It could be troublesome to not point out Nvidia (NASDAQ: NVDA) when recapping the inventory market’s 2023. The rise of synthetic intelligence (AI) and Nvidia’s triple-digit surge are arguably amongst 2023’s main headlines.

By the top of December, Nvidia had rocketed to roughly $500 per share, a steep value for a lot of traders who wish to purchase complete shares.

Will the inventory break up in 2024 and produce down the worth of a full share? Ought to that have an effect on whether or not traders ought to proceed shopping for shares?

Here’s what you have to know.

Why Nvidia inventory might break up

Predicting a inventory break up is not rocket science, and a few clues level to it occurring quickly with Nvidia. The corporate has a historical past of splitting its inventory, which is when an organization multiplies or divides its share depend with out altering total market capitalization. So, if the variety of shares goes up, the worth per share goes down.

Nvidia’s most up-to-date break up got here in 2021. Shares had been buying and selling at $744 earlier than the break up. Nvidia is not but at such a excessive share value, but it surely’s getting inside shouting distance at $500.

Earlier than 2021, Nvidia break up its inventory 4 different occasions between 2000 and 2007. Shares rose 334% over these seven years. I believe administration likes to maintain the share value palatable for many traders.

The fast development of AI in 2023 has additionally established a development narrative round Nvidia that would stretch effectively into the long run. In different phrases, Nvidia’s fundamentals appear destined to hold the inventory larger over the approaching years, and that makes me assume a Nvidia inventory break up is a matter of when and never if.

However here is the key about inventory splits

Traders should perceive what inventory splits do and do not do. Splits cut back the buying and selling value of a share of inventory. This makes it cheaper to personal a chunk of that enterprise, however a break up does not basically have an effect on a inventory’s worth. It creates a decrease share value by splitting the inventory into extra items (shares).

For instance, suppose you need some pie. You go to the shop and see a pie value $40 promoting as two halves for $20 every. You do not wish to pay $20 for pie, so that you ask the shop to chop the halves to divide the pie into 4 quarters promoting for $10 every. In that case, you are paying $10 for pie however getting a smaller piece.

Inventory splits work the identical method. The corporate is value the identical, however traders are paying a smaller share value for a smaller piece of the enterprise the inventory represents. That is not essentially unhealthy, however do not forget that inventory splits do not change basic worth, solely the share value. Traders who cannot afford a full share might additionally take a look at shopping for fractional shares.

Ought to traders purchase Nvidia for 2024 and past?

Traders should purchase Nvidia in the event that they like the place it is enterprise goes, not due to something administration does with share depend. The excellent news is that Nvidia appears to be like like an awesome long-term purchase. It’s the overwhelming market chief in AI chips, that are being put in huge information facilities to course of intense computing workloads.

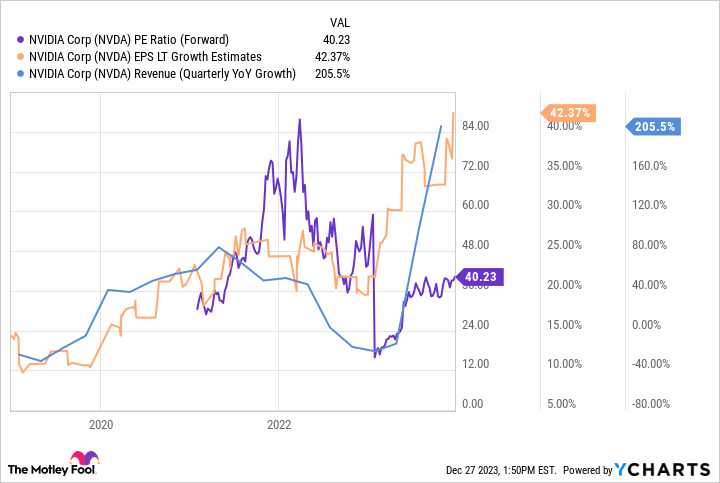

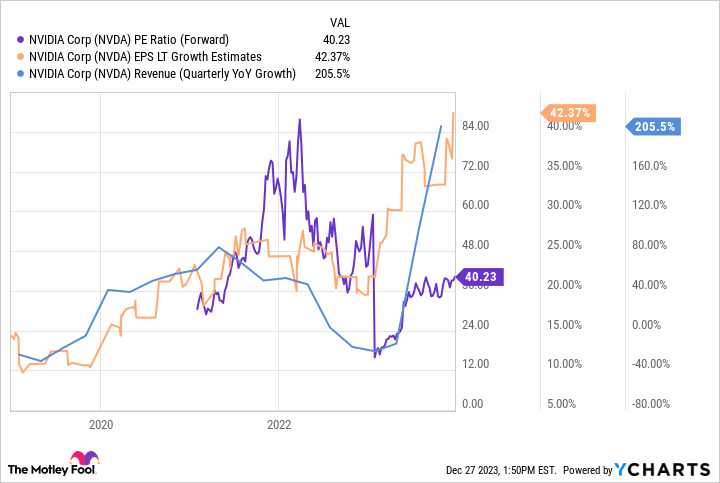

Income within the firm’s most up-to-date quarter was up 200% from the year-ago quarter. Analysts are predicting long-term earnings development averaging 42% yearly. Regardless of its huge run in 2023, the inventory trades at a ahead P/E of simply 40. The ensuing value/earnings-to-growth (PEG) ratio of simply 1 alerts that the inventory is a cut price, assuming long-term development estimates materialize.

No inventory is risk-free. Competitors will certainly come for Nvidia and hitting development estimates is not a certain factor. But when traders intend to carry for the long run, they need to be rewarded.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of the S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

Traders Purchased This Hyper-Development Synthetic Intelligence (AI) Inventory Hand Over Fist in 2023. Will It Cut up Its Shares in 2024? was initially printed by The Motley Idiot