Since late October final yr, Financial institution of America (NYSE: BAC) has been on a tear, growing 58% because the Federal Reserve signaled a pause in its rate of interest climbing marketing campaign. The inventory has gained considerably as buyers priced within the pause and potential rate of interest cuts on the finish of this yr and into subsequent yr, which might assist alleviate strain on the financial institution, whose mortgage portfolio has sizable unrealized losses.

Nevertheless, it stays unclear the place rates of interest shall be on the finish of this yr or subsequent yr. Coming into the yr, markets priced in as many as six rate of interest cuts. These expectations at the moment are down to 2 cuts. Given the latest run-up within the inventory, is it smart for buyers to purchase now? Listed below are some belongings you’ll need to take into consideration first.

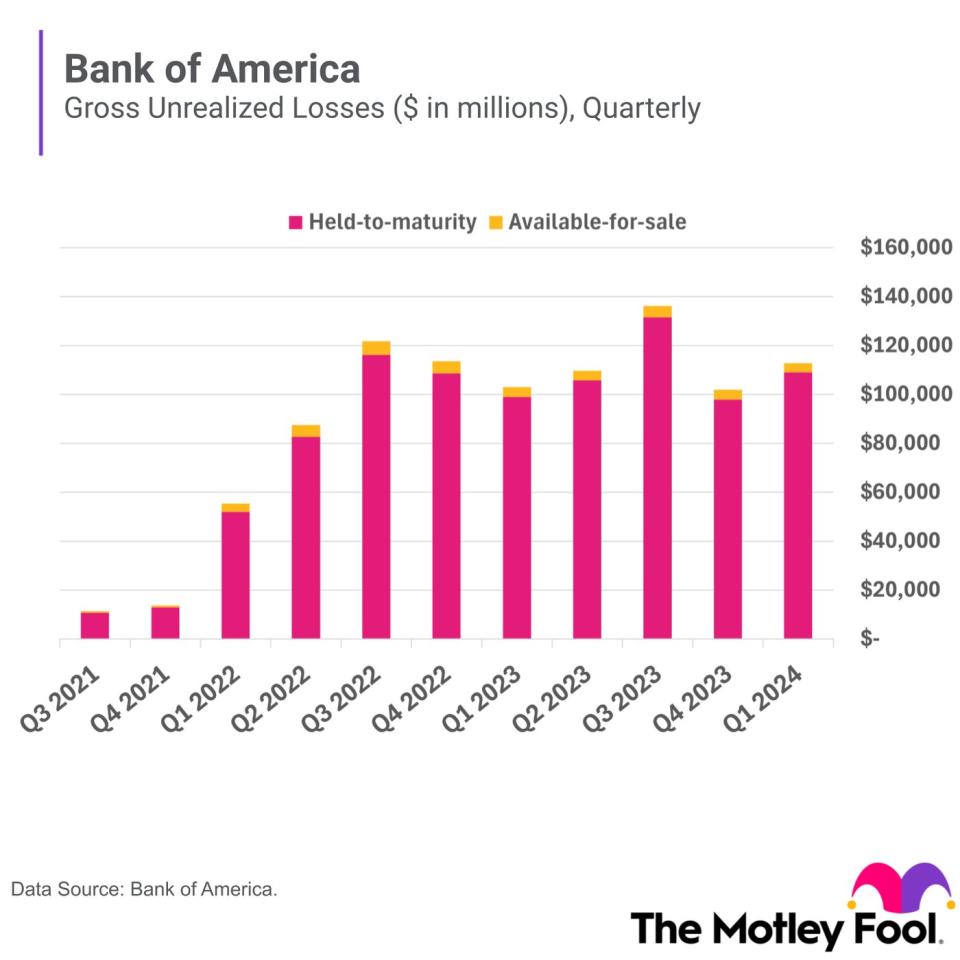

Financial institution of America’s ballooning unrealized losses have drawn investor consideration

Financial institution of America has over $2.5 trillion in complete property, making it the second-largest financial institution within the U.S., behind solely JPMorgan Chase. Its sheer measurement makes it a behemoth, and it has held its personal over time as one of many largest banks within the U.S.

Banks are easy companies that soak up deposits and make loans to clients. They earn cash on the distinction between the rate of interest charged on loans and curiosity paid to clients for his or her deposits.

This enterprise mannequin makes the business delicate to swings in rates of interest, and Financial institution of America’s sensitivity is clear by taking a look at its mortgage portfolio. These rising unrealized losses have been a priority amongst some buyers because the Federal Reserve raised rates of interest on the quickest tempo in a long time. For the reason that Fed started elevating charges in 2022, the financial institution’s unrealized losses have grown from $14 billion to $113 billion.

Unrealized losses signify the losses Financial institution of America would take if it had been pressured to promote its securities available in the market as we speak. This does not essentially imply the financial institution is in bother so long as it could maintain these securities to maturity. Nevertheless, a run on deposits at Silicon Valley Financial institution (a subsidiary of SVB Monetary) final yr pressured the financial institution to lift capital and notice big losses on its treasuries, which might have been even worse had the Feds not stepped in.

As one of many largest, most recognizable banks within the U.S., Financial institution of America has a well-diversified deposit base, with 37 million shopper checking accounts and nearly $2 trillion in deposits from people and companies. This supplies it with a gentle basis for its enterprise, making it much less weak to financial institution runs like these at Silicon Valley Financial institution and different regional banks final yr.

BofA’s internet curiosity earnings might proceed to soar increased

The upper rate of interest atmosphere is a double-edged sword for banks. Whereas Financial institution of America’s unrealized losses have ballooned, it has additionally benefited from a rising internet curiosity earnings. The web curiosity earnings is the distinction between the curiosity a financial institution takes on its loans and the curiosity it pays depositors.

When rates of interest are low, as they had been all through 2021, a financial institution’s internet curiosity earnings is low. Nevertheless, in periods of rising rates of interest, banks take pleasure in a tailwind as curiosity charged on loans adjusts faster than curiosity paid on deposits. As one of many extra curiosity rate-sensitive banks within the business, Financial institution of America grew its internet curiosity earnings from $43 billion in 2021 to $57 billion final yr.

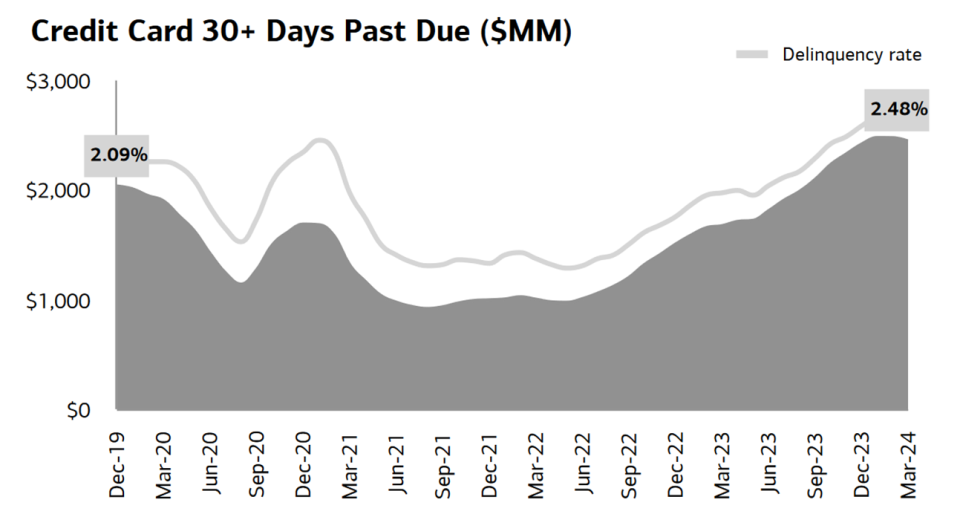

At the moment, banks are in limbo. Within the first quarter, Financial institution of America’s internet curiosity earnings fell in comparison with the identical quarter final yr. The financial institution grappled with rising curiosity bills on deposits and slower mortgage progress as banks tightened lending requirements amid rising charge-offs, which put strain on its internet curiosity unfold.

Delinquencies and internet charge-offs on shopper loans may very well be a short-term headwind for the financial institution, however Financial institution of America administration sees a light-weight on the finish of the tunnel. Throughout its first-quarter earnings name, CFO Alastair Borthwick stated that delinquency tendencies had been starting to enhance and that this may possible result in charge-offs leveling out over the following quarter or two.

Throughout this time, Financial institution of America has capitalized on the “higher-for-longer” rate of interest atmosphere by changing lower-yielding property with higher-yielding ones, which ought to assist it develop internet curiosity earnings late this yr into early subsequent yr.

One analyst at KBW not too long ago expressed optimism for Financial institution of America and projected its fourth-quarter internet curiosity earnings to be 5% above its earlier estimate. Analyst David Konrad stated that internet curiosity earnings and progress throughout different key elements of Financial institution of America’s enterprise will assist shut the hole towards its goal of delivering a 15% return on tangible widespread fairness (ROTCE).

Is it a purchase?

Financial institution of America inventory has elevated considerably because the Federal Reserve paused its rate of interest hikes. Regardless of this rally, the inventory remains to be moderately priced at 1.6 instances its tangible e book worth and 13.6 instances earnings.

Whereas its enterprise ebbs and flows with the U.S. financial system and prevailing market circumstances, Financial institution of America has finished a wonderful job navigating market cycles. As one of many largest banks within the U.S. with a robust model and sturdy stability sheet, the financial institution is poised to do nicely because it makes probably the most of as we speak’s rate of interest atmosphere and is a superb inventory to purchase as we speak.

Don’t miss this second likelihood at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? Then you definitely’ll need to hear this.

On uncommon events, our skilled workforce of analysts points a “Double Down” inventory suggestion for corporations that they assume are about to pop. If you happen to’re apprehensive you’ve already missed your likelihood to take a position, now could be one of the best time to purchase earlier than it’s too late. And the numbers converse for themselves:

-

Amazon: when you invested $1,000 once we doubled down in 2010, you’d have $21,765!*

-

Apple: when you invested $1,000 once we doubled down in 2008, you’d have $39,798!*

-

Netflix: when you invested $1,000 once we doubled down in 2004, you’d have $363,957!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable corporations, and there might not be one other likelihood like this anytime quickly.

See 3 “Double Down” shares »

*Inventory Advisor returns as of June 24, 2024

Financial institution of America is an promoting companion of The Ascent, a Motley Idiot firm. SVB Monetary supplies credit score and banking providers to The Motley Idiot. JPMorgan Chase is an promoting companion of The Ascent, a Motley Idiot firm. Courtney Carlsen has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Financial institution of America and JPMorgan Chase. The Motley Idiot has a disclosure coverage.

Is Financial institution of America Inventory a Purchase? was initially printed by The Motley Idiot