There was a time when tobacco shares have been among the many greatest investments you possibly can personal. For instance, Altria (NYSE: MO), which for a lot of its historical past additionally owned what’s now Philip Morris (NYSE: PM), was the best-performing inventory in the marketplace over an almost 50-year interval, based on Wharton professor Jeremy Siegel.

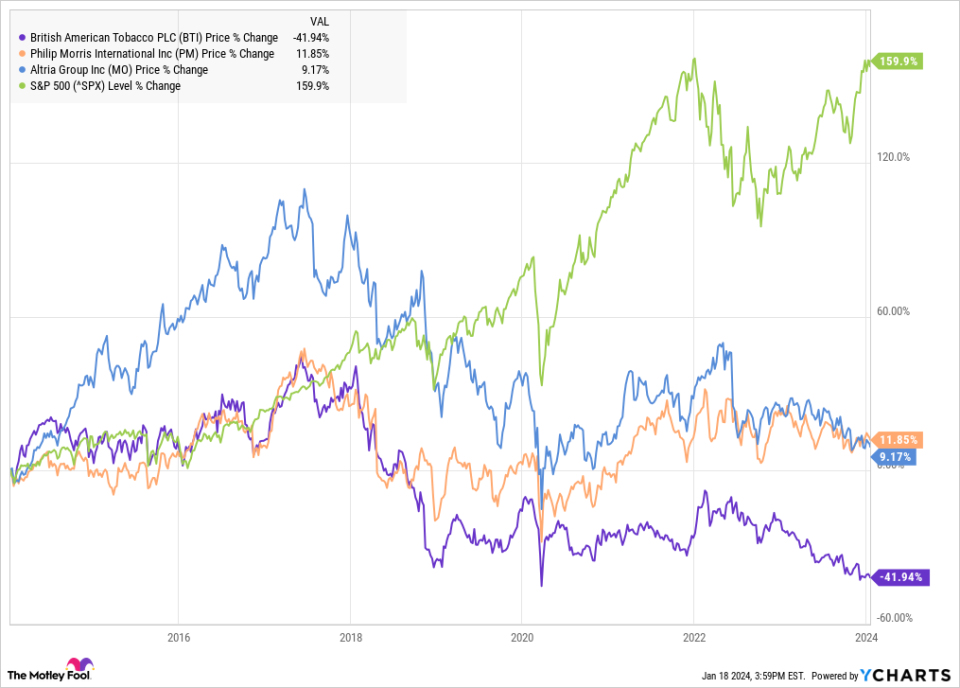

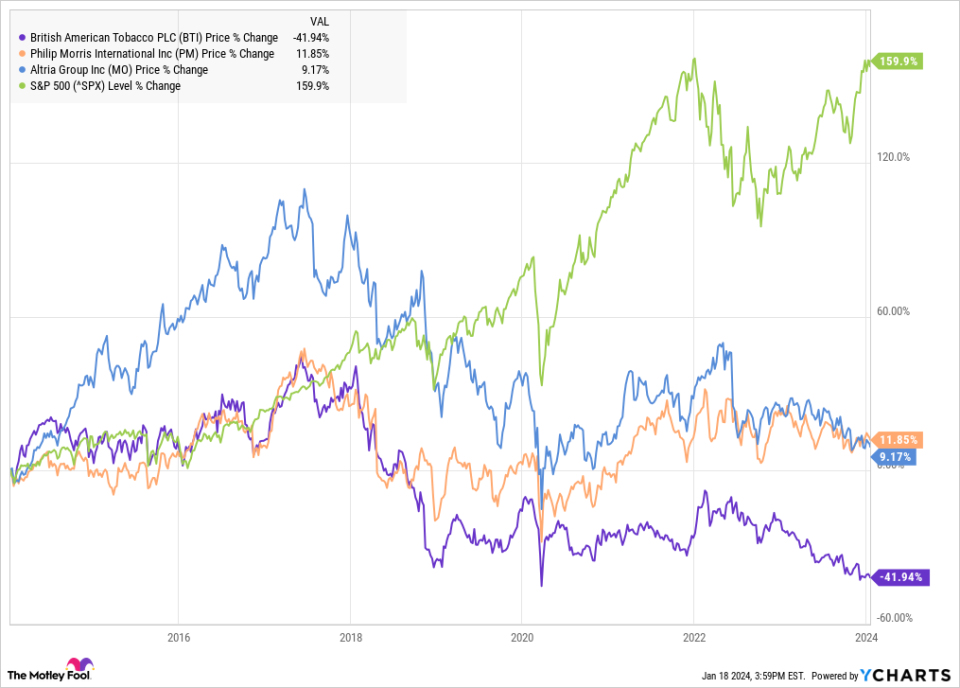

Nevertheless, over the past decade, that is modified. Shares of tobacco corporations like these two and British American Tobacco (NYSE: BTI) have succumbed to stress from declining cigarette gross sales, an incapacity to discover a breakthrough next-gen product, and slowing development in income and earnings. As you’ll be able to see from the chart under, British American Tobacco inventory is down sharply over the past decade, and Philip Morris and Altria have solely posted modest positive factors. Even on a complete return foundation, all three have underperformed the S&P 500.

Regardless of these headwinds, which have additionally included large write-downs for issues like Altria’s minority stake in JUUL and British American Tobacco’s U.S. cigarette portfolio, earnings traders nonetheless just like the tobacco sector for its beneficiant dividend yields.

At its present share value, British American Tobacco provides traders a dividend yield of 9.5%, making it one of many highest-yielding shares in the marketplace. Nevertheless, a excessive yield alone does not make a inventory a purchase, because the chart above helps illustrate. So is British American Tobacco a dividend inventory price shopping for, or is it a yield entice?

The place BAT stands as we speak

British American Tobacco surprised traders final month by taking a $31 billion impairment cost, which the corporate stated was in step with its imaginative and prescient to “Construct a Smokeless World” and the character of the headwinds within the U.S. cigarette business. It stated the write-off was primarily associated to its acquired U.S. combustibles manufacturers, which embody Camel, Newport, and different manufacturers that got here to BAT in its $49 billion buy of Reynolds American in 2017.

That replace additionally displays the truth that demand for cigarettes continues to say no. British American Tobacco hasn’t delivered its full 2023 outcomes but, however the firm stated it expects to report 3% to five% constant-currency income development for the yr, with tobacco gross sales quantity falling by 3%. It additionally guided for adjusted earnings-per-share development within the mid-single-digit percentages on a constant-currency foundation.

Like friends Altria and Philip Morris, BAT has struggled to discover a winner within the next-gen heated merchandise class, and the corporate misplaced market share final yr. Income from new classes was up 29% within the first half of the yr to 1.66 billion kilos. Cigarette quantity, in the meantime, was down 4.7% on an natural foundation within the first half, and constant-currency income within the class was up 0.2% to 10.8 billion kilos.

Wanting forward, the corporate is guiding for low-single-digit income and adjusted working revenue development in 2024, and is concentrating on an enchancment to three% to five% income development and mid-single-digit proportion adjusted working revenue development.

Is British American Tobacco a purchase?

British American Tobacco’s dividend is effectively funded, as the corporate had a dividend payout ratio of 76% primarily based on money circulation and simply 61% on an accounting foundation. That ought to reassure traders that BAT can proceed to fund its dividend even in a slow-growth setting.

Nevertheless, in a best-case situation primarily based on the corporate’s steering, British American Tobacco’s enterprise is just anticipated to generate modest top- and bottom-line development, and the danger for additional challenges is evident, as there are nonetheless vital regulatory dangers in new merchandise and the potential for taxes and different restrictions to extend on cigarettes.

The inventory is affordable and the dividend seems to be protected, however the upside potential of the inventory is proscribed. Dividend traders trying solely for yield would possibly wish to take into account BAT, however there are nonetheless numerous dangers within the tobacco sector that may result in share value depreciation within the coming years.

Must you make investments $1,000 in British American Tobacco P.l.c. proper now?

Before you purchase inventory in British American Tobacco P.l.c., take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for traders to purchase now… and British American Tobacco P.l.c. wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 16, 2024

Jeremy Bowman has no place in any of the shares talked about. The Motley Idiot recommends British American Tobacco P.l.c. and Philip Morris Worldwide and recommends the next choices: lengthy January 2024 $40 calls on British American Tobacco P.l.c., lengthy January 2026 $40 calls on British American Tobacco P.l.c., and quick January 2026 $40 places on British American Tobacco P.l.c. The Motley Idiot has a disclosure coverage.

Is British American Tobacco’s 9.5% Dividend Yield Too Good to Be True? was initially revealed by The Motley Idiot