Are you able to develop into a millionaire by investing in Power Switch (NYSE: ET) inventory? Completely. Over the long run, shares have confirmed a terrific funding. And given the corporate’s distinctive asset base, there is a good probability this efficiency can be repeated within the years to come back.

There’s just one catch: Should you do not make investments on this inventory in a sure approach, chances are you’ll forfeit your probability of reaching the $1 million mark.

1 approach Power Switch inventory could make you a millionaire

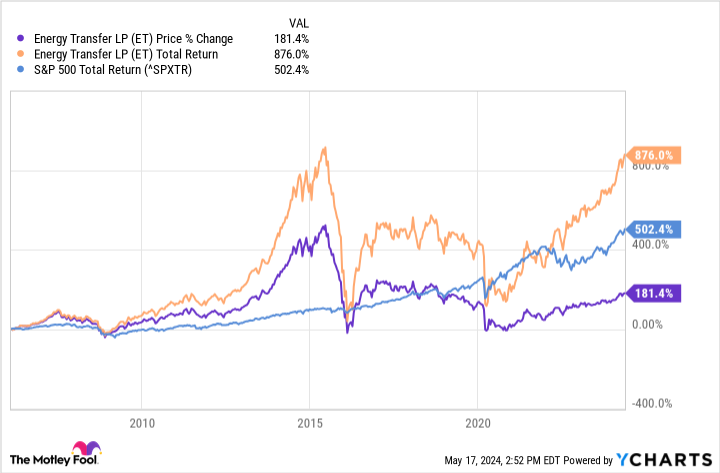

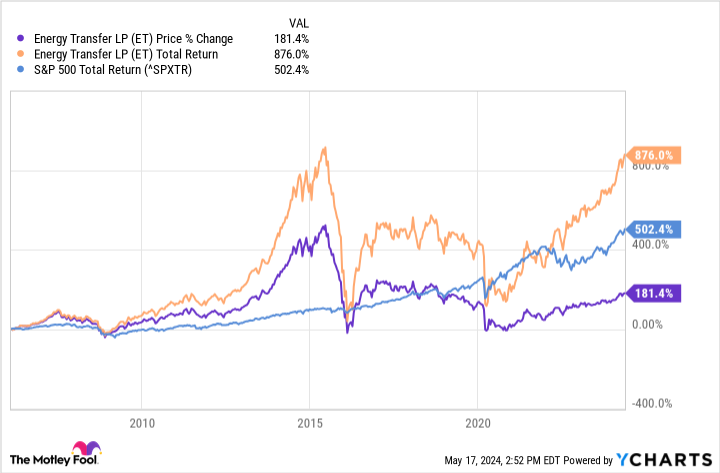

Since 2006, Power Switch’s inventory value has risen by simply 187%. The S&P 500, in the meantime, produced a complete return of 489%. On the floor, Power Switch hasn’t confirmed an incredible long-term funding. However that is why it’s vital to take a look at a inventory’s complete return, not simply its share value motion. Complete returns account for actions that may have an effect on shareholder income — like dividends and spinoffs — however that are not essentially mirrored precisely within the inventory value.

For its half, Power Switch has been a prolific dividend payer. The present dividend yield is round 8%. These large dividends aren’t included within the inventory value motion. Actually, they have an inclination to depress the inventory value, given the discount of money on the stability sheet.

When together with dividends in Power Switch’s complete returns, shares produced an 882% revenue for shareholders since 2006. That is almost double the S&P 500’s complete return over that point interval. This sort of return might help on a regular basis traders develop into millionaires. It could nonetheless take a number of many years of constant saving, however by investing in shares like this, you’ll be able to produce returns that rework a couple of thousand {dollars} a yr into a large retirement nest egg. Simply remember to retain and reinvest your dividends.

The one remaining query is: Will Power Switch inventory stay a long-term winner?

Can you continue to depend on Power Switch inventory?

Power Switch inventory has confirmed its capacity to generate long-term returns that may make you a millionaire. However is Power Switch inventory nonetheless an excellent choice immediately? Completely. That is as a result of this firm has a sturdy, structural benefit in relation to producing income.

At its core, Power Switch is taken into account a midstream power enterprise. Which means it is concerned not within the manufacturing of fossil fuels, however of their transport, refining, and storage. Round 90% of the corporate’s earnings are fee-based, that means it earns cash primarily based on the quantity of providers offered, not the underlying value of the fossil gasoline in query. Its services are costly to construct and tough to duplicate. And since it supplies vital providers to grease and gasoline producers in a approach that insulates the corporate from commodity value swings, Power Switch pays a dependable dividend to shareholders.

Be aware that Power Switch is not utterly insulated from commodity markets. In 2020, it was pressured to slash its dividend because of pandemic uncertainty. This minimize proved conservative, nevertheless, and roughly a yr later, the payout returned to its earlier stage.

“Total,” concludes Idiot author Geoffrey Seiler, “Power Switch is nicely positioned to be a gradual performer all through totally different commodity cycles, on condition that it’s concerned in predominantly fee-based actions which are diversified throughout product sorts.” And since the corporate’s infrastructure spans greater than 20 U.S. states, Power Switch additionally has the distinctive capacity to capitalize on value discrepancies throughout native and regional markets.

As a result of Power Switch is totally depending on long-term fossil gasoline demand, it is very important embody this inventory in a broad basket of investments diversified throughout different sectors and finish markets. However if you happen to’re seeking to construct a portfolio able to producing vital recurring revenue over the long run, Power Switch inventory stays an incredible choose.

Simply keep in mind that it will require a long-term investing plan of your individual. Most of these shares require constant saving over lengthy durations of time to provide the magic of compound curiosity.

Must you make investments $1,000 in Power Switch proper now?

Before you purchase inventory in Power Switch, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for traders to purchase now… and Power Switch wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $566,624!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 13, 2024

Ryan Vanzo has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

Is Power Switch Inventory a Millionaire-Maker? was initially revealed by The Motley Idiot