America’s excessive inflation fee will produce a 7% enhance within the dimension of the usual deduction when employees file their taxes on their 2023 revenue, in accordance with new inflation changes from the Inner Income Service.

It’s additionally going to pump up tax brackets by 7% as effectively, in accordance with the annual inflation changes the IRS introduced this week.

Many tax code provisions — however not all — are listed for inflation, so the bulletins are a recurring occasion. However when inflation is persistently clinging to four-decade highs, these annual changes carry further significance.

“When inflation is persistently clinging to four-decade highs, these annual changes of roughly 7% for the usual deduction carry further significance.”

Begin with the usual deduction, which is what most individuals use as a substitute of itemizing deductions.

The usual deduction for people and married folks submitting individually can be $13,850 for the 2023 tax 12 months. That’s a $900 enhance from the $12,950 commonplace deduction for the upcoming tax season.

For married {couples} submitting collectively, the payout climbs to $27,700 for the 2023 tax 12 months. That’s a $1,800 enhance from the $25,900 commonplace deduction set for the upcoming tax 12 months.

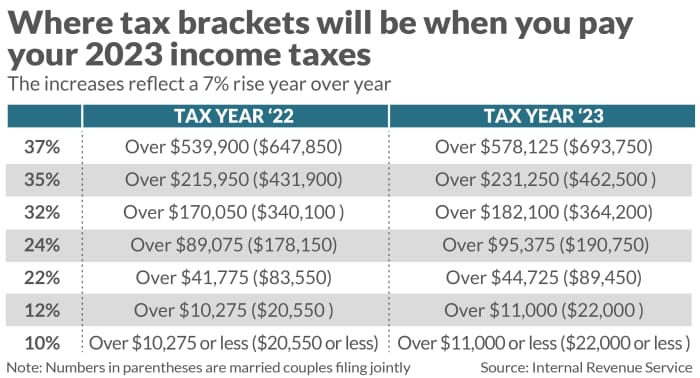

The will increase within the marginal tax charges replicate the identical 7% rise. For instance, the 22% tax bracket for this 12 months is over $41,775 for single filers and over $83,550 for married {couples} submitting collectively. Subsequent 12 months, the identical 22% bracket applies to incomes over $44,725 and over $89,450 for married {couples} submitting collectively.

MarketWatch/IRS

“The adjustments appear to be a lot bigger than earlier years as a result of inflation is operating a lot larger than it has in earlier many years,” mentioned Alex Durante, economist on the Tax Basis, a right-leaning tax suppose tank.

The IRS arrives at its inflation changes by averaging a barely completely different inflation gauge, the so-called “chained Shopper Value Index” as a substitute of the widely-watched Shopper Value Index, Durante famous. That’s an final result of the Trump-era Tax Cuts and Jobs Act of 2017, he added.

“The explanation they do it’s because the common CPI is assumed to overstate inflation as a result of it doesn’t take note of the substitution that buyers could make as value rise,” Durante mentioned. Buyers substitute after they swap a costlier merchandise for cheaper one, and analysis reveals many People are utilizing the tactic.

The IRS inflation changes come after September CPI information final week confirmed inflation of 8.2% year-over-year, barely off from 8.3% in August. Additionally final week, the Social Safety Administration mentioned subsequent 12 months’s funds would come with an 8.7% value of residing adjustment.

“The payout on the earned revenue tax credit score — geared at low- and moderate-income working households who’ve been hit exhausting by red-hot inflation — can also be rising. ”

The payout on the earned revenue tax credit score can also be rising. The utmost payout for a qualifying taxpayer with no less than three qualifying kids climbs to $7,430, up from $6,935 for this tax 12 months. The longstanding credit score is geared at low- and moderate-income working households who’ve been hit exhausting by red-hot inflation.

Greater than 60 provisions are slated for a rise inline with inflation, however many parts of the tax code will not be listed for inflation. Relying on the circumstances, the taxes or the tax breaks kick in sooner.

Capital features tax guidelines one instance. The IRS lets a taxpayer use capital losses to offset capital features taxes. If losses exceed features, the IRS permits a taxpayer to deduct as much as $3,000 in extra loses. They’ll then carry the rest of the capital loses to future tax years. It’s been greater than 4 many years since lawmakers final set the restrict, in accordance with Durante.

“Whereas greater than 60 provisions are slated for a rise inline with inflation, many parts of the tax code will not be listed for inflation. They embrace capital features tax. ”

Given the inventory market’s rocky downward slide this 12 months, many buyers may welcome a fast-approaching tax break — even when it solely allows a $3,000 deduction.

On the identical time, a married couple promoting their residence can exclude the primary $500,000 of the sale from capital features taxation, and it’s $250,000 for a single filer. It’s been that approach because the exclusion’s 1997 institution.

The as soon as white-hot housing market could also be cooling, however many sellers should still be going through the purpose when taxes kick in. The median residence itemizing was over $367,000 as of early October, in accordance with Redfin

RDFN,

The kid tax credit score is one other instance. After the payout to oldsters final 12 months jumped to $3,600 for youngsters below age 6 and $3,000 per youngster age 6 to 17, it’s again to a most $2,000. The credit score’s refundable portion climbs from $1,500 to $1,600 throughout tax 12 months 2023, the IRS notes.

Proponents of the boosted payouts and a few Congressional Democrats wish to revive the bigger funds in negotiations tied to company taxes. The excessive prices of residing are a robust cause to deliver again the boosted credit score, they are saying.

Associated:

What sensible methods can decrease your tax invoice as year-end approaches? Learn this earlier than making any tax strikes.

Three issues one of the best 401(okay)s supply that may assist you save much more

Enhanced youngster tax credit score helped cut back poverty for households earlier than it ended final 12 months. However there’s a technique Republicans and Democrats may agree on reinstating it.