(Bloomberg) — Ignoring the Federal Reserve’s willpower to maintain elevating charges and maintain them there’s a wildly worthwhile commerce on Wall Avenue proper now. It’s making an attempt to swim towards the rising market that carries dangers.

Most Learn from Bloomberg

“Combating the Fed” has truly been a profitable stock-market technique for months. The S&P 500 Index is up 15% for the reason that begin of the fourth quarter and 16% from its October low, placing it inside hanging distance of the 20% threshold many traders outline as the beginning of a bull market.

In the meantime, the central financial institution has raised charges 3 times, says extra hikes are coming and regularly insists that it’s going to maintain the fed funds fee excessive for some time. However to the inventory market the response has been, who cares?

The wager appears to be that these hikes have been priced into shares and that the Fed will truly have the ability to pull off a delicate touchdown, the place it tames inflation whereas the economic system continues to develop. And that’s put rate-wary and inflation-worried merchants within the difficult place of slamming head-first into the prevailing market momentum.

“What if the Fed truly wins? It seems it’s,” stated Adam Sarhan, founder of fifty Park Investments, who’s lengthy US equities, together with battered expertise shares like chip shares. “Buyers are rewarded after they align themselves with the underlying pattern on Wall Avenue. By no means combat the tape and hold your losses small.”

In fact, the chance the herd of bullish traders faces was clear in Friday’s gangbuster jobs report — the potential of stubbornly excessive inflation. If a wholesome labor market retains wage progress up, costs might not come down. And that may forestall the Fed from pausing its most aggressive tightening cycle in many years.

Bullish Sectors

One reassuring issue to fairness optimists is the shift in market management. The sectors main this 12 months’s rebound, like shopper discretionary and knowledge expertise, have traditionally outperformed in the course of the early levels of bull markets, in keeping with funding analysis agency CFRA. The identical goes for supplies shares, which have been outperforming since late September.

Historical past additionally says that whether or not there’s a recession or not can be essential for shares. Since World Struggle II, there have been 9 bear markets which were accompanied by recessions, and on common the S&P 500 has declined 35% versus 28% for bear markets that didn’t include financial downturns, CFRA information present.

What’s notably fascinating is there have been simply three bear markets since 1948 with out recessions. And every time a brand new bull market began inside 5 months of inventory costs hitting a low.

Sam Stovall, chief funding strategist at CFRA, is sticking together with his optimistic name for US equities regardless that he thinks a shallow recession should still happen. His rolling 12-month goal of 4,575 for the S&P 500 is 11% above Friday’s shut.

“May we be in retailer for a extra extreme bear market, or will there be a really gentle downturn this 12 months and the inventory market already bottomed?” Stovall stated. “I consider we’re in a brand new bull part.”

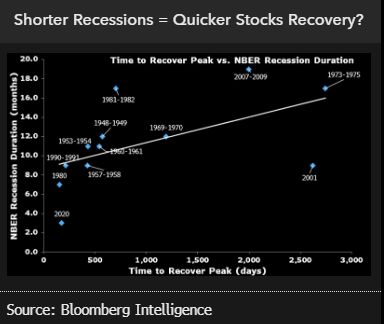

Stovall has a degree. To shares, even when there’s a recession, it’s the size that basically issues. The depth of peak-to-trough actual GDP declines isn’t traditionally correlated to the severity of strikes in fairness markets, in keeping with Gina Martin Adams, chief fairness strategist at Bloomberg Intelligence. However shorter recessions have led to extra fast rebounds.

Forecasters surveyed by Bloomberg are predicting that the economic system will contract within the second and third quarters of this 12 months earlier than recovering at year-end.

Technicals Rule

Even steadfast bears are rising extra optimistic — for now.

Doug Ramsey, chief funding officer at Minneapolis-based Leuthold Group, stated the agency added to its fairness publicity at the beginning of the 12 months. And though he thinks the US might have a recession later this 12 months, he plans to trip the most recent rally in the meanwhile primarily based on enhancing technicals.

“Traditionally, there’s been a possibility to earn money in shares between the preliminary inversion of a yield curve and a peak in shares previous to a recession,” Ramsey stated. “It feels dicey for a lot of. Some might imagine that’s like making an attempt to seize just a few nickels in entrance of a steamroller, however I’m unsure that’s proper. We may very well be choosing up gold cash in entrance of a tricycle — and this may very well be worthwhile.”

Longer-term, Ramsey is cautious of a head pretend. The sectors that outperform in a soft-landing situation are sometimes related to people who do effectively main as much as a recession. For instance, supplies producers and industrial firms — two worth sectors which have held up effectively on this 12 months’s progress rally — often carry out strongly within the six months forward of a downturn.

Naturally, long-term optimists are wanting previous that. To them, a recession is more and more unlikely and inflation is coming down, which is what the Fed wished to do. So the arrow is pointing up, and there’s little sense in combating the tape.

“Inflation is coming down and we don’t have a menace of a extreme recession,” Sarhan of fifty Park Investments stated. “So far as I’m involved, the bear marketplace for all intents and functions is over.”

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.