A Credit score Suisse emblem seen displayed on a smartphone with damaged display and an illustrative inventory chart background in Athens, Greece on March 15, 2023. (Picture illustration by Nikolas Kokovlis/NurPhoto by way of Getty Photos)

Nikolas Kokovlis | Nurphoto | Getty Photos

Shares of Credit score Suisse surged Thursday, rebounding from a recent all-time low after the beleaguered lender introduced it could faucet central financial institution help to shore up its funds.

Switzerland’s second-largest financial institution stated it could borrow as much as 50 billion Swiss francs ($53.68 billion) from the Swiss Nationwide Financial institution, offering a second of reduction for buyers after the Zurich-headquartered agency led Europe’s banking sector on a wild experience decrease through the earlier session.

The Swiss-listed inventory was buying and selling round 17% larger at 1:35 p.m. London time (9:35 a.m. ET) — an enormous swing from Wednesday’s greater than 30% tumble after its largest backer stated it would not present additional help as a result of regulatory restrictions.

The abrupt lack of confidence in Credit score Suisse, which got here as fears concerning the well being of the banking system unfold from the U.S. to Europe, has prompted some to query the “true” price of Credit score Suisse’s inventory value.

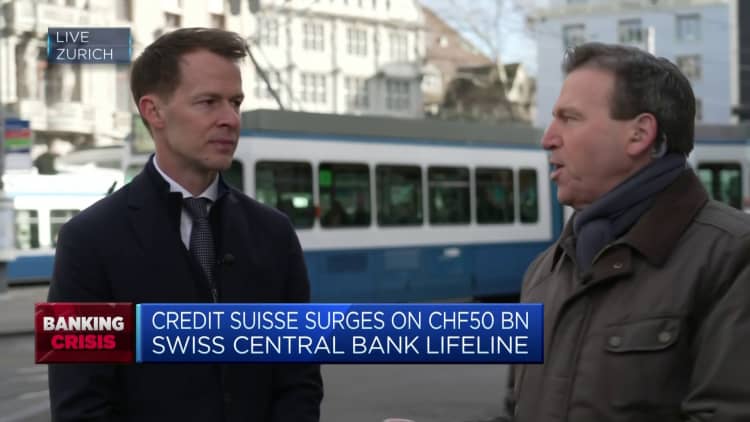

“Now we have to step again and look after all on the viability of the enterprise mannequin [and] on the total regulatory panorama,” Beat Wittmann, chairman of Switzerland’s Porta Advisors, informed CNBC’s “Squawk Field Europe” on Thursday.

“I believe the management of the financial institution has to essentially use now this lifeline to assessment their plan as a result of clearly, the capital markets haven’t purchased the plan as we now have seen by the performances of the fairness value and the credit score default swaps very just lately.”

Requested for his views on the sharp fall of Credit score Suisse’s share value — which dropped under 2 Swiss francs for the primary time on Wednesday — Wittmann stated a “brutal” financial tightening cycle led by main central banks in latest months meant firms weak to shocks have been now starting to “actually endure.”

“The weakest hyperlinks are cracking and that is simply occurring, and that was solely predictable — and this is not going to be the final one. So, now it’s actually time for policymakers to revive confidence and liquidity within the system, be it within the U.S., be it in Switzerland, or be it elsewhere,” Wittmann stated.

Requested for his recommendation to buyers amid the market turmoil, he stated, “The upside momentum in inflation and rates of interest is receding very clearly so I believe there’s a very wholesome underpinning in capital markets.”

“However I’d very strongly advocate sticking to high-quality firms — meaning sturdy administration, sturdy steadiness sheets, sturdy worth proposition. And now you possibly can decide them up at extra enticing valuations,” Wittmann added.

‘Materials weaknesses’

Even earlier than the shock collapse of two U.S. banks final week, Credit score Suisse has been beset with issues in recent times, together with cash laundering fees and spying allegations.

The financial institution’s disclosure earlier this week of “materials weaknesses” in its reporting added to investor considerations.

Credit score Suisse administration stated Wednesday, nonetheless, that its newest step to safe a large funding deal confirmed “decisive motion” to strengthen the enterprise. It thanked the Swiss Nationwide Financial institution and the Swiss Monetary Market Supervisory Authority for his or her help.

Analysts welcomed the transfer and urged fears of a recent banking disaster could also be overstated.

“A stronger liquidity place and a backstop offered by the Swiss Nationwide Financial institution with the help from Finma are optimistic,” Anke Reingen, an analyst at RBC Capital Markets, stated Thursday in a analysis observe.

“Regaining belief is essential for the CS shares. Measures taken ought to present some consolation {that a} spillover to the sector may very well be contained, however the scenario stays unsure,” she added.

Analysts at UBS, in the meantime, stated market contributors have been “grappling with three interrelated however totally different points: financial institution solvency, financial institution liquidity, and financial institution profitability.”

“Briefly, we expect financial institution solvency fears are overdone, and most banks retain sturdy liquidity positions,” they added.

‘A fantastic turnaround story’?

For Dan Scott, head of multi-asset administration at Swiss asset supervisor Vontobel — who used to work at Credit score Suisse — it is not all unhealthy information.

“I’d say that Credit score Suisse particularly remains to be one of many world’s largest asset managers, it has half a trillion in belongings, and definitely this may very well be an excellent turnaround story if the execution is sweet,” he informed “Squawk Field Europe” on Thursday.

Requested by CNBC’s Geoff Cutmore whether or not this could imply buyers staying affected person regardless of market turbulence and the size of outflows from the financial institution, Scott replied: “Completely. However I believe once more that the stress that we’re seeing in the mean time actually ought to have been predictable.”

“When charges come up so quick, sure enterprise fashions get challenged and I do not assume it’s a wealth administration enterprise mannequin that will get challenged. I believe rather more and why we noticed it at Silicon Valley Financial institution, is personal markets are going to be challenged,” Scott added.