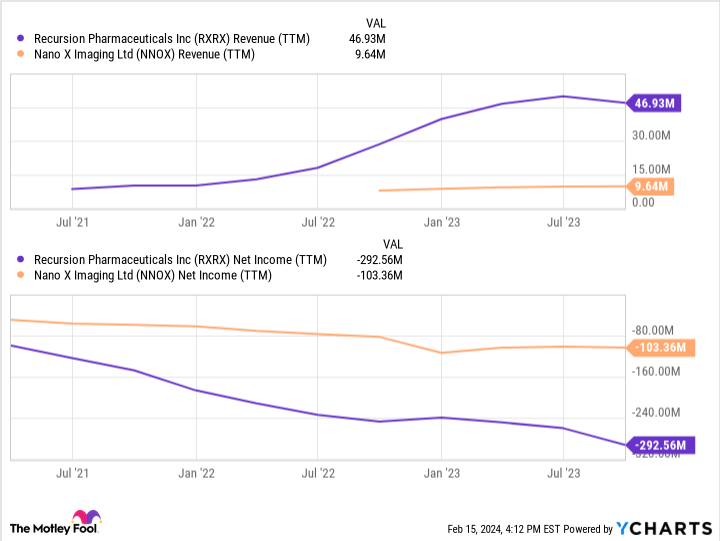

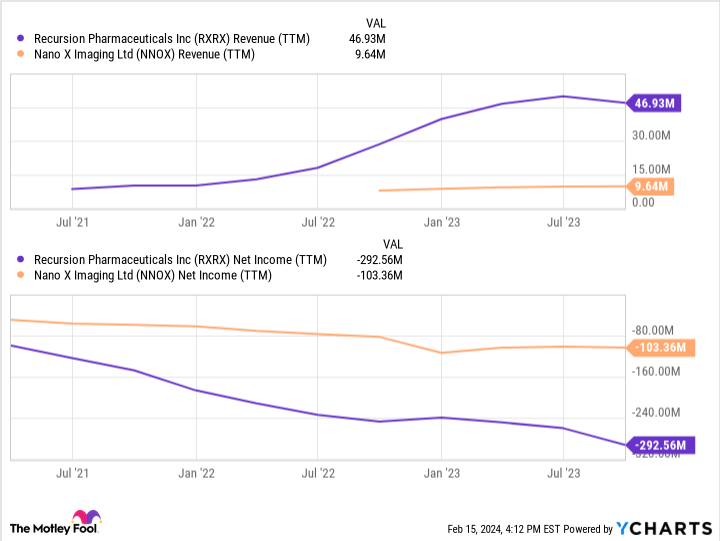

That mentioned, each Recursion Prescription drugs and Nanox have meager income streams and massive losses, because the chart beneath reveals.

Recursion Prescription drugs and Nanox are very high-risk shares, and investing in them shouldn’t be taken flippantly. Each have an elevated probability of failing, and Nvidia’s funding in them should not be seen as one thing that ensures success.

It is thrilling to consider what may occur if issues go proper, and AI leads these two corporations to main breakthroughs. Buyers simply have to maintain their feelings in test, totally recognizing the dangers that include these shares.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for traders to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 12, 2024

Jon Quast has positions in Nano-X Imaging. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot recommends Nasdaq. The Motley Idiot has a disclosure coverage.

Buyers Are Piling Into Nvidia Inventory. However Nvidia Is Investing in 5 Different AI Shares. was initially revealed by The Motley Idiot