(Bloomberg) — Buyers are bracing for key inflation knowledge subsequent week that would worsen the bond-market rout.

Most Learn from Bloomberg

January shopper costs are seen accelerating for the primary time in three months, even because the annual inflation charge declines additional, a Labor Division report Tuesday is predicted to point out.

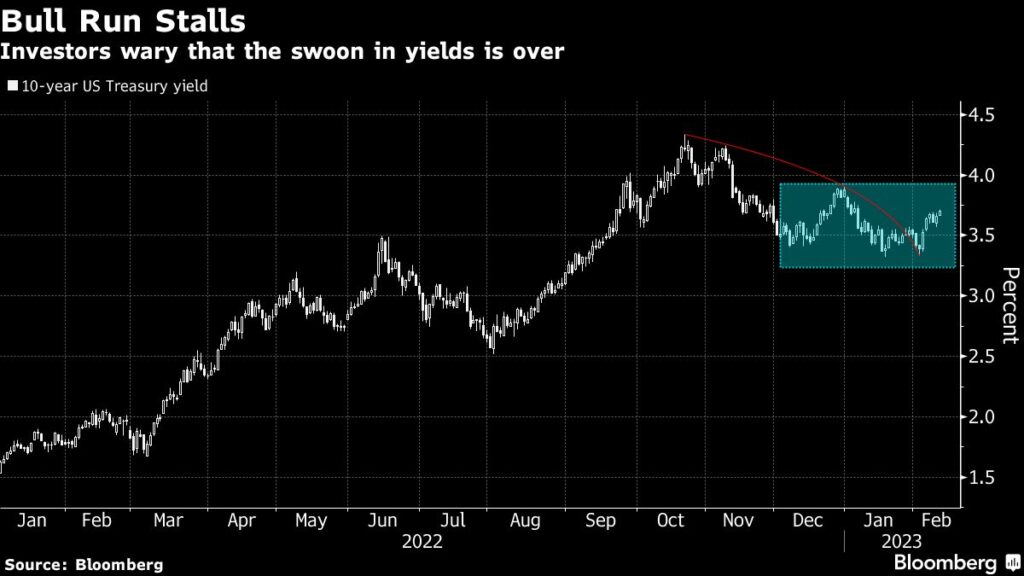

The reversal would come on the heels of blowout January jobs knowledge that despatched bonds tumbling since then. Afterward, Federal Reserve officers conveyed that the inflation battle isn’t over and it could take so much longer for the central financial institution to attain worth stability. It could additionally sprint hopes that inflation would stay in a downward pattern, a view that sparked a rally in Treasuries final month.

“There’s a near-term threat that inflation doesn’t fall as quickly because the market is anticipating,” mentioned Jimmy Chang, chief funding officer of Rockefeller International Household Workplace.

With some up-tick in CPI anticipated, the hazard stays {that a} bigger rise in month-to-month measures would lengthen the selloff in Treasuries. Swaps merchants have hoisted their outlook for the terminal funds charge to almost 5.20%, barely above the median forecast set by Fed officers at their December assembly.

That compares to earlier within the month when bets confirmed the Fed would fail to get its coverage charge even to five%. Upping the ante, rate of interest possibility exercise this week has been spurred by merchants betting on the central financial institution pushing past a peak forecast of 5% to five.25% this yr they made in December, to as excessive as 6%.

The strain on central banks globally was underscored final week in Australia and Mexico, the place cussed inflation strain sparked hawkish charge hikes and coverage steerage.

Fed Chair Jerome Powell additionally struck a cautious tone, telling an viewers in Washington this week: “If we proceed to get, for instance, sturdy labor market studies or larger inflation studies, it might be the case that now we have do extra and lift charges greater than is priced in.” Throughout one other speech, Governor Christopher Waller mentioned: “I’m ready for an extended battle to get inflation right down to our goal.”

That stored the strain on Treasuries, with the two-year yield climbing above 4.5%, its highest degree since late November and up from final week’s low of 4.03%. The benchmark additionally rose some 0.86% above the 10-year yield, marking the deepest curve inversion seen for the cycle. It reveals how the prospect of a extra aggressive Fed path is predicted to ultimately stall the financial system and produce inflation down, rewarding holders of longer-dated Treasuries.

“If folks overlook a continuous enchancment in CPI then jobs matter much more,” mentioned Michael Kelly, international head of multi-asset at PineBridge Investments. “CPI nonetheless does matter. And now we have gasoline ticking up, used vehicles ticking up and technical changes.”

Kelly mentioned a firming “international financial system and the latest US payrolls knowledge means general it’s very onerous proper now for the lengthy finish to make any extra significant decline in yields.”

Barclays US economist Pooja Sriram and her colleagues undertaking that US core inflation accelerated final month amid a nonetheless sturdy service sector and as items inflation rebounded. On Friday, they raised their Fed funds forecast — seeing the terminal charge touchdown in a 5.25%-5.5% vary. The Fed’s present vary is 4.5%-4.75%.

Barclays Modifications Fed Forecast, Sees 25bp Price Hikes Via June

On Friday, the College of Michigan’s survey-based measures confirmed worth expectations over the approaching yr rose to 4.2% from 3.9% however remained properly under ranges seen within the first half of final yr. Powell and different Fed officers have harassed many occasions over the previous yr the significance of inflation expectations remaining anchored — as customers seeing larger costs down the street dangers driving precise inflation ranges upward.

Even in a case the place CPI behaves a bit of higher, the prospect of extra persistent inflation pressures cannot be dominated out given tight labor circumstances which can be seen sustaining agency wage development.

“Sources of inflation come from shortages similar to we’re seeing in labor for the time being,” and “wages will proceed to develop,” mentioned Matt Smith, funding director at London-based Ruffer LLP. Expectations embedded within the yields of five- and 10-year Treasury inflation-protected securities rose to their highest ranges since early December this week. Smith mentioned Ruffer is positioned for larger long-dated breakevens as a result of they anticipate the Fed is unable to in the end scale back inflation right down to its worth stability goal of two%.

Along with CPI knowledge, a bunch of Fed officers are scheduled to talk within the upcoming week, together with Fed Governor Michelle Bowman and New York Fed President John Williams.

What to Watch

-

Financial knowledge calendar

-

Feb. 14: NFIB small enterprise optimism; shopper worth index; actual common hourly earnings

-

Feb. 15: MBA mortgage functions; retail gross sales; industrial manufacturing; capability utilization; enterprise inventories; NAHB housing index; TIC flows

-

Feb. 16: Producer worth index; jobless claims; constructing permits; housing begins; New York Fed providers enterprise exercise

-

Feb. 17: Import and export worth index; main index

-

-

Federal Reserve calendar

-

Feb. 13: Fed Governor Michelle Bowman

-

Feb. 14: Dallas Fed President Lorie Logan; Philadelphia Fed President Patrick Harker; New York Fed President John Williams

-

Feb. 16: Cleveland Fed President Loretta Mester; St Louis Fed President James Bullard; Fed Governor Lisa Prepare dinner

-

Feb. 17: Richmond Fed President Thomas Barkin; Bowman

-

-

Public sale calendar:

-

Feb. 13: 13- and 26-week payments

-

Feb. 14: 12-day CMB

-

Feb. 15: 17-week payments; 20-year bonds

-

Feb. 16: 4-and 8-week payments, 30-year TIPS

-

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.